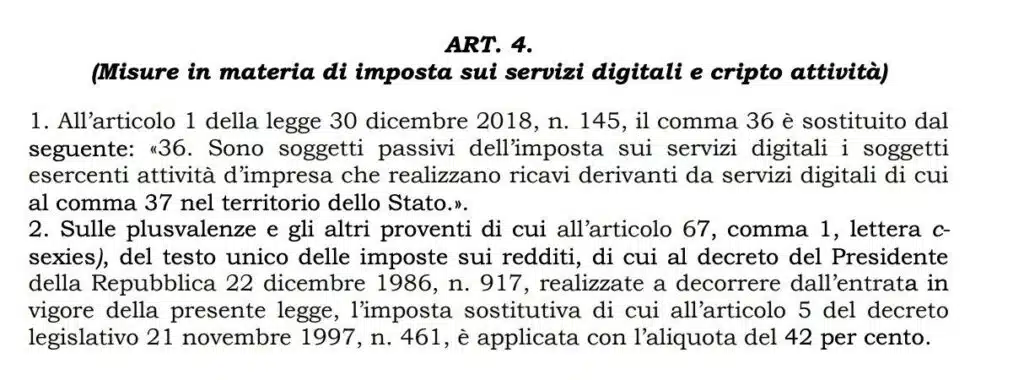

In recent months, the Italian government has introduced a tax change that has caused much debate: the increase in the rate on capital gains from Bitcoin and other cryptocurrencies from 26% to 42%. This decision, announced as part of the Budget Law 2025, aims to regulate a fast-growing sector, and to guarantee more revenue for the state coffers.

Reasons Behind Tax Rate Increase

1. Increase in Tax Revenue

The main objective of this measure is to increase tax revenue to tackle the growing state budget deficit. The Italian government, like many other countries in Europe, is trying to capitalise on a source of revenue that has been relatively under-taxed until now. Cryptocurrencies, and in particular Bitcoin, have become increasingly popular among investors, and this represents a significant opportunity to raise additional resources. It is estimated that Italy could generate billions of additional euros by raising the tax rate

2. Regulation of the Crypto Market

The increase in the tax rate is part of a broader context of regulation of the cryptocurrency sector. Italy, like many other EU countries, is implementing the directives of the Markets in Crypto-Assets Regulation (MiCAR), which establishes a common regulatory framework for cryptocurrencies at European level. The rate increase is part of this attempt to regularise a market that was, until recently, considered 'wild' and insufficiently regulated

3. Tax Fairness

The Italian government has also justified the tax increase in the name of greater tax fairness. The basic idea is that profits from cryptocurrencies should not be treated differently from other financial instruments. The 26% tax rate, which is considered too low compared to other income categories, is therefore aligned with that of other capital gains, such as earnings from stocks and shares. This approach aims to avoid inequalities between different types of investments

4. Control on Tax Evasion

Another factor motivating this choice is the need to curb tax evasion, an endemic problem in Italy. The government has pointed out that many cryptocurrency investors do not declare their earnings correctly. By increasing taxation and implementing stricter controls, the executive hopes to make evasion more difficult and improve market transparency

Impacts of the Provision

On Investors

For Italian investors, the increased tax rate represents a significant tax burden. Investors could see a reduction in their net returns, which could discourage some from continuing to invest in Bitcoin and other cryptocurrencies. Others might look for alternative solutions, such as transferring their capital to jurisdictions with more favourable tax regulations

On the Cryptocurrency Market

This change could negatively affect the growth of the cryptocurrency market in Italy, which has seen an exponential increase in recent years. While some investors may decide to exit the market, more experienced users are likely to find ways to optimise their tax strategies and continue trading. However, the risk of capital flight to countries with more favourable tax regimes is real

Conclusion

The increase in the rate on capital gains from cryptocurrencies represents a bold move by the Italian government. While this may lead to increased tax revenues in the short term, it remains to be seen how it will affect the cryptocurrency market in the long term. As Italy seeks to align with European regulations and reduce tax evasion, it is clear that the cryptocurrency sector will come under increasing scrutiny.

From the perspective of investors and the cryptocurrency sector, this move represents a serious obstacle to growth and innovation. The increase in the tax rate from 26% to 42% is disproportionate, considering that cryptocurrencies are already subject to significant fluctuations and uncertainties.

While we understand the government's need to increase tax revenues and regulate the sector, this measure risks discouraging Italian investors and pushing capital towards countries with more favourable tax regimes. This high tax could also limit the adoption and development of new blockchain-related technologies in Italy, slowing down innovation.

In the long run, we fear that this move could damage Italy's competitiveness on the global cryptocurrency landscape, precisely at a time when the sector has the potential to bring new economic opportunities. We hope the government will reconsider this decision and find a balance between regulation and incentivising innovation.