Elon Musk recently re-proposed the "51% renewable energy" benchmark for Bitcoin mining, reiterating that the energy that underpins the cryptocurrency "cannot be faked".

This reference goes back to his earlier promise that Tesla would resume accepting payments in BTC once at least half of the mining energy had come from clean or low-carbon sources.

However, despite recent data suggesting that the network has surpassed that threshold, Tesla's BTC checkout remains disabled. Why?

Bitcoin has Exceeded the Sustainability Threshold?

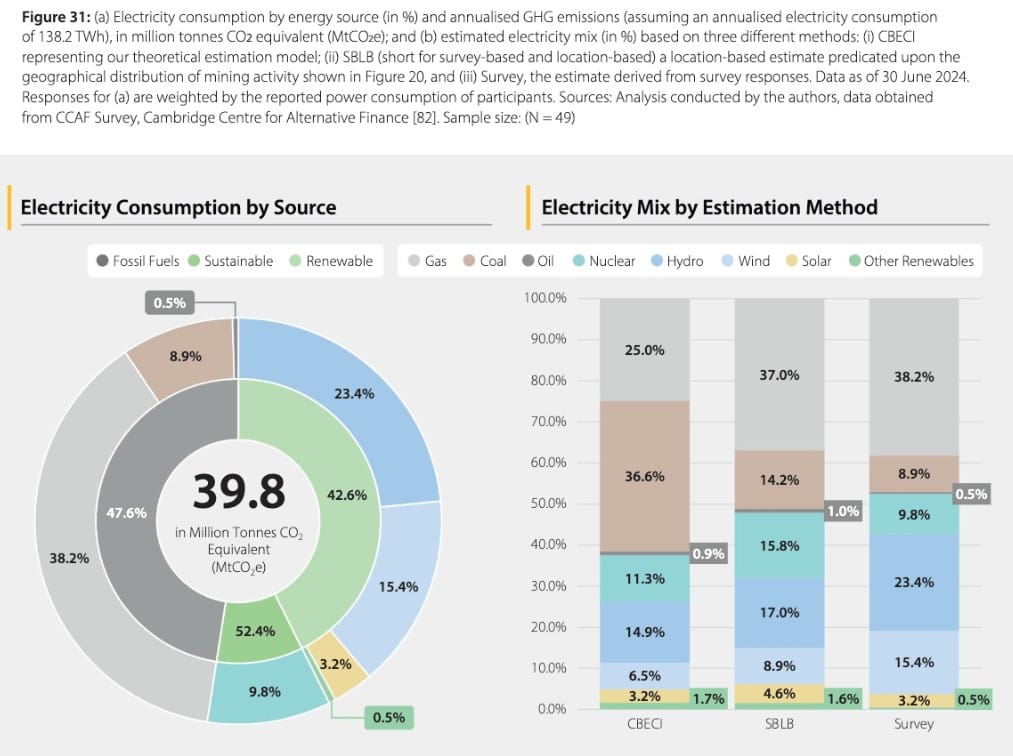

According to the Cambridge Centre for Alternative Finance's 2025 Digital Mining Industry Report, sustainable energy now powers approximately 52.4% of Bitcoin's mining activity.

This percentage is made up of 42.6% from renewable sources (hydro, wind, solar, etc.) and 9.8% from nuclear or other low-carbon sources. At the same time, the contribution of fossil fuels changed, with natural gas rising to 38.2% and coal falling to 8.9%.

If the promise of Musk is interpreted to include nuclear and low-carbon sources in the definition of "sustainable," Bitcoin would have crossed the bar. However, the share of renewables alone is lower (42.6 per cent), and Musk has on a few occasions referred to 'renewables' in a narrow sense.

The True Reasons for Tesla's Rejection

Nominally exceeding the threshold is not enough. Musk's test, in fact, seems to be as much about confidence, consistency and perception as it is about raw data.

- Two Diligence and Trend: Musk had called for 'reasonable clean energy use (~50%) and an upward trend'. A single figure of 52% does not guarantee a verified and sustained trend.

- Definition and Greenwashing: Clarity on the definition of 'sustainable' is crucial. Including nuclear power is a point of debate. Any reactivation without a universally accepted definition would risk triggering accusations of greenwashing against Tesla's environmental image.

- Financial and Operational Risk: Accepting BTC exposes Tesla to price volatility, complicated accounting procedures and regulatory risks. Immediate conversion does not eliminate financial uncertainty, which may not be worth the effort for a company operating on slim margins.

For now, the Tesla checkout page remains cryptocurrency-free. Bitcoin's alleged '51%+ sustainable' status is a convincing rebuttal for critics, but until payments return, it remains more of a symbolic than commercial victory for adoption.