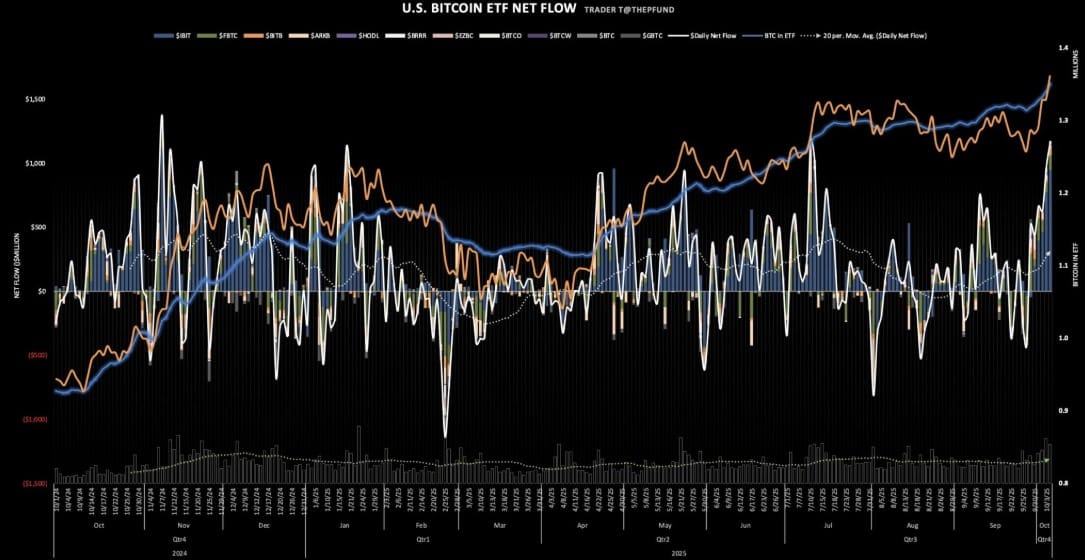

Investor activity in US-listed Bitcoin spot exchange-traded funds (ETFs) surged exceptionally sharply on 6 October.

This massive increase closely mirrors the continued price gains of BTC and the growing, and now unstoppable, interest from institutional investors.

According to meticulous data provided by SoSoValue, the twelve spot funds on Bitcoin that have received regulatory approval collectively took in around $1.2 billion in inflows in a single day.

This result not only stands as the second highest daily inflows since the ETF were launched in 2024, but also sets the most robust and significant performance recorded in the entire current calendar year.

A large portion of this demand has been dominantly focused on BlackRock's iShares Bitcoin Trust (IBIT). This single instrument attracted nearly $967 million in fresh capital, cementing its position as the industry leader.

In parallel, the trading volume recorded by IBIT reached an extraordinary figure of nearly $5 billion.

By virtue of this exceptional performance, IBIT is now on the verge of surpassing the $100 billion mark in assets under management (AUM), an unprecedented milestone that would represent an absolute record for any financial product in the digital asset landscape.

Bloomberg analyst Eric Balchunas recently highlighted IBIT's formidable profitability for its issuer. According to his estimates, the fund has already generated annual revenues for BlackRock of about $244 million.

This remarkable level of profit not only exceeds the gains made by the company's other funds BlackRock, many of which have been in business for much longer and are well established in the market, but also reflects a profound structural change.

These figures indicate how deeply institutional money has begun to integrate Bitcoin within more conventional portfolio strategies. The adoption of Bitcoin by these entities is no longer a fringe trend, but an increasingly central component of modern asset management.

This most recent wave of inflows extends a broader pattern of strength and resilience that financial investment vehicles on Bitcoin have been experiencing with remarkable consistency lately. In the week prior to the 6 October surge alone, Bitcoin ETFs attracted a total of approximately $3.2 billion in new equity.

This figure, which consolidated the second highest-ever inflows for the sector, underscores the growing conviction among investors regarding Bitcoin's enduring and expanding role in the global financial system.