The company strengthens its position in BTC and targets a strategic reserve

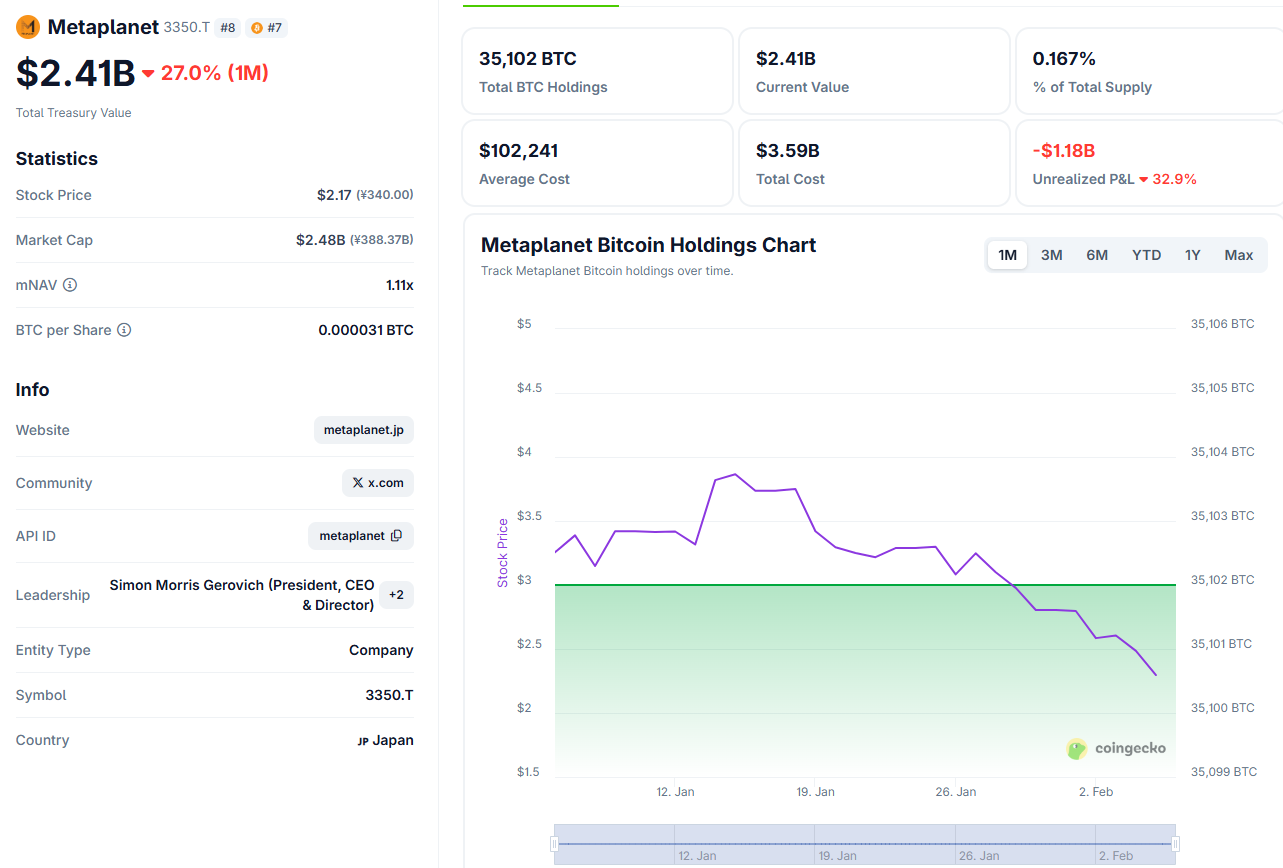

Metaplanet has confirmed its intention to continue purchasing Bitcoin as a central part of the company's financial strategy. The company, already known for adopting an approach geared towards the accumulation of BTC on its balance sheet, sees the digital asset not as a short-term speculative bet, but as a strategic reserve on a multi-year horizon.

The decision comes in a market environment in which more and more companies are valuing Bitcoin as a hedge against inflation, currency devaluation and macroeconomic instability. In this scenario, Metaplanet ranks among the most determined players in turning cryptocurrency into a pillar of its capital structure.

Bitcoin as a corporate treasury asset

From traditional liquidity to digital reserves

In recent years, some listed companies have begun to reconsider the role of cash on their balance sheets. Holding large amounts of cash at a standstill exposes them to the risk of purchasing power erosion, especially during periods of expansionary monetary policies. Hence the idea of diversifying part of the reserves into assets alternatives.

Metaplanet interprets Bitcoin as a form of 'digital gold', characterised by limited supply and independence from national monetary policies. The company believes that, in the long term, this characteristic can translate into structural value protection.

A declared continuous strategy

The plan does not involve isolated purchases, but a gradual and repeated path over time. The objective is to build a significant position through distributed transactions, reducing the impact of short-term volatility.

The accumulation strategy is based on several operational guidelines:

- scheduled purchases in different market phases;

- use of dedicated financial instruments;

- integration of BTC in treasury management.

Market reaction and investor perception

Bitcoin accumulation choices by companies tend to generate immediate reactions among investors. On the one hand, there are those who interpret these moves as a sign of strategic vision and financial innovation. On the other, there is no shortage of concerns related to the volatility of the asset. In the case of Metaplanet, the continuity of the message - maintain and increase exposure - reduces interpretative ambiguity. This is not a test, but a clear course of action. This element, for many analysts, contributes to reinforcing the corporate narrative.

The reasons behind the choice to continue buying

A long-term macroeconomic reading

The decision to continue buying stems from a precise reading of the global scenario. High debt, fluctuating monetary policies and geopolitical tensions are pushing some companies to look for non-sovereign and non-inflationary assets. Bitcoin, with its predetermined supply, is seen as offering predictability on the scarcity side, unlike fiat currencies.

Risks and variables to monitor

Of course, the strategy is not without risks. Bitcoin remains a volatile asset, subject to even very large price cycles. This can affect quarterly results and the market's perception of risk. Additional elements of uncertainty include regulatory developments, tax changes and possible restrictions in some jurisdictions. Companies adopting BTC in their balance sheets must therefore have very clear risk management policies.

Towards a new normality for company balances?

Metaplanet's approach could anticipate a broader trend: the gradual entry of digital assets into corporate treasury strategies. If the model proves sustainable over time, other companies may follow suit.

Much will depend on the stabilisation of the market infrastructure, regulatory clarity and the ability of companies to transparently communicate their choices. In this context, the continuous accumulation of Bitcoin no longer appears as an isolated experiment, but as a possible sign of structural transformation of corporate finance.