Bitcoin's large holders are quietly accumulating again, a sign of renewed confidence despite a sharp market correction that has erased more than 20 per cent from recent highs.

At the time of writing, Bitcoin is trading at just over $101,000, after briefly dropping to $99,600 two days ago.

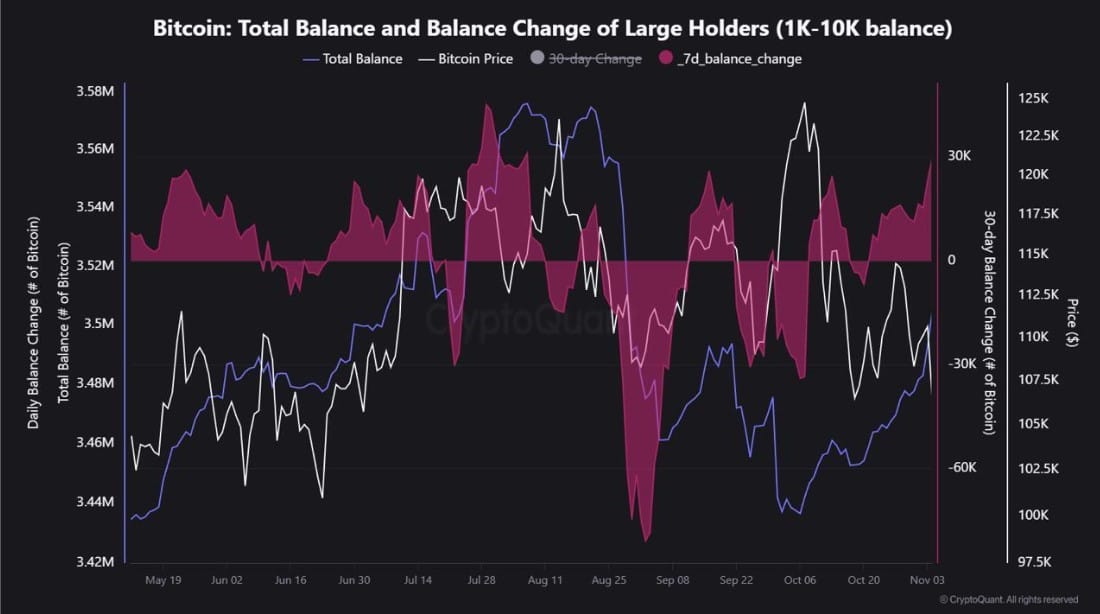

According to CryptoQuant data, wallets holding between 1,000 and 10,000 BTC have added about 29,600 Bitcoins in the past seven days. Analyst JA Maartun noted that the combined balance of these wallets, known as 'whales', increased from 3.436 million to 3.504 million BTC. This marks the first significant accumulation phase since late September.

A Signal Contrary to Retail Feeling

This data suggests that large entities-typically institutions and early "whales"-are buying on market weakness, not running away from it. Their actions contrast sharply with retail sentiment, which has become fearful after heavy liquidations and outflows from ETFs.

Leveraged positions of over $1 billion were wiped out last week. In addition, the ETFs spot on Bitcoin in the US recorded more than $2 billion in redemptions.

JPMorgan forecasts Bitcoin at $170,000 in the next 6-12 months, stating that perpetual contract (perp) deleverage is behind us and that Bitcoin is historically undervalued relative to gold, implying "significant bullish potential in the next 6-12 months," as stated by Balchunas on X.

JPMorgan predicting bitcoin at $170k in next 6-12mo, says perp deleveraging is behind us and that's it undervalued vs gold historically, which implies "significant upside next 6-12mo" pic.twitter.com/CaVVWH6L42

- Eric Balchunas (@EricBalchunas) November 6, 2025

Historically, such a divergence between the accumulation of "smart money" and retail caution has often characterised end-of-cycle corrections, rather than the onset of new downward trends.

Strengthening of the Base of 100,000

Absorbing about four times the weekly mining supply, the "whales" are tightening liquid supply on exchanges and strengthening the $100,000 support zone.

This accumulation also comes amid macroeconomic headwinds, such as the Federal Reserve's cautious tone on rate cuts, which has weakened demand for risky assets and contributed to Bitcoin's recent decline. These conditions have, however, created a liquidity vacuum that the 'whales' appear to be exploiting.

Technical indicators show Bitcoin consolidating between $100,000 and $107,000, while the Fear & Greed Index is plunging into the 'Extreme Fear' zone. Should the build-up by the 'whales' continue, it could form the basis for a medium-term recovery towards $115,000-$120,000.

The message is clear: while short-term traders are panicking, long-term holders are repositioning themselves for the next phase.