Korean investors are moving fast. Record capital is abandoning Tesla Inc, while flows to US-listed crypto stocks have reached new highs.

A number of factors are driving this shift in sentiment, and Wall Street analysts believe it could signal a shift in long-term preferences for one of the largest foreign retail investor bases in the US.

Tesla under siege

August saw a net $657 million withdrawn from Tesla, the largest monthly outflow of Korean capital since February 2023, according to Bloomberg calculations based on deposit records. The electric carmaker had previously benefited from the support of Korean traders, who at one point were among its most bullish foreign investors.

Analysts warn that Korean investors are losing confidence in Tesla due to concerns about its slowing growth and artificial intelligence-related narrative. A significant source of uncertainty is the expected increase in competition from Chinese electric vehicle companies. Global deliveries are also a concern after Tesla's second quarter results.

Elon Musk's behaviour and the risk of a new verbal clash with President Trump have added further 'Musk risk' to the company.

That said, the Koreans still own about $21.9 billion of Tesla shares, representing their largest holding in US equities by value. The outflows have not only affected common stocks: the Tesla Double Leveraged ETF (TSLL) also saw significant redemptions of $554 million in August, the largest monthly outflow since February 2024.

Crypto as a new bet

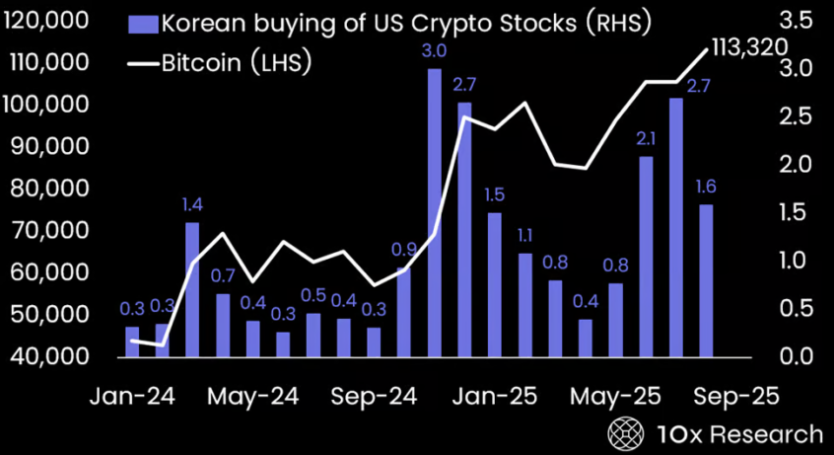

On the other end of the spectrum, Koreans have been pouring capital into US-listed crypto stocks in recent months. In 2024 alone, they purchased more than $12 billion of these instruments. August figures show the scale of the purchases: $426 million flowed into Bitmine Immersion Technologies, while Circle and Coinbase attracted $226 million and $183 million respectively.

A 2x ETF on Ethereum also saw inflows of $282 million, a sign of a broader appetite for crypto exposure via equity markets.

This is also reflected in the local adoption of digital assets: around 20 per cent of South Koreans have investments in crypto, a far higher share than in most other countries. Among adults aged between 20 and 50, the percentage even rises to 25-27%, with a strong demand for crypto-related investment products.

Political support

Favourable moves by politicians have also supported the phenomenon. The government is reportedly working out the final details of regulations on stablecoins, security token offerings and crypto ETFs. The debate on tax treatment is still ongoing, but unlike in the past, when the authorities were more cautious, institutionalisation of the sector is now seen as a priority.

Koreans are one of the largest groups of foreign investors in US equities, and this high concentration of buying and selling may have an impact on prices. Interestingly, the dynamic is rapidly reversing on Tesla as investors pour into cryptos.