Cameron Winklevoss v Barry Silbert, Genesis-DCG loan leads to class action case by Gemini customers

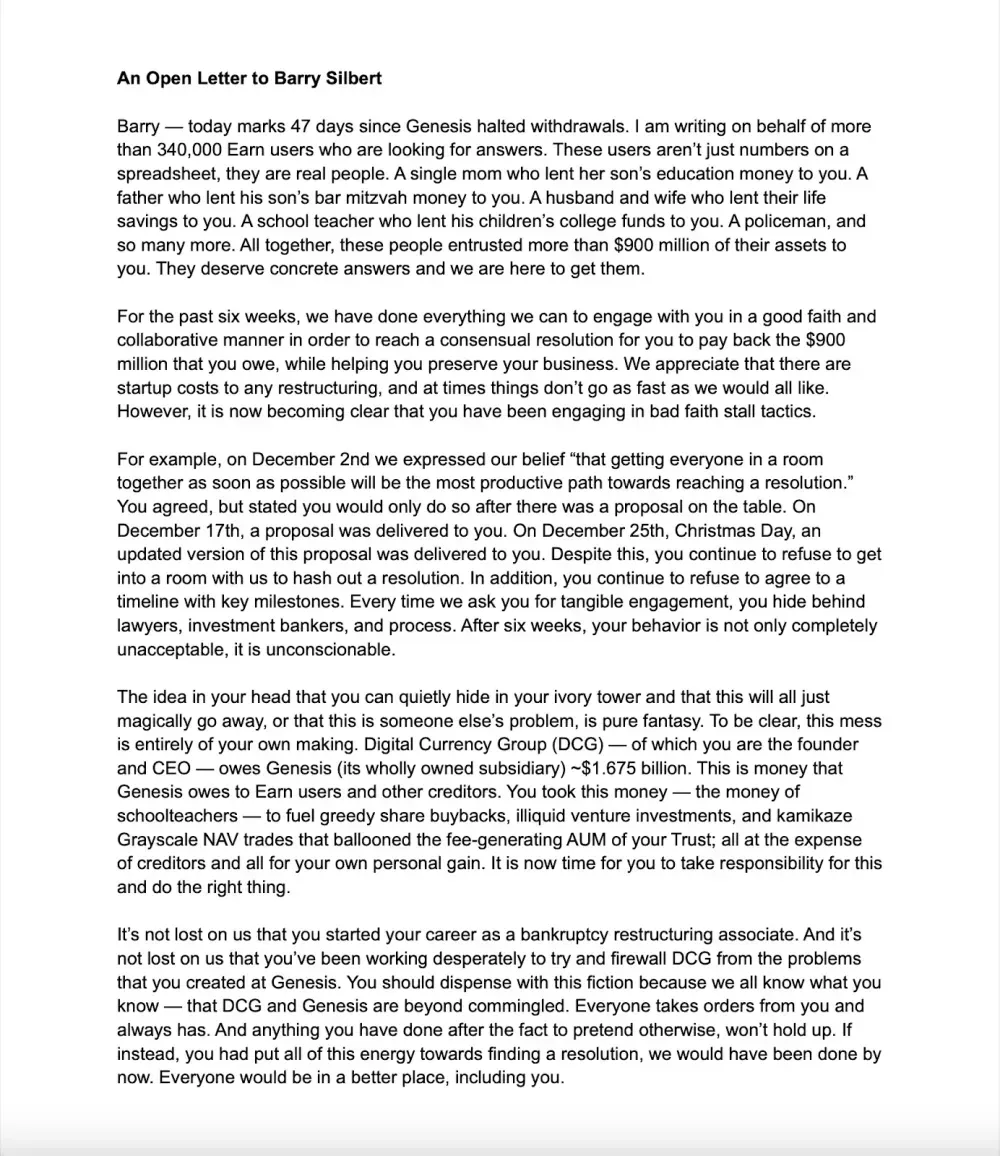

Gemini quarrels with DCG publicly in an open letter - Cameron Winklevoss, co-founder of cryptocurrency exchange Gemini, says Digital Currency Group's (DCG) CEO has yet to repay $900 million loaned as part of the Gemini Earn programme.

"When Genesis ran into financial difficulties following a series of crashes in the cryptocurrency market in 2022, including FTX Trading Ltd. ("FTX"), Genesis was unable to repay the cryptocurrencies borrowed from Gemini Earn investors," he said. from the class action Pica and Hastings says.

"[Gemini] refused to honour any further investor repayments, effectively wiping out all investors who still had holdings in the program, including the plaintiffs."

Gemini co-founder Cameron Winklevoss and DCG CEO Barry Silbert engaged in a Twitter clash on Monday, where the exchange executive accused Silbert of engaging in "bad faith stalling tactics" over plans to resume withdrawals from Genesis.

Winklevoss says Genesis and DCG owe Gemini and its customers $900 million and have given Silbert until 8 January to publicly commit to resolving this issue.