Two popular indicators used to measure investor demand in the US and Asia - the Coinbase Premium and the Kimchi Premium - have risen sharply recently.

This surge occurred while the general sentiment of the market remained gripped by panic and heavy selling. This divergence suggests that while global retail investors were selling, large-scale entities and determined Asian investors were accumulating.

Below is a detailed analysis based on historical data and expert commentary.

Two Premium Indices Reach Record Levels

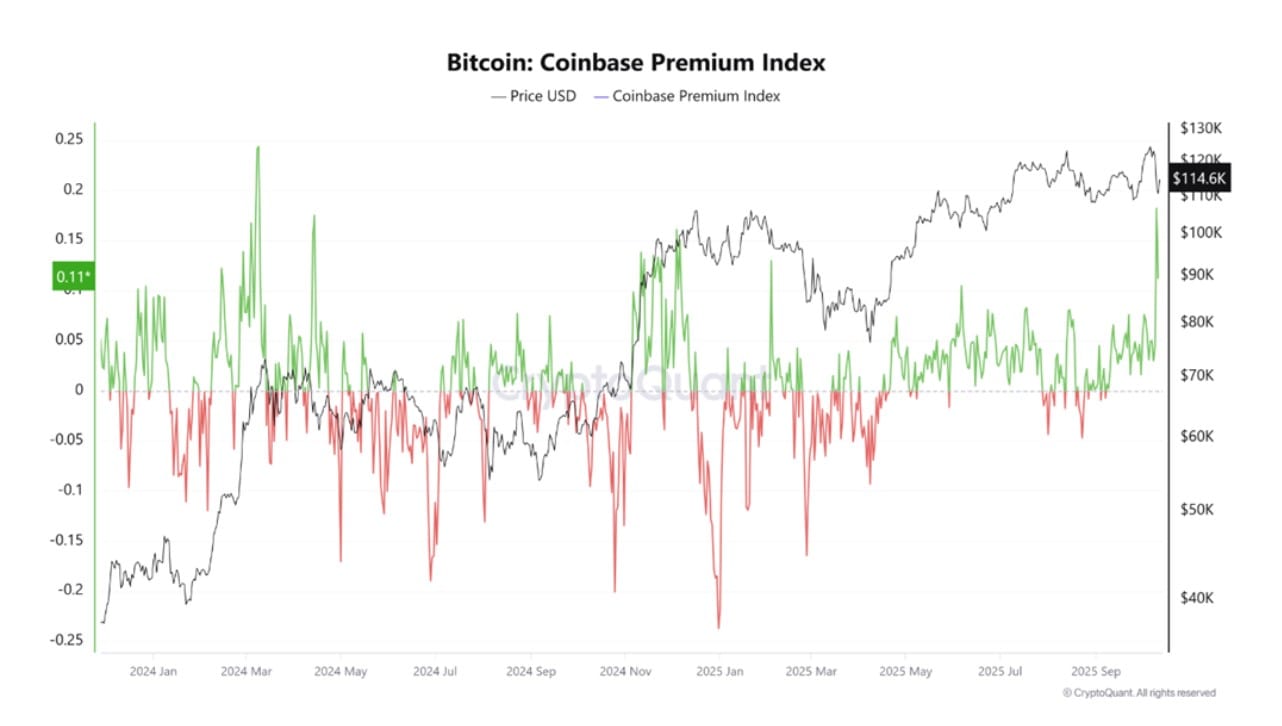

The Coinbase Premium measures the percentage difference between the price of Coinbase Pro (USD pair) and the price of Binance (USDT pair). A high premium indicates intense buying pressure from US investors on Coinbase.

According to CryptoQuant data, this indicator rose to 0.18 on 10 October, the highest level since March 2024. It has since fallen to 0.09, which is still the highest since June.

Analysts noted that despite the "Black Friday"-like panic sell-off, Bitcoin's Coinbase Premium hit a 19-month high during the crash, signalling massive institutional accumulation.

