In the last 24 hours, the cryptocurrency market has fallen sharply, with total capitalisation down 6%. This wave of selling has spared no one, extending far beyond individual digital tokens and hitting hard the stock prices of major companies that have adopted Bitcoin and Ethereum as mainstays of their corporate reserves.

Leading companies such as MicroStrategy (now Strategy) and BitMine now face mounting pressure as their equities hit lows not seen in months.

Market Overview: A Black Monday for Bitcoin and Ethereum

The financial storm was fuelled by rising macroeconomic tensions that triggered widespread risk flight. During the first hours of Asian trading on the Binance platform, the two main cryptocurrencies by capitalisation hit two-month lows. Bitcoin (BTC) fell 6.7 per cent, while Ethereum (ETH) saw even sharper losses, slipping 7.6 per cent.

The crash was not limited to the digital sector alone: negative sentiment quickly spread to precious metals and global stock markets, creating a domino effect that swept through the largest corporate holders of crypto assets.

MicroStrategy at 16-Month Lows: Peter Schiff's Analysis

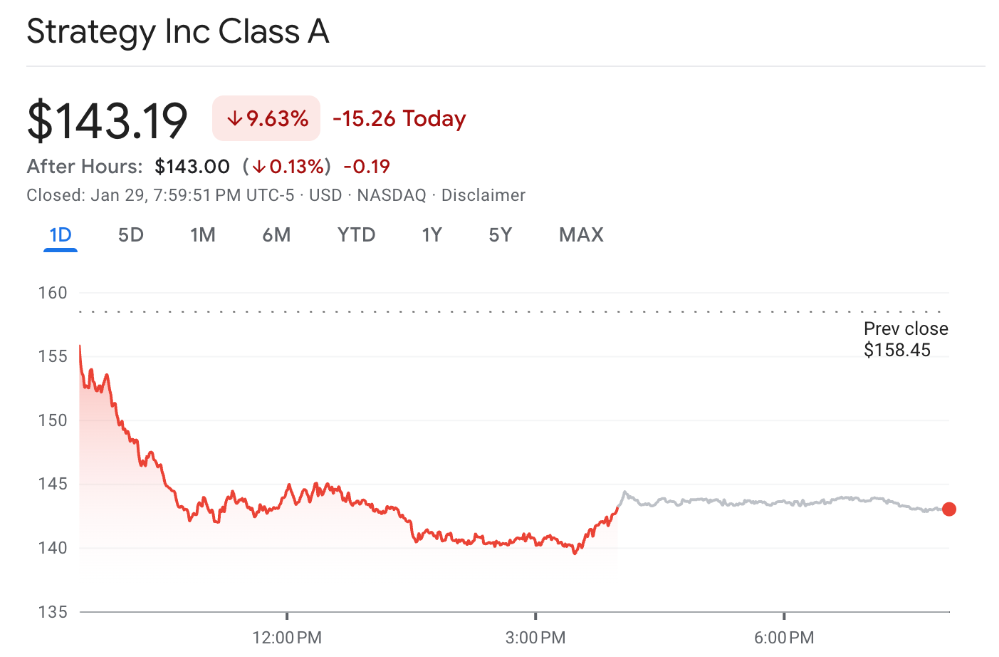

According to data from Google Finance, Strategy (MSTR) shares closed Thursday's session at $143.19, down 9.63%. This is the lowest level recorded since September 2024, with a further slide of 0.13% in after-hours trading.

Economist Peter Schiff, a well-known Bitcoin critic, commented harshly on the drop, pointing out that MSTR's stock has lost almost 70% from its peak.

Saylor has spent $54 billion over the past five years to buy over 712,000 Bitcoins at an average price of just over $76,000. His total unrealised gain is less than 11%. Too bad he didn't buy gold!" he wrote.

$MSTR closed down 9.5% today, a new 52-week low. The stock is down nearly 70% from its high. @Saylor spent $54 billion over the past five years buying over 712K bitcoins at an average price of just over $76K. His total unrealised gain is less than 11%. Too bad he didn't buy gold!

- Peter Schiff (@PeterSchiff) January 29, 2026

In spite of the drawdown, the company driven by the philosophy of extreme accumulation shows no signs of changing course. On 26 January alone, Strategy announced the purchase of a further $264.1 million in BTC at an average price of $90,061 per coin. With this transaction, the fourth in January alone, the company now holds a total of 712,647 BTCs, valued at about $59.1 billion.

However, analysts warn: with the net asset value (NAV) multiple dropping below 1.0x and Bitcoin per share growth close to zero, Strategy risks becoming dilutive to shareholders unless share premiums return.

BitMine and the Weight of Ethereum: Unrealised Losses for 38 billion

Mirror situation for BitMine (BMNR), whose stock closed the day on Thursday at $26.70, losing 9.89% and touching its lowest since November 2025.

Despite the downturn, BitMine recently finalised its largest purchase of Ethereum since 2026, acquiring 40,000 ETH. Currently, the company controls about 4,243,338 ETH, or 3.5% of the entire circulating supply of Ethereum, worth about $11.68 billion.

Although more than half of these assets are employed in staking operations, CryptoQuant's on-chain data reveal a worrying reality: BitMine is reportedly facing an unrealised loss of around $3.8 billion. This figure highlights the structural weaknesses of treasury strategies heavily exposed to the volatility of digital assets during economic downturns.

A Systemic Phenomenon for Crypto Focused Companies

The collapses of Strategy and BitMine are not isolated events, but reflect a systemic vulnerability. Other industry-focused companies, such as Metaplanet, Strive and Sharplink, experienced significant declines, albeit smaller in magnitude than the two market giants.

While these companies continue to show a strong belief in the long-term value of digital assets, the stock market appears to be punishing their direct exposure, raising questions about the sustainability of such treasury strategies in an uncertain macroeconomic environment.