A market in turmoil between traditional currency and digital finance

In recent months, the South Korean financial market has shown signs of profound change. At the heart of this transformation is an increasingly evident phenomenon: the explosive growth of trading in stablecoin, cryptocurrencies pegged to traditional currencies such as the US dollar.

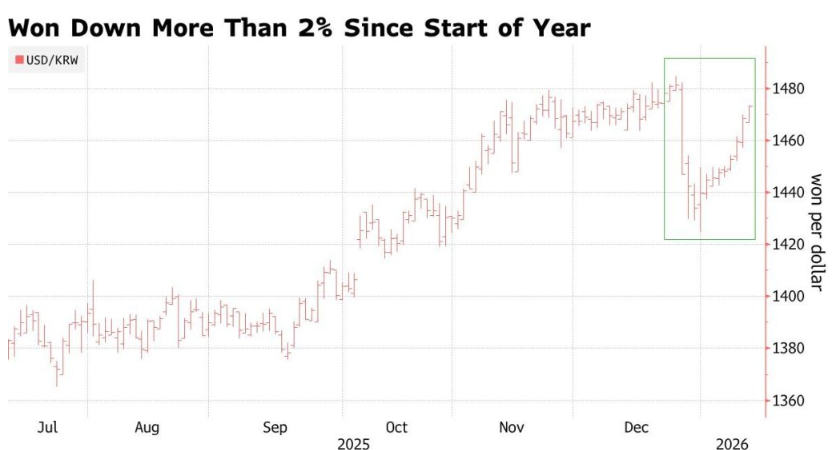

The weakening of the won against the dollar has prompted thousands of investors to look for alternative instruments to protect their capital. In this scenario, stablecoins are emerging as a bridge between traditional finance and the crypto world, offering relative stability and immediate access to global markets. This is not just a passing fad, but a structural sign of how currency tensions can accelerate the adoption of digital financial technologies.

Why the strengthening dollar changes investment strategies

The pressure on the won and the search for financial shelters

When a domestic currency loses value against the dollar, the effects are quickly felt in the domestic economy. In South Korea, the strengthening of the greenback has increased the cost of imports, reduced purchasing power and prompted many savers to seek forms of protection.

Dollar-denominated stablecoins offer an immediate solution: they allow people to expose their assets to the dollar without going through traditional banking channels, which are often slower and more expensive.

Easier access to global markets

In addition to currency protection, stablecoins are a strategic tool for trading on international platforms. Due to their digital nature, they enable fast transfers, reduced costs and direct access to trading, lending and decentralised finance. For many South Korean investors, this means being able to diversify their portfolios with unprecedented flexibility.

The rise of stablecoin trading

Stablecoin trading volumes are growing strongly

On local exchanges, stablecoin trading volumes have increased significantly. This affects not only professional traders, but also small savers who see these assets as a form of defence against currency market volatility. The most interesting fact is that this growth is not related to an increase in pure speculation, but to an increasingly functional use of stablecoins as a risk management tool.

Stablecoins as "new digital dollar account"

In a sense, stablecoins are taking on the role of a true digital dollar account. They make it possible to hold hard currency value, move it quickly and deploy it in different investment strategies without leaving the blockchain ecosystem.

This paradigm shift could have profound consequences on the structure of the Asian financial system.

Implications for the financial system and for regulators

A new ground of confrontation for authorities

The growth of stablecoins poses new challenges for regulators. On the one hand, they represent a useful innovation for the market; on the other, they raise questions about controls, transparency and financial stability. The South Korean authorities are closely watching the development of the phenomenon, aware that too rapid a spread could create grey areas that are difficult to govern.

Risks and opportunities for investors

In spite of the advantages, stablecoins are not without risks. Their stability depends on the soundness of the reserves, the governance of the issuers and the confidence of the market. For this reason, many experts emphasise the need to:

- carefully assess issuer quality;

- diversify exposure;

- understand the collateral mechanisms that underpin the value of stablecoin.

A scenario that could extend beyond Korea

The South Korean case may not remain isolated. In a world marked by geopolitical tensions, restrictive monetary policies, and strong currency movements, stablecoins could emerge as a key instrument of financial adaptation in many other countries. If the dollar continues to strengthen, it is likely that a growing number of international investors will follow the same path: taking refuge in stable digital assets to protect value, liquidity and flexibility.

In this new balance between traditional currencies and blockchain, stablecoins are no longer a technical detail, but one of the silent players in the global financial transformation.