BitMine significantly expanded its holdings in Ethereum this week, making purchases of nearly $200 million and consolidating its position as the largest single holder of the asset.

The deal comes as ETH moves near one-month lows, in an environment marked by steady distribution by mid-sized portfolios.

Purchases While Mid-Sized Holders Sell

According to data reported by Lookonchain, based on Arkham Intelligence, on 6 December BitMine purchased 22.676 ETH from BitGo for about $68.7 million, with an average price of $3,028 per token.

Just one day earlier, the company had already acquired 41,946 ETH from FalconX and BitGo worth $130.8 million.

Tom Lee (@fundstrat) and his #Bitmine just bought another $22,676 ETH ($68.67 million) four hours ago, he stated Lookonchain on X.

Tom Lee(@fundstrat)'s #Bitmine just bought another 22,676 $ETH($68.67M) 4 hours ago.https://t.co/H5PQRjt2oBhttps://t.co/Oyc0Cm1tob pic.twitter.com/vey8AwqmnF

- Lookonchain (@lookonchain) December 6, 2025

These purchases follow the recent disclosure that BitMine held 3.73 million ETH as of 30 November, an amount now worth over $11 billion.

In addition to ETH, the company said it owned 192 BTC, a $36 million position in Eightco Holdings and $882 million in cash.

BitMine Outperforms Major Competitors

Data from Strategy ETH Reserve indicates that BitMine now holds more ETH than its top five competitors combined, including SharpLink and the Ethereum Foundation.

The volume of its treasury also ranks it as the second largest corporate holder of cryptocurrency in the world, behind only Strategy led by Michael Saylor, the largest corporate holder of Bitcoin.

ETH Weak, but Outlook Positive

The latest buying comes at a weak phase for Ethereum: over the past four weeks, the token has lost more than 10 per cent, dropping to around $3,027.

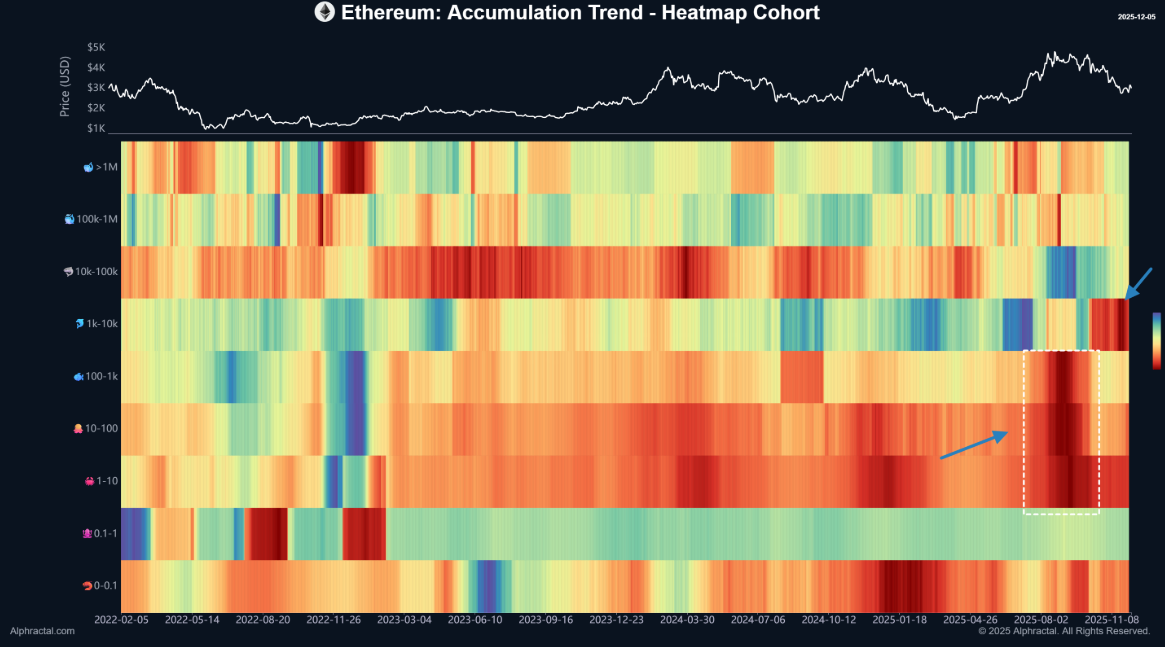

According to Alphractal, wallets between 1 and 10,000 ETH have been selling heavily near the recent cyclical peak and continue to dump tokens, putting pressure on the market. Whales with over 10,000 ETH, on the other hand, show only a slight distribution.

Optimistic Long Term Forecasts

Despite the weakness, several analysts remain bullish. Tom Lee, CEO of Fundstrat and president of BitMine, said that ETH could reach $12,000 if Bitcoin reached $250,000.

He also added that ETH could even touch $62,000 if the valuation ratio with Bitcoin widens over time.