First Republic Bank faces collapse as regulators help troubled bank.

According to multiple reports, the Federal Deposit Insurance Corporation (FDIC) is poised to take control of First Republic Bank. Shares of the troubled regional bank plummeted on Friday after a CNBC report that the bank is very likely to be seized by federal financial regulators, putting it at risk of becoming the third bank to collapse after the failure of Silicon Valley Bank and Signature Bank last month.

According to Reuters, FDIC officials think First Republic is running out of time to arrange a bailout with other banks, leaving the agency with no choice but to take over the bank.

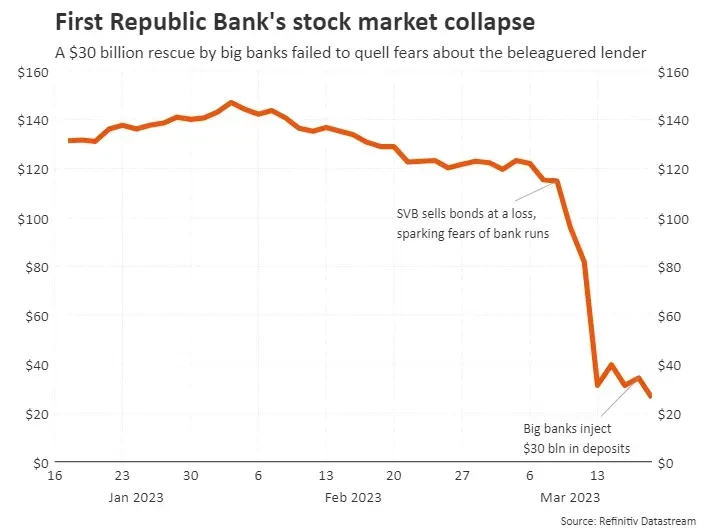

First Republic's stock price, which had been above $200 through 2021, plummeted 43% on Friday and continued to fall in after-hours trading. The stock is down 97% this year.

Investors were spooked earlier this week after San Francisco banks revealed that depositors had withdrawn more than $100 billion during last month's crisis, raising concerns about the stability of the First Republic. The outflows of funds were "unprecedented," bank executives said at an earnings conference Monday.

As with Silicon Valley Bank, a significant portion of First Republic's deposits were uninsured, making it more susceptible to withdrawals from nervous customers.

The troubled bank, which had about $233 billion in assets under management as of 31 March, announced that it now plans to sell assets and restructure its balance sheet, as well as lay off up to a quarter of its workforce, which amounted to about 7,200 employees at the end of 2022. The bank will also reduce its head office presence, cut executive compensation by a "significant" amount and eliminate "non-essential" projects, executives said Monday.

In an unusual move, 11 of the largest financial institutions in the United States gave First Republic $30 billion in deposits last month to prop up the troubled bank.

First Republic's crisis adds to the list of banks that have failed recently, such as Silicon Valley Bank and Signature Bank, which have suffered severe capital losses and come under criticism for their management. The Federal Reserve has admitted that it bears some responsibility for the Silicon Valley Bank crisis due to insufficient supervision and weak regulations.

This situation highlights the importance of having safe alternatives to protect one's savings, such as the use of cryptocurrencies like Bitcoin. This tool allows people to take control of their funds without having to entrust them to banks that may be vulnerable to financial crises.