The cryptocurrency market is going through turbulence, with the price of Bitcoin (BTC) falling below the psychological $80,000 threshold for the first time since April 2025. However, despite the drop, the leading digital asset is demonstrating surprising relative strength, clearly outperforming gold amid general risk aversion.

While Bitcoin suffered losses in line with high-risk assets, its decline was considerably smaller than that of precious metals. This resilience has attracted the attention of a new wave of investors, who see the current downturn as a strategic opportunity to accumulate BTC at discounted prices.

Bitcoin vs Gold: A Resilience Comparison

The contrast between the digital and traditional asset became clear at the close of last week. Between Thursday and Friday, gold suffered a violent sell-off, plummeting by almost 10%. In the same time frame, Bitcoin experienced a much more moderate drop of about 5.6%.

This gap highlights a significant shift in investor preferences during times of financial stress. Although gold has historically been considered the ultimate safe haven asset against inflation, Bitcoin is showing greater resilience in the short term. The shallower drawdown suggests that there is very solid demand support for Satoshi Nakamoto's coin, with capital appearing to favour 'digital gold' over its physical counterpart during recent volatile phases.

On-Chain Data: Record Surge in New Addresses

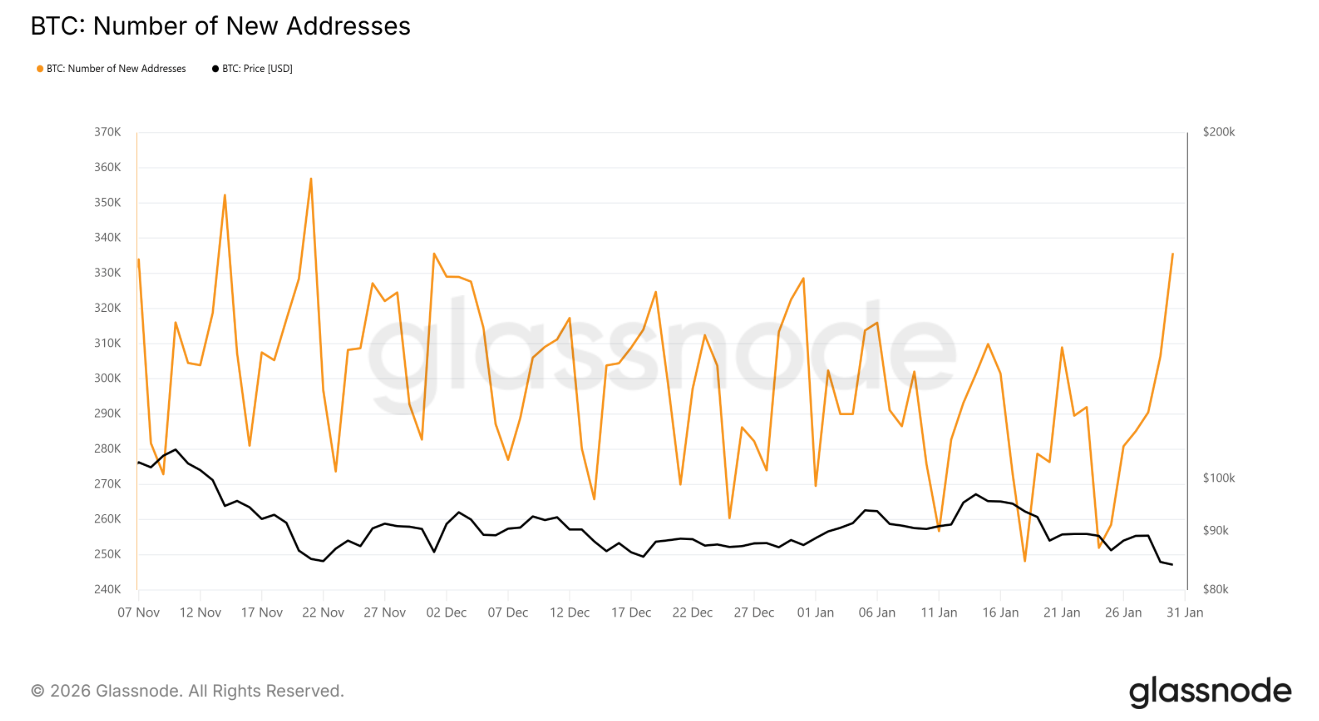

Confirming this renewed interest, data-on-chain reveals frenetic activity on the network. In the past 24 hours, the Bitcoin network has recorded the creation of some 335,772 new addresses, marking a two-month high. This is the largest daily increase since November 2025.

The surge in new participants occurred just as the price was approaching $81,000, indicating that many users identified that level as a favourable entry point. Historically, such rapid address growth signals an expansion in adoption that can act as a buffer for price stability, absorbing selling pressure during corrections.

Technical Analysis: The Risk of Further Declines

At the time of writing, the Bitcoin trades around $78,000. From a technical point of view, the situation remains delicate: BTC has broken out of a broadening ascending wedge pattern to the downside. This bearish pattern projects a potential overall decline of 12.6 percent, with a target identified in the $75,850 region.

Selling pressure intensified after the loss of key support at $82,503, confirming the short-term negative momentum. However, analysts believe a recovery from that level could quickly reverse market sentiment. For a firmer recovery, Bitcoin would need to regain and consolidate $87,210 as support, a signal that would restore full confidence to buyers.

If the bearish trend persists, the levels to monitor are $78,763 and then $75,895. A close below the latter figure would officially invalidate the bullish medium-term outlook, opening the door to further corrections. Nevertheless, improving on-chain metrics and a steady influx of new investors give hope for an imminent stabilisation phase.