The market watchers have labelled Andrew Tate as one of the worst traders in the crypto landscape after he was completely liquidated on Hyperliquid, losing over $800,000.

He thus joins a growing list of high-profile traders who have seen their fortunes evaporate on the platform. The repeated liquidations suffered by Tate dramatically underline the harsh reality of using high leverage, a risk inherent in trading cryptocurrency derivatives.

The Loss Detail

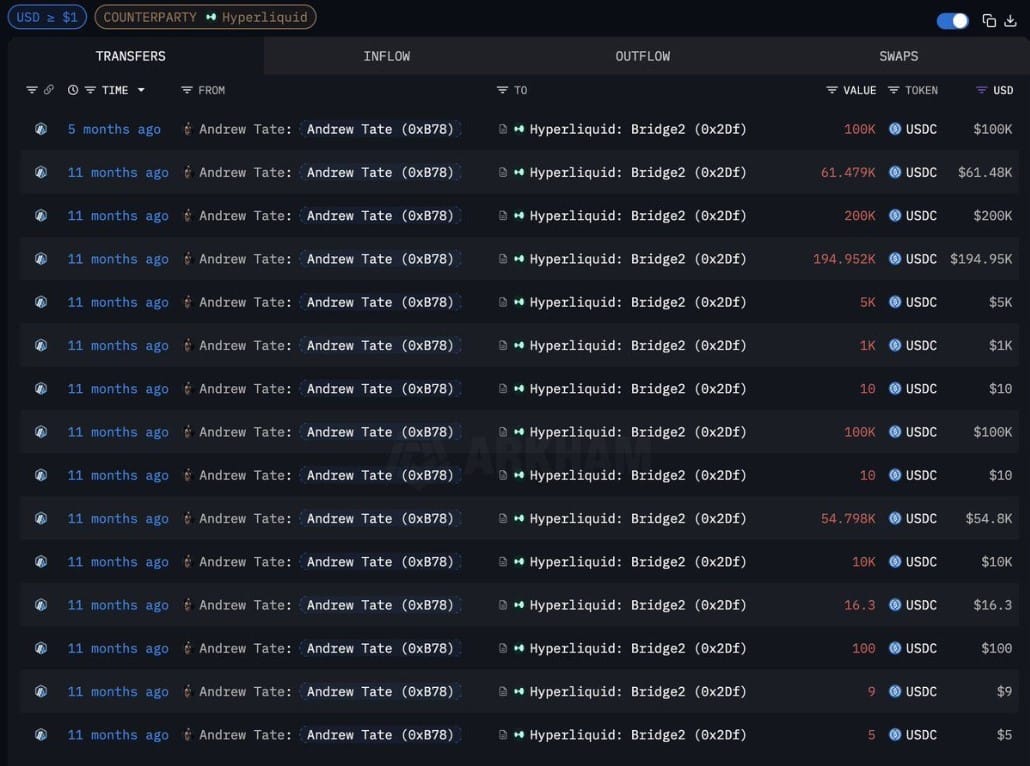

The blockchain analysis conducted by Arkham revealed the extent of the losses suffered by the former kickboxer. Tate had initially deposited $727,000 on Hyperliquid, a decentralised exchange of perpetual contracts.

All his funds remained on the platform, locked in losing trades until they were totally liquidated.

Not satisfied, Tate desperately tried to recoup using the proceeds generated by referral, receiving $75,000 from users who joined via his link.

Instead of taking these rewards, he employed them in further trades, which also vanished in the same, inexorable cycle of liquidations. In total, a combined loss that exceeded $800,000.

Andrew Tate is now fully liquidated on Hyperliquid. He only has $984 left. Some people thought he had been liquidated many times before, but he earned the money through referrals and traded that money on HL (Hyperliquid) again and again," said analyst Param.

Andrew Tate is now fully liquidated on Hyperliquid.

- Param (@Param_eth) November 18, 2025

He has only $984 left.

Some people thought he had been liquidated many times before.

But he earned the money through referrals and traded that money on HL again and again. pic.twitter.com/b3ad1OshY4

A History of Failed Operations

Tate's trading history is characterised by a pronounced volatility and almost always negative results. As early as June 2025, he had lost $597,000 on Hyperliquid, and the situation did not improve thereafter.

StarPlatinum analysts pointed out that in September, Tate opened a long position on the token World Liberty Financial (WLFI), suffering a loss of $67,500. A few minutes later, he opened a new position, being hit with a further loss.

His losing streak continued until this month. On 14 November, he was liquidated again - this time while holding a long position on BTC with 40x leverage. The liquidation cost him $235,000.

The only successful moment came in August: a small short position on YZY that had netted him $16,000. Even this brief victory vanished, however, wiped out by a fresh losing trade.

All in all, Tate has executed more than 80 trades with a success rate of just 35.5%. His cumulative loss amounted to $699,000 in just a few months, reflecting an aggressive risk-taking pattern and consistently poor timing, leading crypto analysts to call him "one of the worst traders in crypto."

Andrew Tate has been liquidated again and may be one of the worst traders in crypto/Web3 to take advice from," said a user on X

Andrew Tate was liquidated again and might be one of the worst traders in crypto/Web3 to take advice from.

- CMDR (@CommanderCrypt0) November 19, 2025

Bro is gonna end up flipping burgers at this rate

The numbers are brutal 👇 pic.twitter.com/fVwS4ro8Fn

The Victims of Leverage: Tate is Not Alone

Tate is not the only one who has suffered heavy losses from leveraged trading. Other well-known traders have gone through similar situations on Hyperliquid. James Wynn, for example, lost more than $23 million, with his account dropping from millions to just $6,010.

In July, Qwatio suffered a $25.8 million hit after a rally market liquidation liquidated his short positions. Another whale, known as 0xa523, had an even more difficult experience, losing $43.4 million in a single month.

Their experiences, including Tate's, highlight the inherent risks associated with highly leveraged trading on decentralised exchanges of perpetuals. These results serve as a warning: leverage can amplify both profits and losses, and even well-known market participants are not immune to the volatility of derivatives crypto.