An unprecedented transfer of wealth in modern history

In the coming decades, the world will witness one of the largest wealth transfers ever recorded. According to various estimates, more than $100 trillion will pass from older generations to their heirs, largely belonging to Millennials and Generation Z. An economic phenomenon that does not only affect banks, funds and real estate, but could have a direct and profound impact on one sector in particular: the cryptocurrencies.

This enormous flow of capital does not only represent a change of hands, but also a change of mentality. The new beneficiaries of global inheritance have radically different financial habits than their parents and grandparents. More digital, more risk-prone and more open to innovation, they could be the ones to push the crypto market into a new phase of growth.

Why new generations look at cryptocurrencies

A different relationship with money and technology

Millennials and Gen Z have grown up in a world dominated by the internet, smartphones and digital platforms. For many of them, the concept of 'physical banking' is already obsolete, while payment apps, fintech and blockchain are part of everyday life.

Unlike previous generations, these investors do not see cryptocurrencies as a fringe experiment, but as a natural extension of the digital economy. This cultural shift could prove decisive as huge assets come into their possession.

More willingness to risk, more openness to innovation

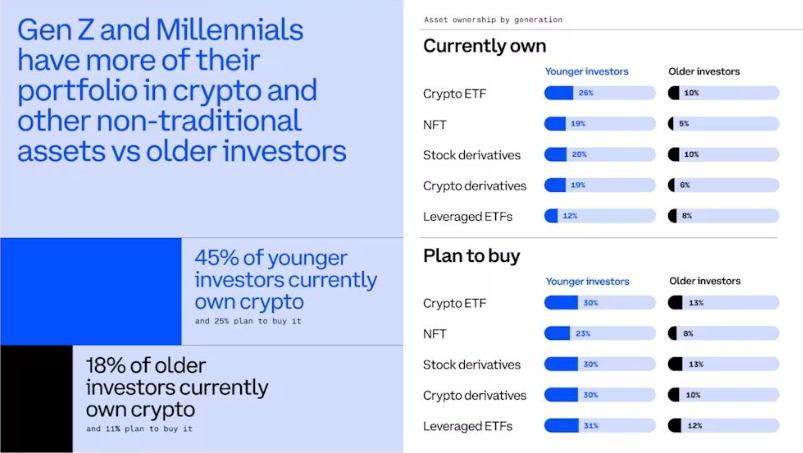

Another key element is the different perception of risk. Younger generations are generally more willing to allocate a significant part of their capital to alternative assets, including Bitcoin, Ethereum and projects related to decentralised finance.

According to several analysts, even a small percentage of that $100 trillion invested in cryptocurrencies would be enough to completely reshape market dynamics.

The possibility of a new bull market

An influx of capital that could drive prices higher

The massive inflow of new capital is one of the main drivers of any financial market. In the case of cryptocurrencies, which are characterised by a limited supply - just think of the 21 million Bitcoins - the effect could be amplified.

If even just 5% of inherited wealth were to be allocated to digital assets, we would be talking about trillions of dollars ready to enter a market that today is worth a fraction of that amount.

The CEO's voice: "A generational revolution is coming"

According to the CEO of one of the leading international crypto platforms, the generational shift represents a historic turning point for the entire industry.

"We are about to witness a silent but very powerful revolution," the CEO said in a recent interview. "When a new generation inherits not only wealth, but also a digital view of the world, the rules of the game change. Cryptocurrencies could become a standard component of the portfolios of the future."

The executive emphasised how the combination of inheritance, technological literacy and trust in decentralised tools could create the ideal conditions for a new market expansion.

Volatility and Regulation

Although the outlook remains positive overall, the path of cryptocurrencies is far from without pitfalls. The very nature of these assets, characterised by strong price fluctuations and a still evolving regulatory framework, calls for caution for those approaching the sector with large amounts of capital.

In particular, there are a number of critical factors to consider:

- the high volatility of the markets, which can generate quick gains but also sudden losses;

- the regulatory uncertainty in many jurisdictions, with laws that change rapidly and create instability;

- the risk that a massive influx of capital will amplify the swings, making the market more difficult for less experienced investors to interpret.

A scenario that could reshape the financial future

The $100 trillion legacy wave is not just a demographic event, but a potential catalyst for global economic transformation. If even a significant portion of this capital finds its way into the world of cryptocurrency, the sector could enter a new phase of maturity and centrality. The future is unwritten, but one thing seems increasingly clear: the generational shift will not only affect wealth, but the very way in which money is conceived, invested and circulated. And in this new scenario, cryptocurrencies could play a much bigger role than we imagine today.