Financial institutions have finally learned to live with the volatility of Bitcoin. The reason is simple: volatility is measurable and, through sophisticated strategies, manageable. However, what still holds back large capital allocations is not the price fluctuation, but the risk of 'moving the market' during entry or exit.

A fund can hedge against price fluctuations with options or futures, but there is no hedge for the cost generated by a thin order book, the overhang of spreads or the slippage visible during a rebalancing. In summary: liquidity matters more than headlines. It is the market's ability to absorb trades at a predictable cost.

The Spot Layer: Depth and "Refill" Capacity

The first level of analysis is spot execution. Often we simply look at the bid-ask spread (the gap between the best buy and sell price), but this can be misleading. A spread can appear narrow even when the underlying market is thin.

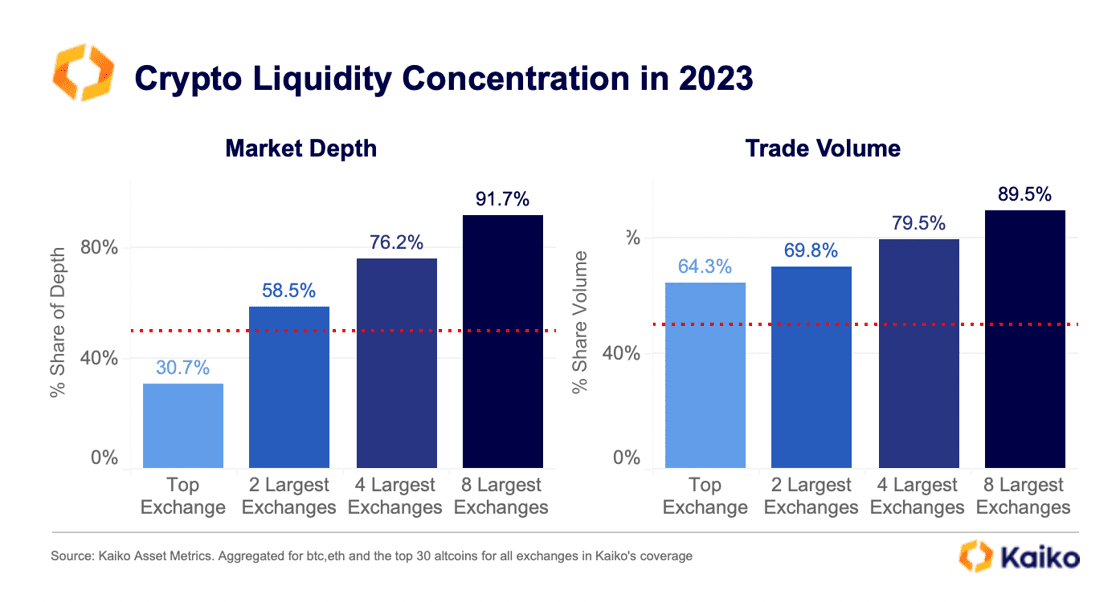

Industry research, such as that conducted by Kaiko, suggests monitoring market depth at 1%: the total amount of liquidity available within 1% of the average price. When this depth decreases, even a small order size can cause disproportionate price movements. Another crucial factor is 'refill': the speed with which liquidity returns to the order book after a large trade. Resilient markets are distinguished from fragile markets precisely by this ability to immediately refill.

The time factor: Liquidity is not constant

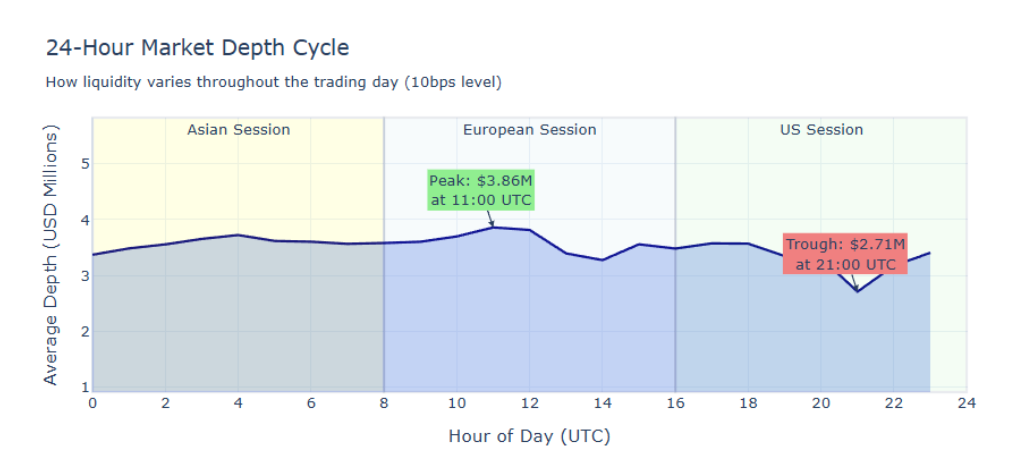

Although Bitcoin is traded 24 hours a day, institutional liquidity is not evenly distributed. Data from Amberdata show intraday and weekly rhythms: market depth tends to shrink dramatically outside of the overlapping office hours between the large financial centres.

This means that a market can appear solid during the New York or London session, only to become mechanically fragile during the overnight or weekend hours. Recent analyses indicate that 30% drops in aggregate depth near psychological price levels (so-called 'round numbers') make the market extremely sensitive, turning simple flows into violent price events.

Derivatives and ETFs: Stress transmitters

When the spot market tapers off, derivatives gain more weight. perpetual swaps and futures can concentrate leverage; if funding rates rise too much, positioning becomes 'crowded' and vulnerable. In the case of forced liquidations, these are executed as market orders, causing price 'gaps' if spot liquidity is lacking.

The ETFs play an ambivalent role. They create a secondary market where investors can trade shares without directly touching the underlying Bitcoin. However, large one-way flows force authorised participants to create or redeem trades that inevitably spill over into the spot market, increasing pressure if supply channels are tight.

Stablecoin: The Invisible Cash Infrastructure

The last pillar is cash mobility. Institutions need not only BTC liquidity, but reliable 'rails' to move collateral and cash. Today, stablecoins are at the heart of this system.

Liquidity is increasingly shaped by regulations: capital tends to concentrate where stablecoins are regulated and exit channels are certain. If liquidity is plentiful on a platform that an institution cannot use for compliance reasons, for that investor that liquidity simply does not exist.

Conclusion: Measure without conjecture

To understand whether the market is maturing, you need to look at the data:

- Profundity at 1% on major exchanges.

- Standardised slippage for fixed-size orders.

- Funding rates of perpetual contracts as a thermometer of leverage.

- Volumes of ETFs cross-referenced with creation/redemption data.

If these layers improve in unison, Bitcoin becomes a widely tradable asset. If not, institutions will continue to buy, but with extreme caution, taking refuge in derivative instruments and treating hours of low liquidity as high-risk zones.