Spot ETFs on Bitcoin in the US are experiencing a persistent haemorrhage of capital, marking a sharp reversal from the institutional support at the beginning of the year. Holdings have fallen dramatically, from 441,000 BTC on 10 October to around 271,000 BTC in mid-November.

According to data from Farside Investors, Bitcoin ETFs have recorded four consecutive days of outflows, extending the defensive tone that dominated the month. Although redemptions had peaked at over $800 million in a single day, the latest figure shows a smaller, but significant, outflow of around $60 million.

In parallel, the Fear and Greed index slumped to 11, underscoring a condition of extreme fear in the market. Historically, such levels have often coincided with market lows.

However, retail investors remain cautious. Bitcoin, down nearly 27% from its all-time high of $126,272.76 on 6 October, traded between $91,000 and $92,000 in Asian morning hours, down more than 3% over 24 hours and 13-14% for the week. Even Ethereum slipped briefly below $3,000 and Solana was at around $130, down 5% and 21% on a daily and weekly basis respectively.

Accumulation in the middle-of market weakness

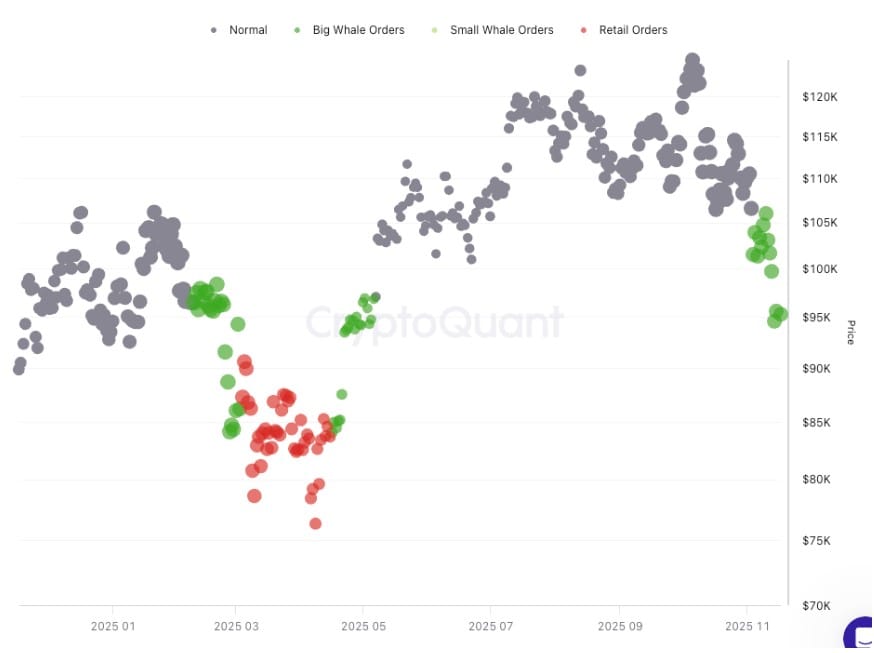

While the retail side holds sway with average order data from platforms such as Binance, Coinbase, Kraken and OKX showing larger sizes, indicating whale activity-the big players continue to aggressively accumulate.

One example is the address tracked by OnchainLens, which bought 10,275 ETH at $3,032 for a total of $31.16 million USDT in the 24 hours prior to 17 November. Between 12 and 17 November, this address acquired a total of 13,612 ETH for $41.89M USDT, at an average price of $3,077.

A whale has spent $31.16M $USDT to purchase 10,275 $ETH at $3,032 in the past 24 hours.

- Onchain Lens (@OnchainLens) November 18, 2025

Since November 12, the whale has spent $41.89M $USDT to buy 13,612 $ETH at a price of $3,077.

Address: 0x1fc75ad0511ddc3a23b9583ba1c285b8292faed5

Data @nansen_ai pic.twitter.com/qBtzFYQgKk

In addition, the permanent holders of Bitcoin, defined by CryptoQuant as wallets with no outflows, are sustaining what is described as the largest accumulation spike in recent selloffs. Demand from these holders has increased from 159,000 BTC to 345,000 BTC, the largest uptake in several cycles.

CryptoQuant CEO Ki Young Ju notes that this dip involves a rotation of coins among long-term holders rather than new capital inflows, suggesting that the drop does not signal the start of a new bear market.

Technical Signals and Structural Changes

Technical signals remain bearish: Bitcoin is down more than 20% from its high, and its 50-day moving average has recently fallen below its 200-day moving average, forming a 'death cross'.

However, the current selloff differs from previous "winters crypto" due to the presence of advanced financial infrastructure, with institutions such as JPMorgan accepting Bitcoin as collateral for loans. This increased liquidity helps stabilise the market.

Although macroeconomic factors such as the Federal Reserve's delayed rate cuts add pressure, analysts see long-term trends, such as high sovereign debt and geopolitical tensions, as future support for Bitcoin.