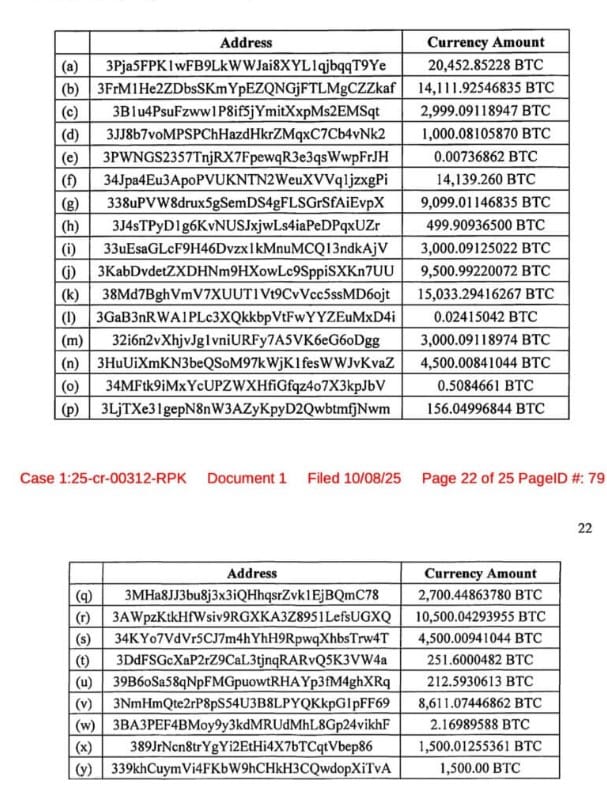

The US government is set to seize 127,271 Bitcoins, worth an estimated $14.2 billion, an action that, if completed, would represent one of the largest cryptocurrency seizures in history.

The funds, according to investigators, are the product of a vast cross-border scam known as "pig butchering" ("pig butchering" or "sha zhu" in Chinese), orchestrated by Chinese citizen Chen Zhi.

The Strategic Bitcoin Reserve will be capitalised with bitcoins owned by the Treasury Department that have been seized as part of criminal or civil asset forfeiture proceedings, The Executive Order states explicitly

The extent of the seizure has direct implications for US digital monetary policy. Under the terms of the Executive Order signed earlier this year by then-President Trump, the Bitcoins seized should be added to the US Strategic Bitcoin Reserve.

However, the implementation of this plan is hampered by the lack of a formalised policy, exacerbated by the current governmental blockade, and limited time to ratify the legal action.

The legal file, filed on 14 October, describes a far-reaching criminal enterprise that has fused cryptocurrency investment fraud, human trafficking and political corruption.

The Fraud Mechanism and Forced Labour

According to the court document, Chen Zhi headed the Prince Group, a key player in Cambodia's underground digital economy. The group operated a network of scam complexes that also served as detention centres for trafficked workers.

Thousands of migrants, lured with false job offers, were allegedly forced to run fraudulent cryptocurrency investment schemes under the constant threat of violence.

Under Chen's direction, at least ten large complexes were established, including sites linked to the Jinbei Hotel and Casino, Golden Fortune Science and Technology Park and Mango Park.

Court records indicate that Chen personally kept detailed records of each site's operations, referring to the Chinese expression 'sha zhu', which denotes long-term scams based on emotionally manipulating victims before robbing them.

The US government alleges that Chen and senior executives of his group exploited bribes and political influence to evade prosecution, even managing to obtain advance warnings about law enforcement raids. By exploiting these connections, the group maintained control over billions in illicit cryptocurrency flows, consolidating its position in Cambodia's underground economy.

International Sanctions Against the Group

In addition to the action to confiscate the illicit funds, US authorities, in coordination with the UK's Foreign, Commonwealth and Development Office (FCDO), have imposed sanctions on Chen and his related entities.

According to a press release, OFAC sanctioned 146 individuals and entities linked to the Prince Group Transnational Criminal Organisation (TCO), a Cambodia-based syndicate that allegedly ran hundreds of online investment scams against Americans and citizens of allied nations.

In addition, the Financial Crimes Enforcement Network (FinCEN) invoked Section 311 of the USA PATRIOT Act to formally isolate Cambodia-based Huione Group from the US financial system, labelling it a primary conduit for laundering the proceeds of cryptocurrency fraud and related cybercrimes.

US officials claimed that Huione's networks were instrumental in hiding billions of dollars stolen from investors around the world.