In the last few days, the crypto market spotlight has once again shone on one of its most emblematic dynamics: Strategy, the company led by Michael Saylor, has forcefully relaunched its strategy of accumulating Bitcoin. In just eight days, the company has invested approximately $2.13 billion, marking one of the most aggressive and significant buyouts by a listed entity in recent years.

The move, officially communicated to US regulators, has not gone unnoticed and further reinforces Strategy's role as one of the most influential institutional players in the Bitcoin ecosystem, capable of affecting market sentiment and expectations in the short to medium term.

A new chapter in BTC accumulation by Strategy

According to official documents, Strategy acquired 22,305 Bitcoins between 12 and 19 January 2026, bringing its total position to 709,715 BTC. The transaction was mainly financed through proceeds from the at-the-market share offering programme. This holding level corresponds to over 3.5% of the Bitcoin supply currently in circulation, cementing the company's role as one of the largest private Bitcoin holders globally.

Market and immediate reactions

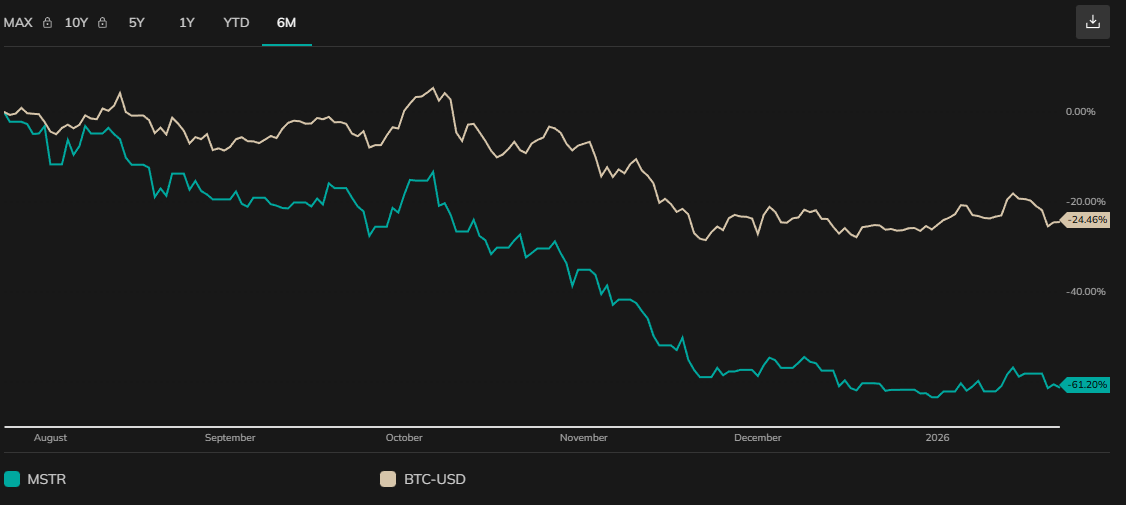

Despite the size of the purchase, market reaction was mixed. During the period of the purchase, Bitcoin's price declined slightly, while Strategy's shares (MSTR) fell by around 7%, reflecting the stock's sensitivity to crypto market fluctuations. Analysts point out that the action to continue buying is partly motivated by a desire to convey confidence to the markets: stopping purchases could be interpreted as a sign of weakness in the company's financial position.

A long term strategy or a risky bet?

The philosophy of accumulation

Strategy, which was formerly known as MicroStrategy, has adopted a policy of Bitcoin accumulation since 2020, gradually transforming its balance sheet into a kind of Bitcoin treasury. With this latest transaction, the company further reinforces this strategy, which has brought its total spending in BTC to over $53.9 billion, with an average cost per Bitcoin of about $75,979. This philosophy reflects a strongly bullish view on Bitcoin as a store of value over the long term, similar to how some companies hold gold or other strategic assets on their balance sheets.

Investors' point of view

These dynamics are redefining Bitcoin's role in the financial landscape, with clear implications for the market:

- Signal of structural confidence:

Institutional investors and large holders interpret the continued accumulation as a confirmation of Bitcoin's strength as a long-term asset. - Strengthening role as a "reserve asset":

Involvement of listed companies contributes to consolidating the perception of Bitcoin as a reserve asset, especially in phases of high macroeconomic uncertainty. - More mature market, but not immune to risk:

The presence of institutional capital tends to reduce impulsive reactions, but does not eliminate volatility altogether. - Concentration risk:

Analysts warn that a growing share of BTC held by a few large players may amplify price movements in the event of sudden shocks or changes in sentiment.

All in all, institutional accumulation emerges as an underlying stability factor, but also as a key variable to be monitored in times of market stress.

Conclusion: a movement watched with attention

The recent Strategy buying offensive reinforces a now structural trend: for a growing part of the corporate and institutional world, Bitcoin is no longer a marginal asset, but a diversification tool and a potential store of value. The scale of the transaction - over $2.1 billion invested in just eight days - signals a strong conviction on the part of management, which has matured despite a market environment still marked by volatility and macroeconomic uncertainties.

At the same time, the relatively composed response of Bitcoin and Strategy stock suggests that the market is increasingly naturally absorbing this type of holding. Major institutional moves no longer provoke knee-jerk reactions, but are gradually being integrated into the overall picture, contributing to a greater maturity of the sector.

The sentiment remains multifaceted and lacking in absolute certainties, but one point is becoming increasingly clear: the decisions of institutional players are becoming one of the main drivers of crypto market evolution. And moves like Strategy's continue to redefine, step by step, Bitcoin's role within the global financial system.