The price of the leading cryptocurrency has been rising almost without significant correction since Donald Trump's victory in the US presidential election.

Bitcoin's (BTC) rate has surpassed $99,000 for the first time, again updating the all-time high. At the peak, the price reached $99,390 on the US exchange Coinbase, while on the largest exchange by trading volume, Binance, paired with the USDT stablecoin, it rose to $99,299.

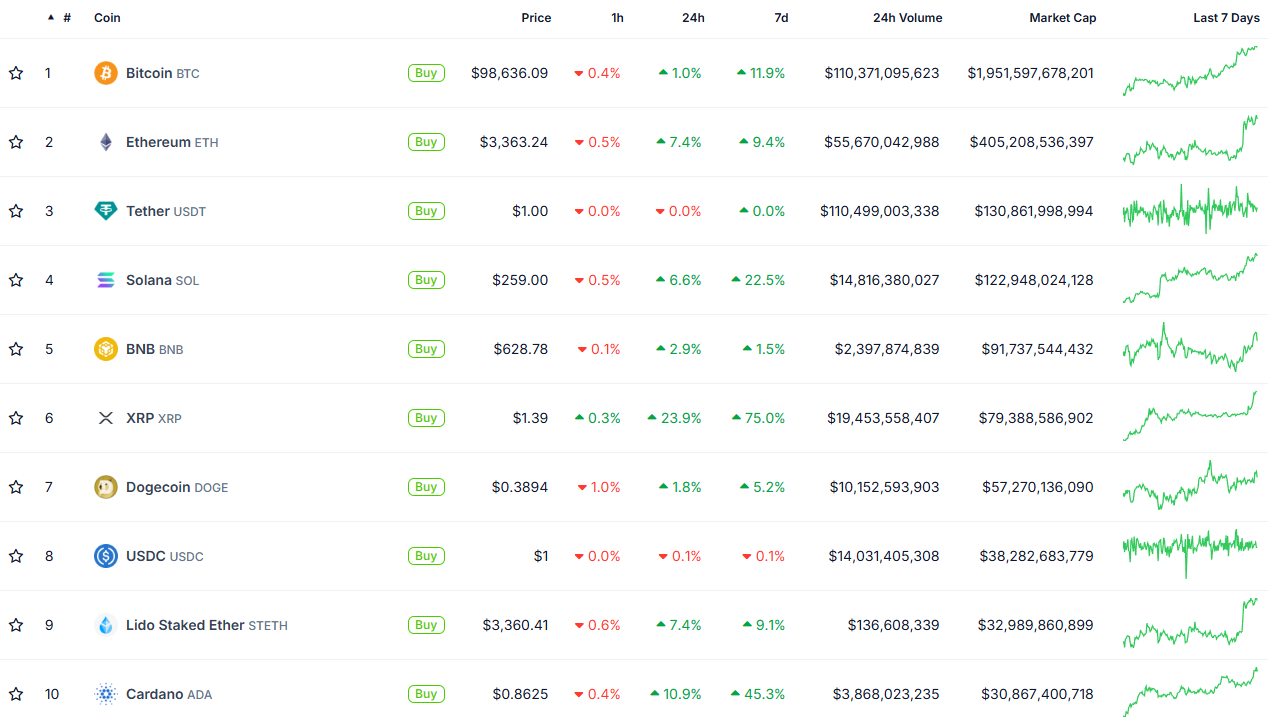

At 9am, Bitcoin is trading slightly below the $99,000 mark, with a market capitalisation of $1.96 trillion. Bitcoin's share of the total cryptocurrency market capitalisation is 60.37 per cent, according to TradingView.

Since 6 November, the exchange rate has been rising from the $68,000 mark, steadily updating records and without significant corrections. The price growth is accompanied by positive news for both Bitcoin and the cryptocurrency market as a whole.

After winning the election on 5 November, Donald Trump is surrounding himself with more crypto industry-friendly candidates for key positions in his administration, and his advisors are consulting with crypto industry representatives about possible changes in public policy. Under Trump, US authorities are expected to adopt a softer attitude towards cryptocurrencies.

On 21 November, Gary Gensler, head of the Securities and Exchange Commission (SEC), announced that he will step down on 20 January, the day of Trump's inauguration.

The US markets' top regulator is known for numerous lawsuits against cryptocurrency companies during his administration, but there are already several pro-crypto candidates ready to replace him.

The growth of Bitcoin is accompanied by an influx of capital into US exchange-traded funds (ETFs), which allow Bitcoin to be traded like stocks on the NASDAQ and NYSE markets. At the end of the 21 November trading session, net inflows of investor funds into a group of 12 ETFs on Bitcoin, issued by companies such as BlackRock, Grayscale, Bitwise and Fidelity, exceeded $1 billion. These funds already manage $105 billion worth of Bitcoin since their launch in January, representing 5.46 per cent of existing coins.

According to Reuters, Trump's team is creating an advisory board that could include major crypto industry players in the US, including Ripple, Kraken and Circle, as well as representatives from venture capital firms Paradigm and Andreessen Horowitz (a16z). One of its functions will presumably be to work on the creation of a government reserve in bitcoin, which Trump spoke about in July during his speech at the Bitcoin 2024 conference in Nashville.

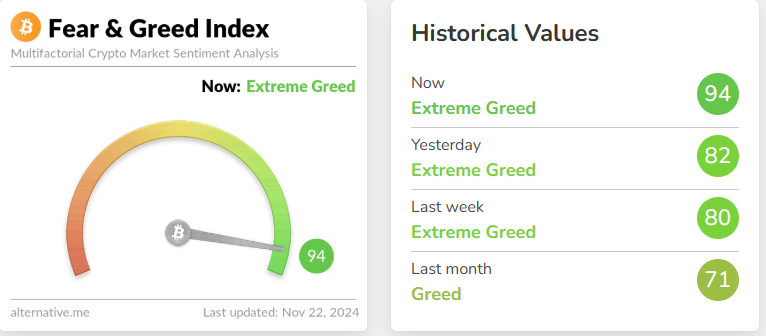

The so-called Fear and Greed Index, which measures the emotional state of the cryptocurrency market, is in the 'extreme greed' zone - 94 points out of 100. This range starts at 75 points. When calculating the value of the index, several parameters are taken into account at once: the state of the market and volatility, discussions in English-language social networks, bitcoin's dominance in the market, trends in changes in major Google searches, and other factors.

Such a high value of the index has only been recorded once before, between December 2020 and February 2021. In that period, the rate had risen from about 10,000 to 58,000 for about six months without significant corrections. At the peak of the market cycle at the end of 2021, the value of the index had not exceeded 82 points. In November 2024, its value did not fall below 80.

Other cryptocurrencies in the top 10 by market capitalisation are also showing growth. The rate of Ethereum (ETH) over the past day has risen 9%, with "ether" trading at $3386, while Solana (SOL) has updated its all-time high, surpassing $260 for the first time since 2021. Ripple's XRP has gained more than 70 per cent in a week, up about 25 per cent in the past 24 hours. This is not the first year that Ripple is suing the SEC over the status of its token, and news of Chairman Gensler's resignation has been interpreted by the market as a sign of its likely victory in court.

More than $200 million in short positions have been liquidated in the past 24 hours by traders betting on the cryptocurrency's price drop. More than 100,000 users of major crypto trading platforms who were betting on the downside suffered losses when the market did the opposite of their bets.