In an event that captured the attention of the entire crypto community, a Bitcoin miner from the early days of the network re-emerged from a long hibernation to move as much as 2,000 BTC.

This strategic profit-taking manoeuvre has an estimated market value of around $181 million, marking one of the most significant moves by a so-called 'historic holder' in recent years.

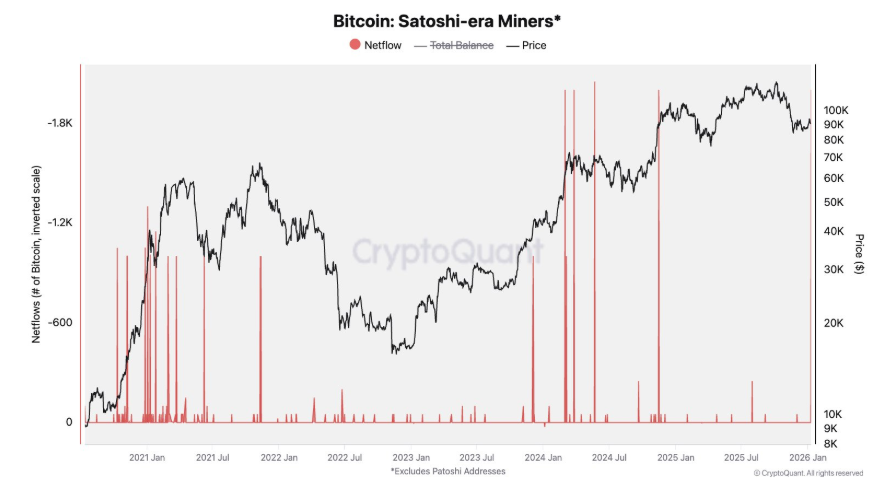

Julio Moreno, head of research at CryptoQuant, pointed out that this activity represents the strongest signal coming from a Satoshi-era whale since late 2024. According to the analyst, the timing is not coincidental: miners from that pioneering era tend to move their assets at "key inflection points" in the market.

Source of Funds: The Pioneers' Reward

Providing further technical details on the operation was Sani, founder of TimechainIndex. On-chain analysis confirms that the funds derive directly from block rewards generated in 2010. At that time, the Bitcoin network, still in its embryonic stages, rewarded miners with a 50 BTC subsidy per single block.

A miner has just sold 2,000 BTC derived from block rewards that had been dormant since 2010, transferring the funds to the Coinbase exchange, he said.

The coins have remained untouched for more than 15 years, distributed across 40 legacy Pay-to-Public-Key (P2PK) addresses. Recently, these funds have been consolidated and transferred to the Coinbase exchange. In the world of cryptocurrencies, the transfer to a centralised platform is almost always interpreted by analysts as the prelude to a sale on the open market.

The Trend of “Vintage” Supply

This transaction is not an isolated case. On the contrary, it highlights a growing trend whereby 'vintage' bidding is hitting the market more frequently. Over the past year, several portfolios dating back to 2009-2011 have been reactivated. This phenomenon reflects the willingness of early adopters to lock in generational gains or, alternatively, to upgrade their outdated custody systems.

An illustrious precedent dates back to July 2025, when Galaxy Digital handled one of the most impressive sales in history, assisting a Satoshi-era investor in liquidating over $9 billion in Bitcoin.

The Resilience of the Market

Despite the selling pressure exerted by these "Original Gangsters" (OGs) of the blockchain, the market has shown extraordinary resilience. Bitcoin has managed to digest these supply shocks without suffering any structural breakdown in price or investor confidence. This indicates that market liquidity is now deep enough to support the exit of the big incumbent holders without triggering systemic panic.

Future Outlook: Bitcoin at $2.9 Million?

While veterans are cashing in on the fruits of their foresight, long-term institutional forecasts remain extremely optimistic. In a report published last week, asset management giant VanEck made a bold projection: Bitcoin could reach a theoretical valuation of $2.9 million per coin by 2050.

VanEck's thesis is based on Bitcoin's potential adoption as a global settlement currency. Should the asset consolidate as a pillar of the international financial system, the planned scarcity of Bitcoin, coupled with growing institutional demand, could push the price to hitherto unimaginable heights.