Have you ever observed a little-known cryptocurrency that gained value quickly and then collapsed, leaving a group of investors confused and at a loss?

The trading episode you saw may have been a "pump and dump" scheme, exploiting the FOMO (fear of missing out) sentiment typical of the crypto market. Investors need to learn to recognise these patterns and the warning signs to protect their digital investments from volatility.

Deciphering the Deception: What is a Pump and Dump Scheme?

A 'pump and dump' scheme starts when market manipulators push the price of a cheap cryptocurrency up to attract naive investors. After creating enough excitement and attracting buyers, they quickly sell their assets, causing the price to drop dramatically. Investors are thus left with worthless tokens, while fraudsters collect significant profits.

Many cryptocurrencies are vulnerable to this type of manipulation due to their decentralised structure and low liquidity, which create favourable conditions for these practices. In addition, the lack of strict controls such as those in traditional financial markets allows these schemes to flourish.

The Anatomy Of Deception: The Four Phases

Pumping and dumping tactics follow four distinct phases that serve to generate momentum and attract new participants:

1. Pre-launch

In this phase, creators and early adopters generate hype around a cheap and little-known token. Through exclusive whitelists and pre-sales, they try to create a sense of exclusivity and anticipated benefits.

2. Launch

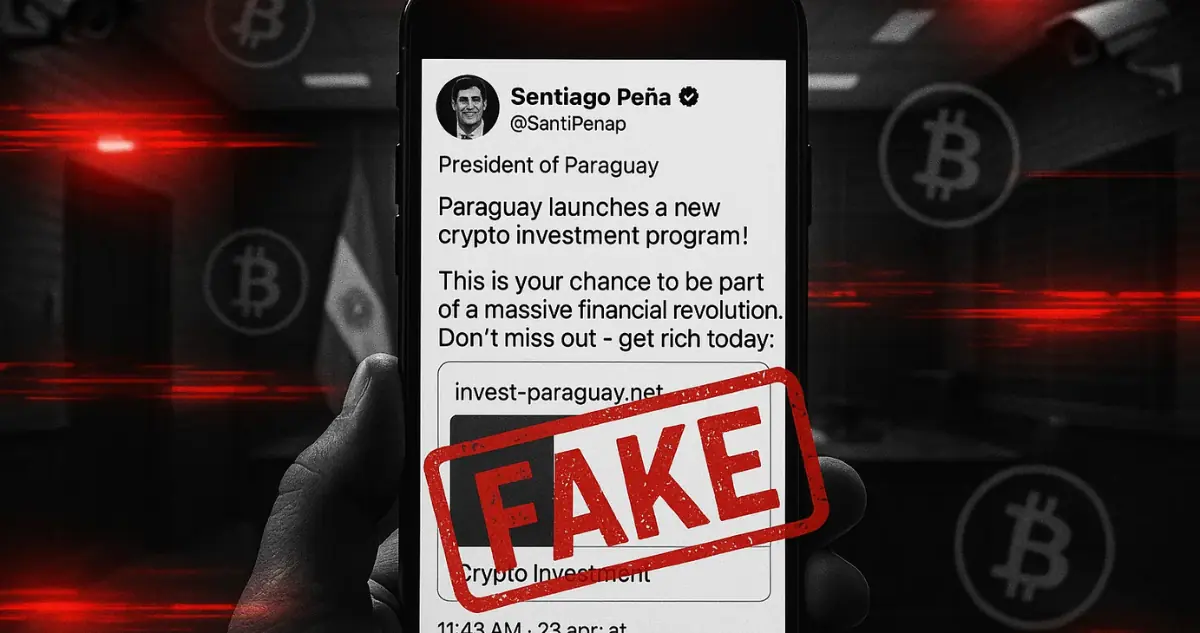

Once the token is made public, promoters - often paid by the organisers - aggressively advertise it on social media, online forums and through sponsored ads. Exaggerated promises are made about potential earnings to attract more investors.

3. Pump

The token price takes off as more and more people buy for fear of missing out on an explosive growth opportunity. The rapid rise in price fuels the hype and attracts other investors, creating artificial growth.

4. Dump

When the price reaches a profitable level, manipulators sell en masse. The sudden supply exceeds demand and the price collapses. The last investors are left with nearly worthless assets, because the token has no solid foundation.

Learn to recognise the dump signals: The Warning Signals

Recognising a pump-and-dump scheme requires careful observation and critical thinking. Here are the signs not to be ignored:

- Sudden Price Increases:If the price of a crypto rises quickly without news, technological innovation or real adoption, you should be suspicious.

- Limited Information and Lack of Transparency: Avoid projects with vague whitepapers, anonymous teams or no practical use.

- Sudden Spikes in Trading Volumes: An illiquid asset that sees a surge in volumes could be subject to manipulation.

- Aggressive and Sensationalist Promotions:Beware of those who advertise safe and quick gains, especially on social media.

- "Too Good to Be True" Offers:Beware of exaggerated promises: they often hide scams.

The Domino Effect: The Impact of These Schemes

Pump-and-dump schemes cause damage to both investors and the crypto market as a whole. The losses incurred undermine confidence in cryptocurrencies and damage the reputation of the industry, hindering its widespread adoption.

Protect Your Investments: Defence Strategies

Defending against these schemes requires preparation and awareness:

- Do Your Own Research (DYOR):Analyse the fundamentals of the project, the development team, the technology and the actual applications.

- Beware of Unsolicited Advice and Guaranteed Returns:Serious projects do not promise certain profits.

- Analyse Price and Volume History:Beware of abnormal and sudden surges.

- Understand Market Sentiment:Follow trends, but remain critical of current fads.

- Diversify the Portfolio:Don't put all your eggs in one basket. Diversification reduces risk.

- Use Logic, Not Emotion: Decisions should be made with data and reasoning, not FOMO.

The ever-evolving crypto market requires constant vigilance. Understanding how pump-and-dump schemes work and being able to recognise the signals is key to making smart choices and protecting your investments.