The issuer of the USDT stablecoin, Tether, is significantly increasing its exposure to physical gold in response to changing global monetary dynamics.

The most recent move to reinforce this strategy sees the firm hire two senior HSBC traders, Vincent Domien and Mathew O'Neill, to oversee its gold operations.

Both professionals bring with them decades of experience in metals trading and are expected to help Tether expand and manage its bullion reserves in an institutional manner.

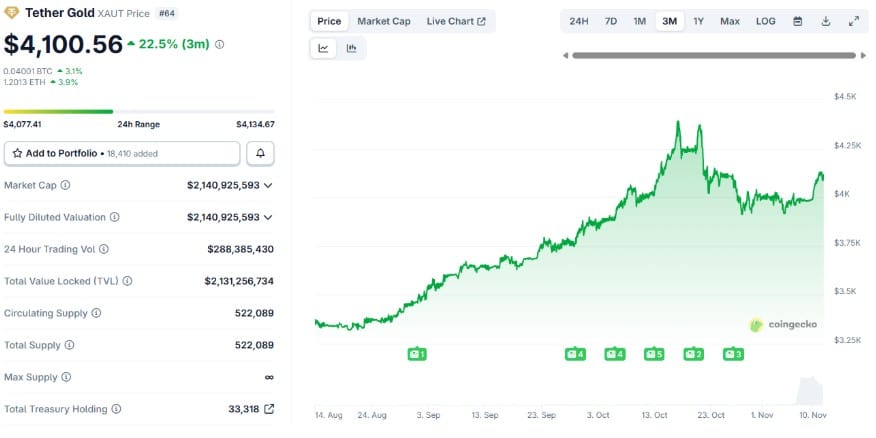

This development follows reports that Tether has already amassed billions in physical gold, signalling a marked and growing preference for hard assets over fiat currency-based instruments.

The timing of this strategy is crucial, as it coincides sharply with record gold purchases by central banks and growing global demand for non-dollar reserves.

As central banks globally continue to diversify their holdings away from the US dollar, Tether appears to be treading a parallel path in the private sector.

The firm's change of course suggests that it sees gold as an essential strategic hedge, effective against both fiat currency volatility and potential regulatory pressure.

Unlike Circle's USDC, which holds its reserve predominantly in short-term US Treasury bills, Tether's bullion reserves mark a clear and strategic break from dollar dependence.

Tether owns more than 100 tonnes of physical gold, said affirmed Tether's CEO

Tether owns >100 tons of physical gold pic.twitter.com/gVnKe7rdL5

— Paolo Ardoino 🤖 (@paoloardoino) November 11, 2025

This divergence highlights a fundamental divide in the philosophy of stablecoin reserves: on the one hand, yield generation (as with USDC); on the other, long-term security and stability (as with Tether's gold strategy).

The accumulation of bullion by Tether could alter the perception of stablecoins in the market, transforming them from mere 'digital cash' to real, privately managed reserve assets. In effect, Tether is acting less like a simple payment processor and more like a sovereign wealth fund.

The Echo of the Central Banks

Central banks collectively purchased over 1,000 tonnes of gold in 2024, the second highest annual total ever recorded. Much of these purchases came from emerging economies actively seeking insulation from dollar-related volatility. Tether's accumulation of gold closely mirrors this diversification pattern.

Tether is not accumulating dollars. They are accumulating gold. To the tune of $12.9 billion. If that's not your wake-up call to go long on gold, I don't know what is, he affirmed Mr. Uppy

Tether isn’t stacking dollars.

— Mr. Uppy (@MisterUppy) November 7, 2025

They’re stacking gold.

$12.9B worth.

If this ain’t your wake up call to go long gold I don’t know what is. pic.twitter.com/JU64xK5BZ8

The expansion of bullion operations also introduces new logistical and security challenges. Managing physical assets within a tokenised framework requires strict custody measures, regular audits and strong cyber resilience.

With HSBC veterans now on board, the firm seems focused on building that institutional structure and managing risk.

However, transparency remains a lingering concern. Critics argue that without frequent independent audits or full disclosure of reserves, Tether's gold strategy could face the same scrupulous scrutiny that has long surrounded its stablecoin reserves.

All in all, this ambitious move suggests the arrival of an era in which private entities hold diversified, multi-asset reserves that can compete with those of national central banks.