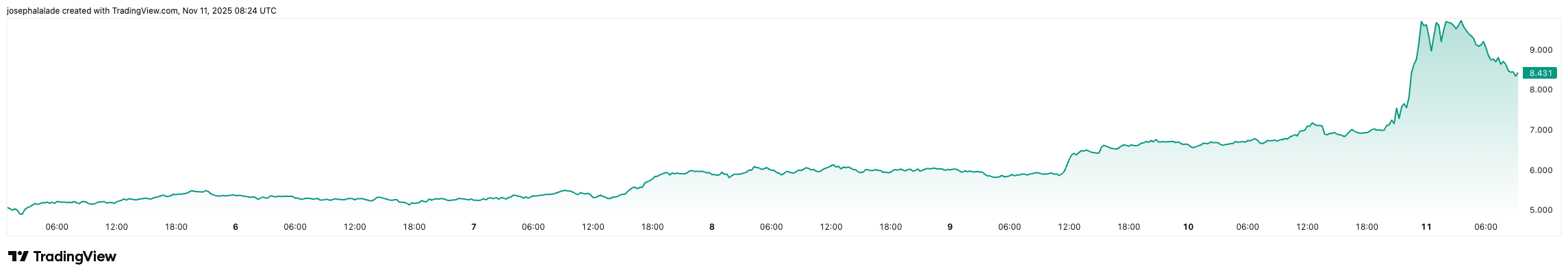

Uniswap's governance token, UNI, spiked to its highest level in two months after founder Hayden Adams unveiled one of the biggest structural reforms in the protocol's history: a plan to burn 100 million tokens and allocate trading commissions to continuous burning.

On Monday, the token rose above $10, up from around $5 in the previous 24 hours and up about 100 per cent from last week's lows, while - according to on-chain data - institutional investors ('whales') accelerated their purchases. The move pushed Uniswap's market capitalisation over $5.3 billion, making it one of the day's best-performing DeFi coins.

The "UNIfication" Plan Transforms UNI into an Asset Combustion of Commissions

In a detailed governance proposal, Adams outlined a plan called "UNIfication", backed by both Uniswap Labs and the Uniswap Foundation.

The plan calls for the immediate burning of 100 million UNIs, equivalent to nearly $1 billion at today's prices, representing the commissions that would have been destroyed if Uniswap had activated the 'fee switch' at launch in 2020.

Today, I'm incredibly excited to make my first proposal to Uniswap governance on behalf of @Uniswap alongside @devinawalsh and @@nkennethk

- Hayden Adams 🦄 (@haydenzadams) November 10, 2025

This proposal turns on protocol fees and aligns incentives across the Uniswap ecosystem

Uniswap has been my passion and singular focus for... pic.twitter.com/Ee9bKDric5

More importantly, the proposal would permanently activate the burning of commissions at the protocol level on Uniswap's decentralised exchange and its new layer-2 network, Unichain. Approximately 0.05% of the exchange fees from the v2 and v3 pools, along with Unichain's sequencer fees, would now be allocated directly to token burning.

"Uniswap has been my passion and sole focus for the past eight years," Adams wrote on X. "This proposal sets the stage for the next decade of growth."

If approved, the change would transform UNI from a simple governance token into a deflationary asset tied to protocol revenue streams.

Whales in accumulation and positive technical signals

On-chain data from analyst firm Nansen show that large investors increased their holdings to 9.63 million UNI, up from 8.31 million in October.

Public wallets linked to known investors also rose sharply, while UNI balances on centralised exchanges fell to around 647 million, a sign of accumulation.

Market participants see this turnaround as an inflexion point for Uniswap, which has generated over $2.8 billion in annualised fees but has never returned them to token holders.

Technically, UNI has broken out of a descending channel that had been limiting its price since August, trading well above the major moving averages. Next resistance lies just above $10, while bullish traders are aiming for $12.50 as a short-term target.

However, analysts warn that the RSI index, above 75, indicates overbought conditions, leaving room for a possible retracement towards the $7.80 area.

For now, Uniswap's price surge shows how quickly sentiment can change as protocol reforms align incentives across the ecosystem - and how DeFi's longest-running DEX is perhaps preparing for the next phase of its growth.