The cryptocurrency world has a problem. Too many traders think it's a casino.

The proverbial pulpit from which the sermon comes is the one from which Vitalik Buterin, head of Ethereum, notoriously critical of the current state of affairs and, above all, the levity and superficiality of a good part of traders, appears. In his view, much has been wrong and continues to be wrong by proposing investments in infrastructure, as they say, rather than in tokens or assets more relevant to traditional finance and, therefore, less risky.

Buterin does not understand why people continue to find people willing to put their money on protocols that offer channels, bases and services based on or tied to other in-progress projects, which often founder, rather than investors tying themselves to a service, a base or a channel already in place.

On Warpcast, Buterin emphasised how this habit of betting and wagering takes sick forms in the world of investments and ends up having a harmful impact not only on the specific field, but on the entire industry.

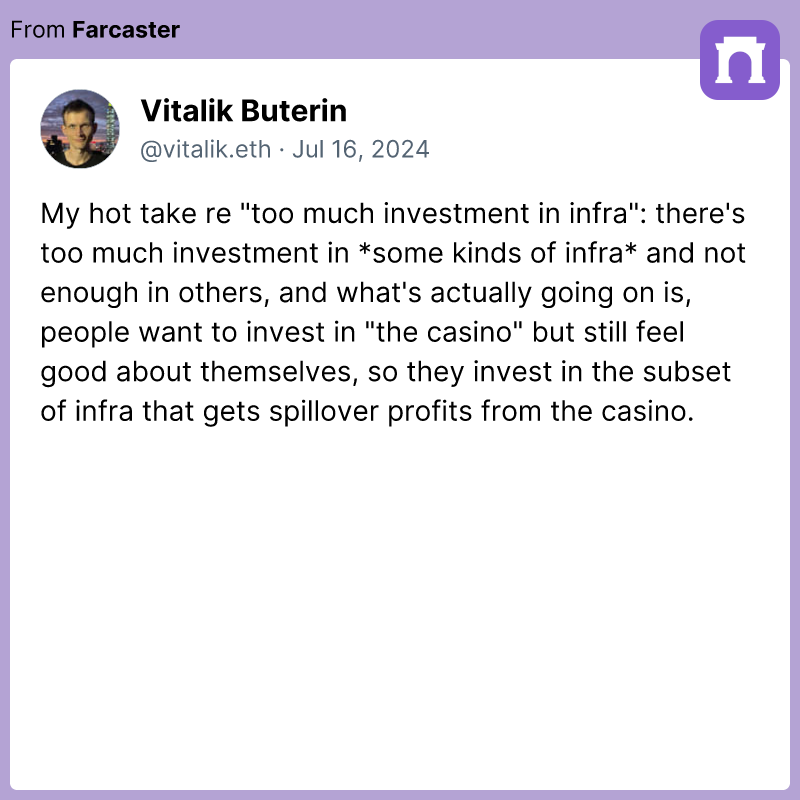

In the above cast we read:

"My opinion about too much investment in infrastructure is that there is too much investment in some infrastructure and not enough in others. What is happening is that there are people who want to invest casino-style, but still feel good about themselves. So they invest in a part of the infrastructure that still enjoys the capital that comes from the casino."

References not too Veiled

Buterin is referring to a very common figure in cryptocurrency investing: those who choose relatively risky projects, avoiding supporting the more stable and secure ones, and those who chase revenue from capital rotations due to operations that are anything but shrewd. The one highlighted by the head of Ethereum is a real problem, linked to a degenerate aspect of this field and which is a very bad calling card for the entire sector.

Criticism of Buterin's Complaint

Not everyone, of course, sees it the same way. There are also those who believe that the strength of decentralised finance is precisely that it can rely on high-risk, high-reward investments, which entail less security but allowgreater returns, should they succeed. Vitalik Buterin, after all, is a personality of absolute prominence, let's even say apex, within Ethereum and, according to some, he would directly, as they say, or rather, use his platform to attack behaviour that he personally does not like. His opinions carry a lot of specific weight and immediately acquire a different relevance than those of less prominent personalities.

The position of Ethereum's CEO is known to many in the environment and it is hard to blame him. Behaviour like the one he denounces is commonplace and is one of the main reasons for distrust of the cryptocurrency system. We at SpazioCrypto quite agree with Buterin and would welcome it if this trend were reduced. On the other hand, however, we also believe that the riskier and less solid investments are the ones that have allowed Web3 to establish itself and we are aware that they have a well-defined dimension within this sector.

Keep up to date with all the latest news from the Web3 world: subscribe to the weekly newsletter from SpazioCrypto.