In August 2025, Ethereum (ETH) broke its all-time high of 2021, touching $4,945 and reaching a market capitalisation of $600 billion.

However, this race to the top has a different flavour. There are no Bored Ape sold for millions of dollars, no viral videos on TikTok explaining how to get rich. The 2025 climb is 'clinical': a silent reallocation driven by institutions that see Ethereum no longer as a speculative bet, but as a yield-generating infrastructure.

The drainage of reserves: ETH leaves exchanges

Coinglass data as of 21 December shows an unambiguous picture: only 10.5 per cent of the total supply of ETH is now on centralised exchanges. This is one of the lowest levels since the network's inception, down 43% since July. At the same time, more than 35.6 million ETH are stuck in staking (as of 20 December).

According to analysis by Nansen, the main holders are no longer individual 'whales', but staking contracts, institutional custodians and ETF vehicles. Liquidity is no longer ending up in the portfolios of intraday traders, but is flowing into the 'pipes' of the system: layer-2 bridges, restaking protocols and corporate treasuries.

Companies become the new accumulators

Corporate treasuries and spot ETFs now control 10.72% of the circulating supply. Specifically, 5.63% is in corporate hands and 5.09% is managed by ETFs. A case in point is BitMine, which has already amassed over 4 million ETHs (3.36% of the total supply) with a stated goal of reaching 5%.

These purchases are not financial gambles, but strategic moves. Ethereum has become fundamental to stablecoin settlement and tokenized asset infrastructure.

Net inflows into ETPs (Exchange Traded Products) confirm this trend: they have attracted about $12.7 billion this year, of which $12.4 billion came from US spot ETFs.

Ethereum as financial "Plumbing"

The 2025 research cycle has changed the narrative. Citi, in a September note, set a year-end target of $4,300, identifying the adoption of stablecoins and tokenization as key drivers. In an optimistic scenario, the bank assumes growth to $6,400.

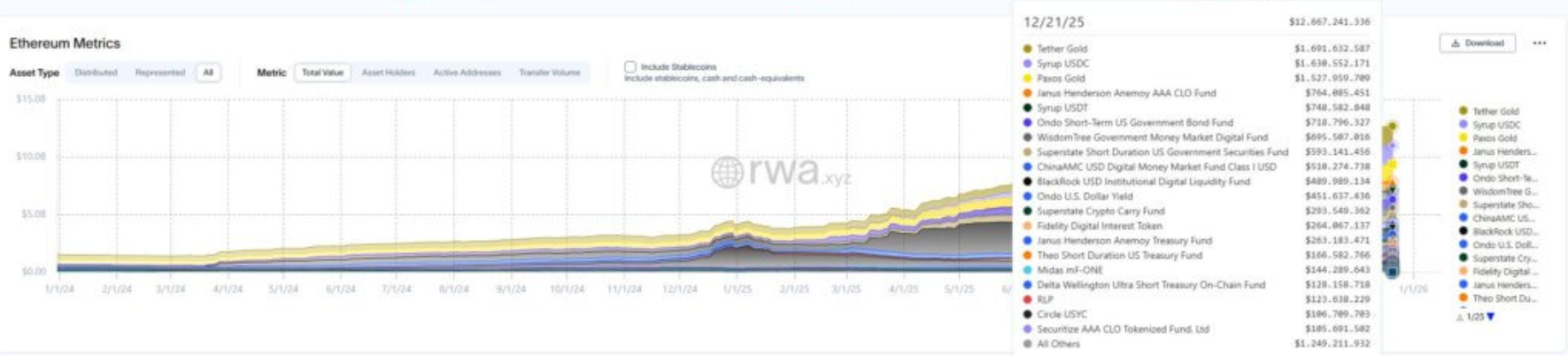

The rwa.xyz data confirms the dominance: Ethereum controls 66.6% of the Real-World Assets (RWA) tokenized market, with a value of $12.5 billion. This is a 735% growth from the $1.5 billion at the beginning of 2024.

The volume of stablecoins has also exploded, recording $1.6 trillion in monthly transactions as of 21 December.

A cultural vacuum filled by the numbers

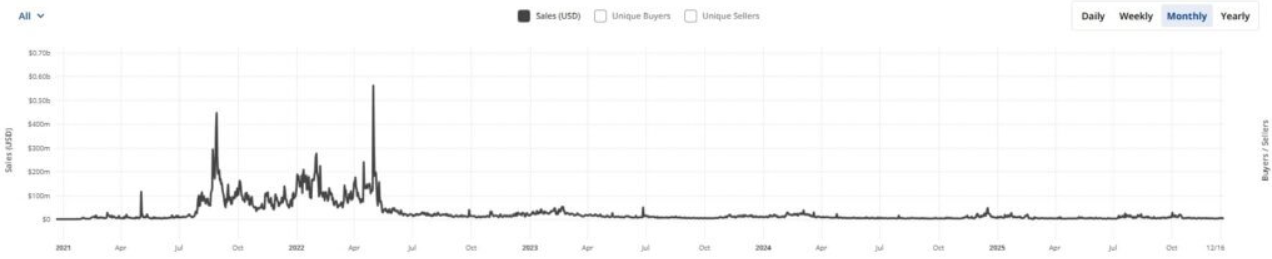

While fundamentals are growing, crypto "pop" culture seems to be fading. NFT sales plummeted from $16.5 billion in 2021 to just $2.2 billion in 2025 (-87%). Big brands like LG have closed their marketplaces and Google searches remain far from the peaks of the past.

The question that remains open is whether this new phase of steady institutional flows and infrastructural utility can sustain the valuations that were once fuelled by the retail craze in the long run. Ethereum is ceasing to be a casino to become the plumbing system of global finance.