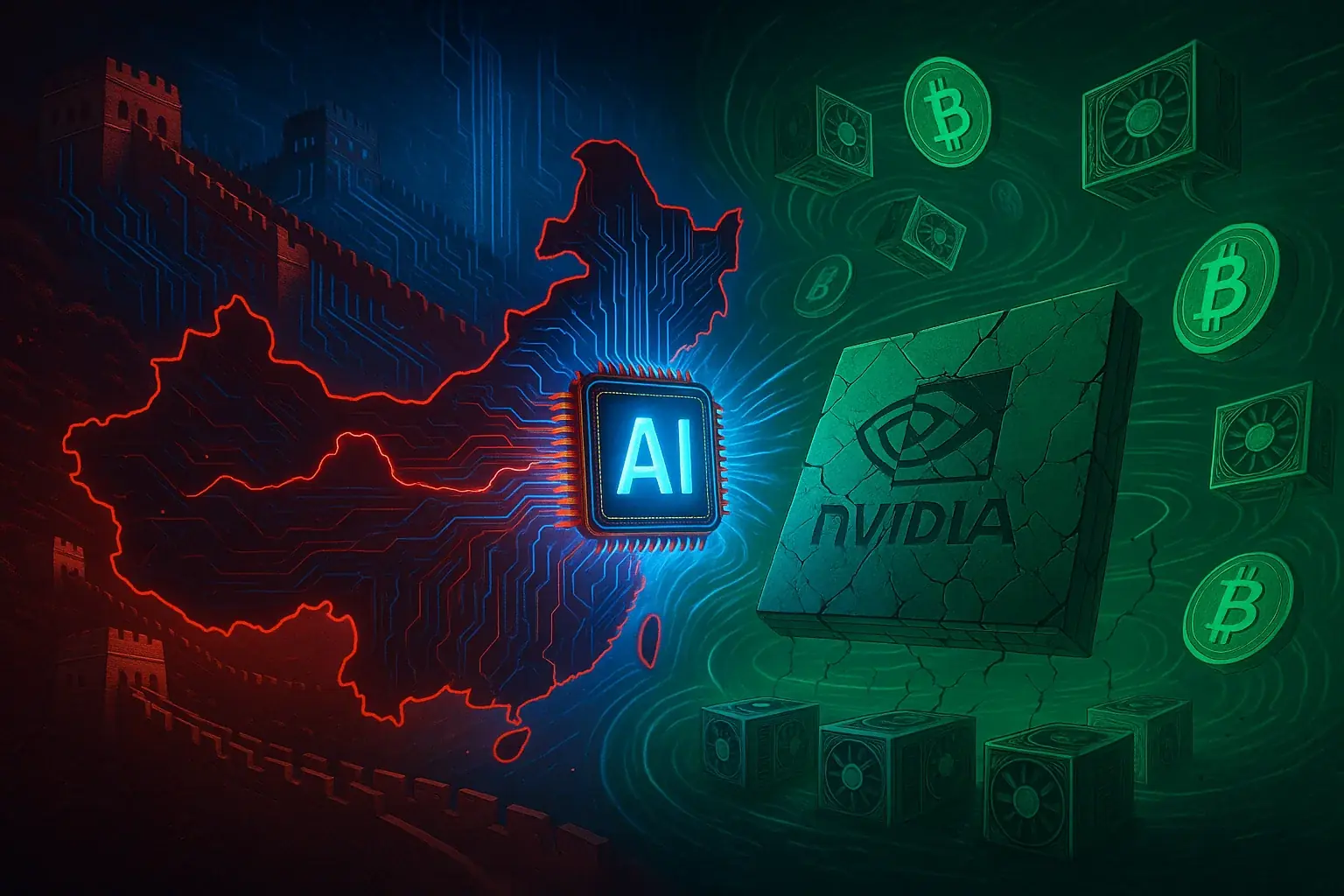

Chinese artificial intelligence company DeepSeek is expected to release its own AI chip, entirely designed and manufactured in China.

The launch could create new concerns for US technology companies and cryptocurrencies, which are already affected by China's advances in AI and its self-sufficiency in the necessary hardware.

The release of DeepSeek's large language model (LLM) in January has already shaken the AI and cryptocurrency markets. With this new announcement, some analysts predict a further turnaround. While OpenAI's CEO Sam Altman recently predicted an AI bubble and Meta announced a slowdown in its AI division, DeepSeek's latest hardware news has rattled the markets.

According to the company's announcement, the AI chip is entirely designed and manufactured in China, as also reported on the company's social media. The announcement emphasised that 'both processes were completed by Chinese companies, without relying on foreign supply chains'. In other words, even if the chip does not compete with Nvidia in terms of performance, the US company still risks losing ground in China if DeepSeek succeeds.

"Most analysts believe China's advanced chip production lags far behind that of Western companies like Nvidia. But China is opaque and the world has been stunned by DeepSeek. I think the chip ban imposed on China is achieving the exact opposite of what the US wanted,' said The Passive Income Guy.

Most analysts reckon advanced Chinese chipmaking is far behind Western co's like Nvidia. But China is opaque & world was stunned by DeepSeek. I reckon chip ban on China is going to achieve exact opposite of what US wanted.

- The Passive Income Guy (@hazelwood_dave) August 22, 2025

It is particularly relevant that Nvidia is at the crossroads of artificial intelligence and cryptocurrency. Its GPUs are used both for training large AI models and for mining cryptocurrencies. A move away from the US company could therefore have a domino effect on multiple sectors. The mere possibility that China's DeepSeek could wrest control of AI from the US has already caused significant declines in Nvidia's share prices and stocks related to cryptocurrency mining.

The latest developments could be a response to the trade bans imposed during the Trump era on Nvidia chips with computing power above 7 billion transistors and the introduction of a security backdoor after trade with China resumed. In reaction, Beijing has banned the use of Nvidia chips by Chinese companies, accelerating the country's race towards hardware self-sufficiency.

According to a Reuters report, Nvidia is now abandoning the Chinese market altogether. This is significant, because should DeepSeek's chip be successful, Nvidia would lose access to one of the world's largest technology markets. This would also be a major disruption for cryptocurrency miners who use Nvidia GPUs in their mining rigs.

The move would hit cryptocurrencies even harder. If an anti-crypto country like China came to control a key sector of the hardware industry, the supply chains and economies of mining would be severely compromised globally. Even if DeepSeek's hardware was inferior to Nvidia's, the geopolitical shift alone would hurt the US company. But if DeepSeek were to match or surpass Nvidia, it would open up a global race for dominance.

For now, one thing is certain: DeepSeek's AI chip will represent much more than just a matter of artificial intelligence.