In a move that surprised international observers, Turkmenistan has officially legalised cryptocurrency mining and exchange platforms as of 1 January 2026.

The decision, sanctioned by the signature of President Serdar Berdimuhamedow, represents one of the most significant policy changes in recent decades for the Central Asian state, historically characterised by almost total isolation and a rigidly planned economy.

A regulatory framework under the Central Bank's stranglehold

The new legislation does not aim at unbridled liberalisation, but rather at controlled 'institutionalisation'. For the first time, virtual assets enter the country's civil law. At the heart of the reform is the introduction of a strict licensing regime, the supervision of which is entrusted directly to the Central Bank.

Despite the openness, the government has set impassable stakes: cryptocurrencies cannot be used as a means of payment for goods and services. Exchanges will operate within a limited scope, ensuring that the state retains absolute control over capital flows and financial transactions.

Energy strategy and economic diversification

The main motivation behind this shift lies in the country's underground. Turkmenistan's economy is almost exclusively dependent on natural gas exports, with China in the role of main buyer. However, the instability of global energy markets has prompted Ashgabat to seek new avenues of revenue.

Turkmenistan legalises cryptocurrencies under the new virtual assets law, have reported Crypto Miners on X.

Turkmenistan legalises crypto under new Virtual Assets law

- Crypto Miners (@CryptoMiners_Co) January 1, 2026

Turkmenistan has passed a new Law on Virtual Assets, effective January 1, 2026, legalising cryptocurrency mining and trading for the first time. The law was signed by President Serdar Berdimuhamedov on November 28, 2025,... pic.twitter.com/NNrZKi3e9T

Crypto mining is seen by authorities as a strategic way to monetise the excess energy capacity produced by gas-fired power plants. Turning excess gas into computing power for the blockchain allows for diversification of government revenues without relying solely on physical gas pipelines. It is, in essence, an economic modernisation effort aimed at attracting foreign capital and technical expertise in a high-tech sector.

Between isolation and regional trends

Turkmenistan is known to be one of the most closed nations in the world, with severe restrictions on freedom of the press, travel and foreign investment. This opening up to the crypto sector follows a timid reform trend that began last year with the introduction of electronic visas to facilitate visitor entry.

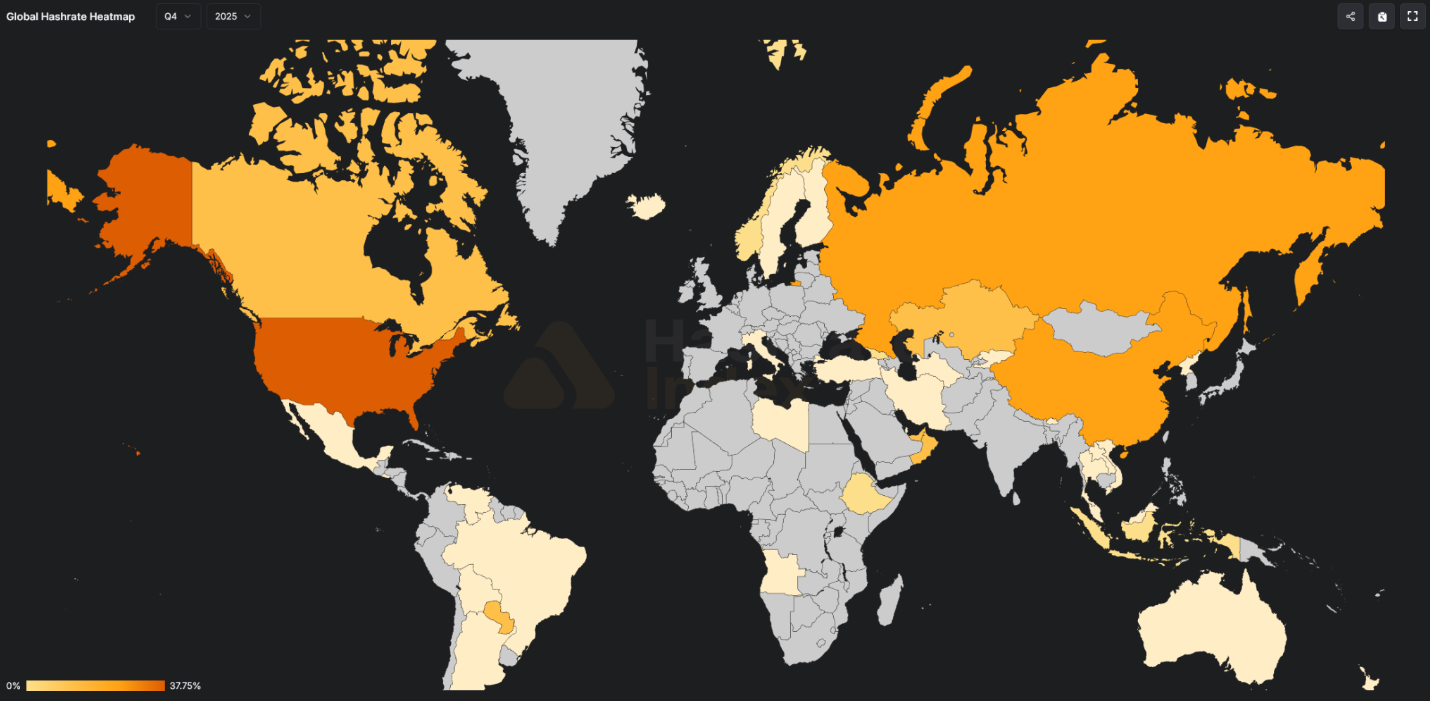

On a geopolitical level, Ashgabat's move fits into a rapidly evolving Eurasian context. While Russia is tightening its domestic regulations to channel mining into taxed and formal circuits, Turkmenistan seeks to position itself as an alternative hub.

Although the country maintains a policy of 'permanent neutrality' and is not a formal ally of Moscow, the new law reflects the regional desire to expand mining capacity outside the sphere of influence of the United States, which currently remains the dominant destination for industrial miners.

The challenges: Internet and censorship

Despite the enthusiasm of the markets, there remain serious doubts about large-scale operational feasibility. Turkmenistan exercises strict censorship over the Internet and government control over the network is among the strictest in the world. As successful mining requires a stable, fast and unfiltered connection, many analysts wonder how the technical requirements of blockchain will coexist with the digital surveillance of the state.

In conclusion, the mining sector in Turkmenistan is set to develop slowly and highly selectively. We are not facing a libertarian financial revolution, but an experiment in 'digital state capitalism', where innovation is only welcome as long as it does not threaten central political power. For now, Turkmenistan's door is ajar, but the signal sent to the world is clear: even the most closed economies can no longer ignore the potential of digital assets.