Analyst CryptoOnchain suggested:

This is a textbook example of institutional 'dip-buying' on a massive scale. While the global market was selling off, these large entities took advantage of the market panic and resulting liquidity to accumulate Bitcoin at lower prices.

CryptoOnchain added that the strong accumulation around $110,000 suggests the formation of a solid support zone. These institutions could step in with additional buy orders if the price declines.

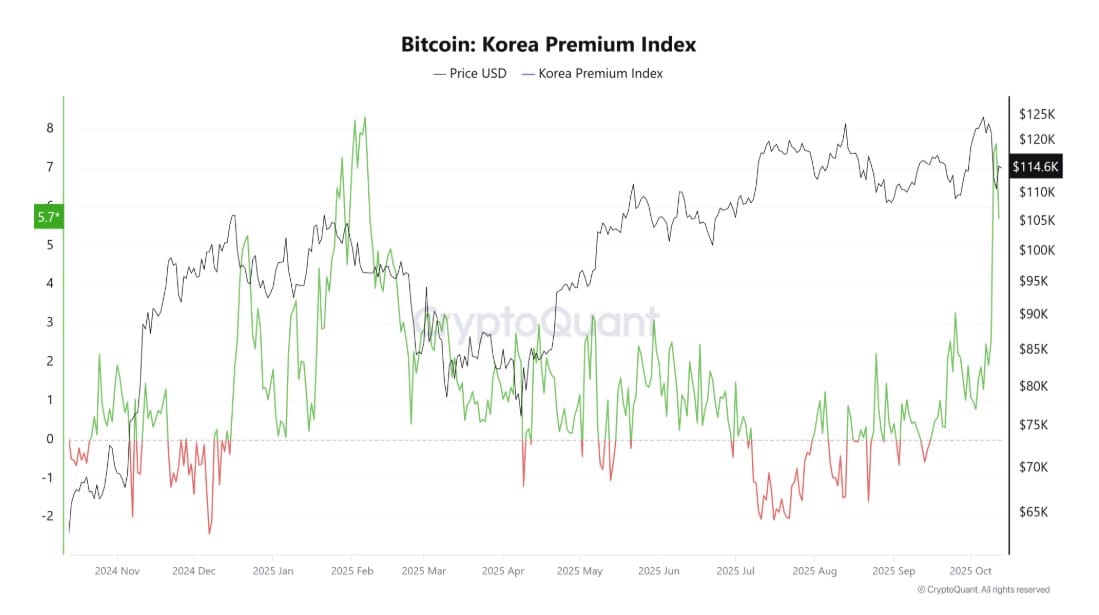

The Kimchi Premium Reflects Retail Sentiment

If the Coinbase Premium represents institutional buying pressure in the US, then the Kimchi Premium (also known as the Korea Premium) reflects the retail investor sentiment in South Korea.

This indicator measures the price gap between South Korean and global exchanges. A high premium means that Korean retail investors are showing strong buying interest.

CryptoQuant's data also showed that this indicator has risen to its highest since February 2025. Brian HoonJong Paik, Co-founder and CEO of SmashFi, highlighted the current frenzy, stating:

The Korea Kimchi premium is exploding. Bitcoin on Bithumb is trading at 7.47% higher than Binance. Insane. This also...

Although the Crypto Fear & Greed Index moved abruptly from greed to fear during the second week of October, this wave of fear seems to be creating opportunities for some investors to build stronger positions.

While the bullish arguments for institutional buying seem reasonable, past patterns suggest a potential warning signal for the market.

Broadening the analysis and smoothing both indicators using the 30-day simple moving average (SMA30), a clear pattern is revealed: historically, when the Coinbase Premium and Korea Premium rose together, the market tended to decline shortly afterwards - as seen in March 2024 and February 2025.

This pattern also shows how long it might take the market to recover. In the two previous instances, after both indicators spiked, the market took three to six months to rebound. Some analysts believe the market will remain stable, while others are sceptical, suggesting that new investors may hesitate after witnessing the recent volatility.

Depending on this, the path to recovery will depend heavily on the next moves by the leaders of major global economies, developments that investors are closely monitoring.