The onchain data on the latest movements of Bitcoin wallets was recently published and returned interesting data to analyse. In the last six months or, in not a few cases, even longer, around three quarters of all Bitcoins in circulation have not been moved.

The Graph Used

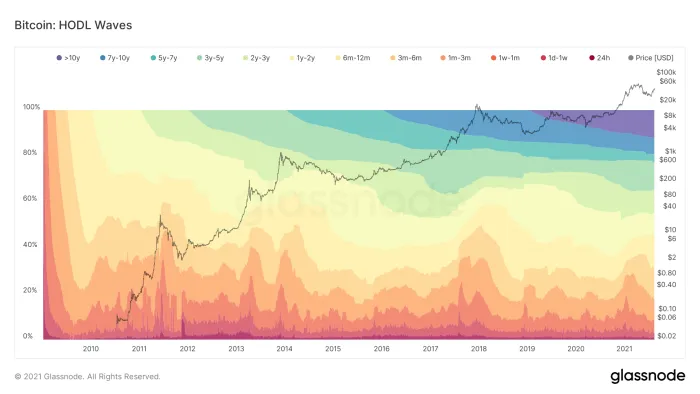

The survey is based on data compiled by Glassnode, the company that produced a clear, in the sense of easily intelligible, graph HODL waves. This name denotes the visual representations of the latest movements on the blockchain, collected in order to provide a macro view of the trends of BTC held within the various wallets.

What is particularly interesting is the fact that over 74% of Bitcoins have not moved since 1 January 2024. Yet, the value of the currency is down 21% from its all-time highs

Bitcoin and the Drawers

The high proportion of drawer investors who are holding-rather than selling as soon as the price rises, as speculators do-suggests that many prefer to hold their BTCs, managing them as a store of value. Some may have decided to act in this way because they plan to sell during an upturn in the value of BTC, while others, perhaps, are waiting for crypto to acquire a status akin, to all intents and purposes, to that of fiat currencies. Only then will they begin to dispose of them, treating them in the same way as the currency systems we handle every day.

Although new currencies are emerging almost continuously, investors recognise the older systems, such as Bitcoin and Ethereum, as much for their higher value as for their wider spread. The holding trend inevitably reduces the supply of BTC available for trading. This will lead, in the short to medium term, to a rise in the price of Bitcoin, due to increased demand and reduced supply.

Panic Selling Threatens Bitcoin?

None of the considerations just highlighted should surprise the reader. Many of the investors in cryptocurrencies, and in Bitcoin in particular, are long-time enthusiasts and have no intention of disposing of their assets prematurely; in fact, they prefer to wait for crypto to establish itself as an alternative method of payment, flanking cash and digital payment systems in their daily operations.

Of course, no one knows when (and if) this will happen, but it is of course the more or less stated goal of these payment methods. In some countries, this process is already underway. In this regard, the news that in the city of Dubai, it will be possible to pay one's employees in cryptocurrencies.

Alongside this category of investors, we also find another one, consisting of more impulsive individuals. It is that of the so-called short-term holders, who have no interest in holding their currencies and prefer to sell them as soon as they are able to yield a higher value than they bought them. A short-term investor is defined as any saver who has held BTC, or another benchmark cryptocurrency, for less than 155 days.

This type of investor is the one at risk of panic selling, as they say, i.e. inclined to sell quickly, without thinking too much about it, as soon as the value of Bitcoin, or the currency they hold, starts to fall, for several consecutive days. Since they are not good planners, and do not have much patience, they prefer to protect themselves from possible further losses by selling as soon as their portfolio starts to lose value in a steady and, in their view, inexorable manner.

We have often witnessed impulsive panic selling, in previous years, when cryptocurrencies depreciated. This phenomenon plays an important role in their devaluation. As former Twitter, James Check, a well-known onchain analyst, wrote on X, the moment we are experiencing is nothing new:

"We are in a situation that has many similarities to those of 2018, 2019 and mid-2021, which showed how many investors risked panicking and setting off a bearish trend."

The Role of Fear

In general, market sentiment towards Bitcoin is still strongly bearish. The currency, for its part, is fluctuating. Over the past weekend, it surpassed $60,000 but then, on Monday, fell back below $59,000 again (58,619, at the time of writing).

The Crypto Fear & Greed Index scored a 28, deep in fear territory. In fact, we have not seen such a value since December 2022. The timing is pretty bad for cryptocurrencies, and a rebound is expected.

If you want to keep track of all the fluctuations in the values of Bitcoin and other cryptos, sign up for the SpaceCrypto Newsletter.