The cryptocurrency market experienced an abrupt shock early Monday in Asia, when the Bitcoin (BTC) briefly fell as low as $93,000, before rising again.

This drastic price movement triggered a veritable cascade of events in the derivatives market, causing liquidations of more than $510 million in just 24 hours and officially wiping out all gains recorded since early 2025.

An aggressive correction wipes out annual gains

Bitcoin's recent correction has mowed nearly 24% from its early October high of $126,000. The drop to $93,000 represented a significant psychological and technical break, taking the price back to its opening point for the year.

A marked change was also observed in the sentiment of the weekend: for the first time in several weeks, Bitcoin fell rather than rose, creating, according to market analyst KillaXBT, a "bearish set-up ahead of Monday".

Based on the last 300 days of price action, there is about a 36% chance that Monday will open with a pivot low rather than a pivot high, has affirmed Killa on X.

$BTC

- Killa (@KillaXBT) November 16, 2025

For the first time in weeks, BTC didn't pump over the weekend, it actually moved lower. Instead of setting up the usual bullish narrative heading into Monday, this created a bearish one.

Based on the last 300 days of price action, there's roughly a 36% chance that Monday... https://t.co/NGkkqLHtYo pic.twitter.com/3lyd1sRxdI

Based on 300 days of historical data, this pattern suggests a 36% probability that Monday will set a short-term low.

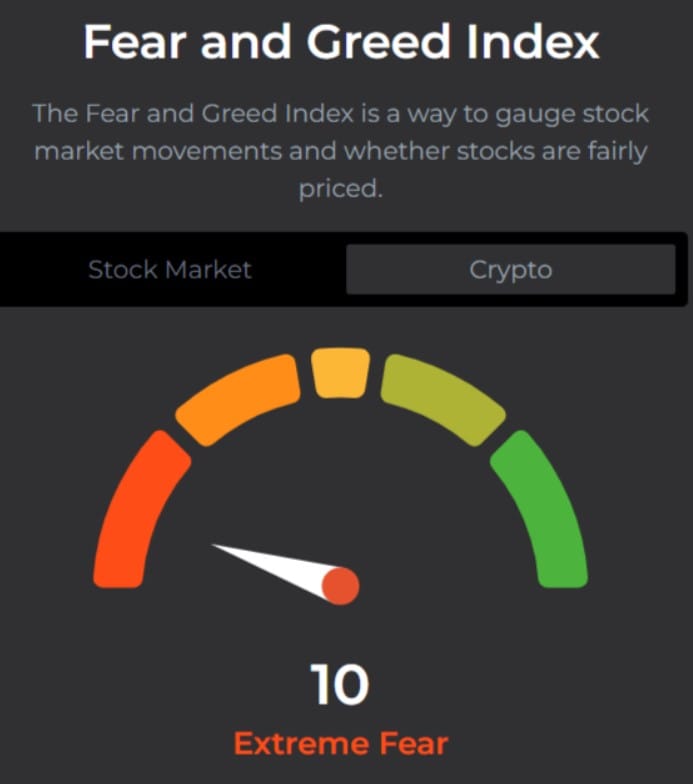

A testament to the panic, the Crypto Fear and Greed Index plunged to 10, two points lower than the previous reading, signalling a state of "extreme fear" among traders. This is a sharp reversal from November 2024, when the index had peaked at 93 amid euphoria.

Massive liquidations in the derivatives market

The price collapse triggered a flurry of liquidations in the crypto derivatives market. In 24 hours, exchanges liquidated more than 150,000 traders, with total closures exceeding $510 million.

Long positions were the hardest hit, suffering losses of $40.37 million in a single hour and $77 million in four hours. The Bitcoin alone contributed $41.61 million in long position liquidations, followed by Ethereum with $13.99 million. Other cryptocurrencies such as Solana, XRP and Dogecoin also recorded multimillion-dollar liquidations.

Support Levels Determine the Route

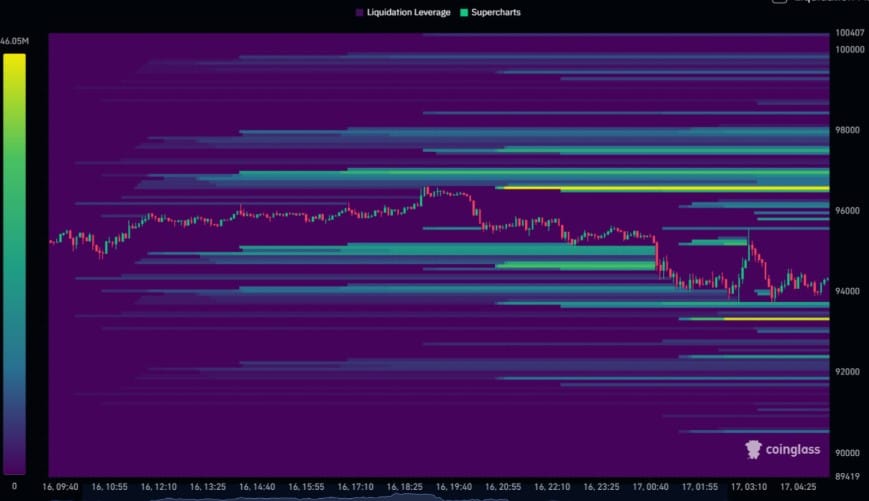

Analyst KillaXBT has identified several crucial support zones to define Bitcoin's short-term direction. The immediate focus is on $94,100, with more substantial support expected at $93,500 - the year's opening price - and in the $89,000 to $91,000 range.

These areas are considered key buying zones, but the analyst advised against the use of high leverage due to the current high volatility.

The invalidation of the bullish scenario would occur with a sharp fall below $85,000, signalling a trend reversal. If, on the other hand, liquidity is absorbed at the lower supports, a recovery towards the psychological $100,000 threshold would be possible, although resistance at $98,300 would have to be overcome first. The market remains at a critical juncture of uncertainty.