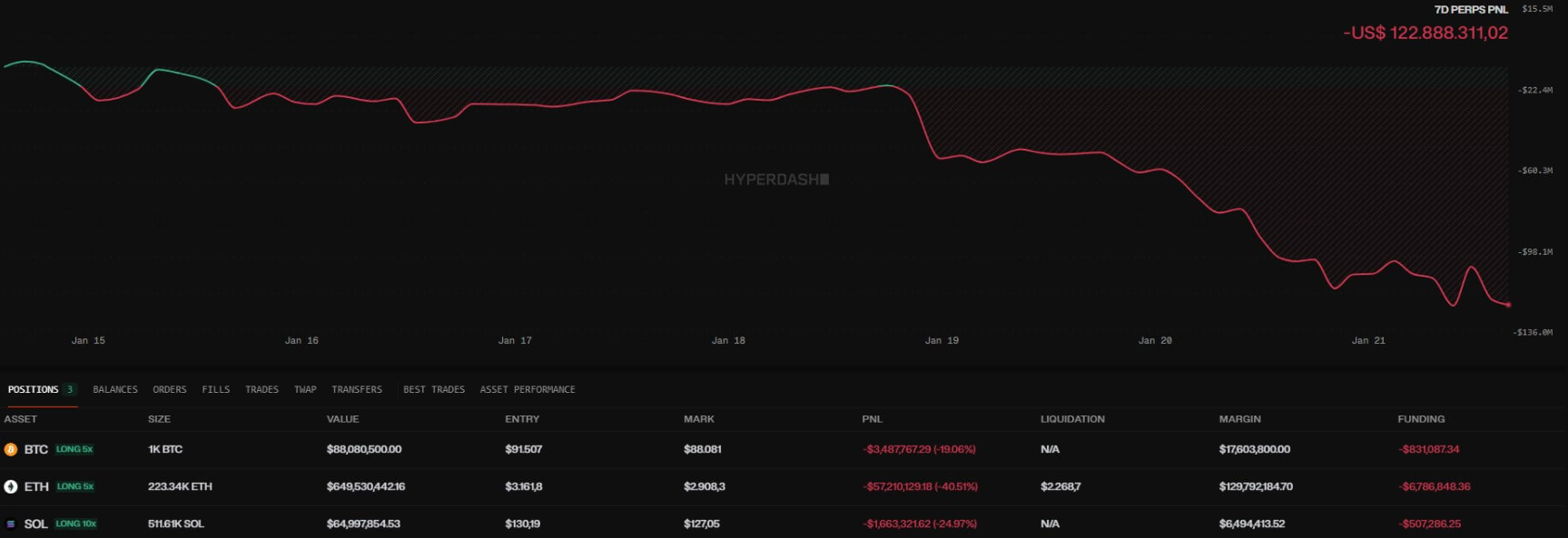

In the cryptocurrency landscape, movements of so-called 'whales' are often premonitory signs of storms or major restarts. Currently, analysts' attention is catalysed by a single wallet on the Hyperliquid platform, which holds a long position in Ethereum (ETH) worth a monumental $649.6 million.

The trader has accumulated 223,340 ETH at an average entry price of $3,161.85. However, with the market recently trading around $2,908.30, the operation is going through a critical phase. The position is already registering unrealised losses of about $56.6 million, plus $6.79 million in financing costs (funding costs).

The mechanics of the cross-margin and the "moving target"

Making this situation particularly complex is the cross-margin system adopted by Hyperliquid. Unlike isolated margin, here the settlement price is not a static value. It fluctuates according to the available collateral, the funding payments that accumulate and the overall performance of all other positions in the account.

Currently, the estimate for the forced position closure stands at around $2,268.37, about 22% below current prices. Although this provides a buffer of $129.9m, the dynamic nature of the cross-margin turns the liquidation price into a 'moving target'. In the event of high volatility or correlated losses in other assets in the wallet, this safe-harbour threshold could shrink rapidly, coming dangerously close to the spot price.

The risk of a cascading effect on the market

What would happen if Ethereum were to fall dramatically? The mechanism of Hyperliquid is that most liquidations are sent directly to the order book. This means that the forced closure occurs first in the perpetual (derivatives) market, without immediately dumping ETH on the spot market. However, the indirect impact is almost inevitable.

- Arbitrage: Market makers respond quickly to misalignments between perpetual and spot prices.

- Deleveraging: If the backstop fund (HLP) failed to cover losses, automatic deleveraging would be triggered, closing out the opposite positions.

- Spot pressure: Forcing a closure of similar volume would create a wave of selling reflected on the major exchanges.

There are worrying precedents: in March 2025, a $200 million long settlement caused a $4 million loss at the HLP backstop, leading Hyperliquid to introduce minimum collateral requirements of 20% in specific scenarios.

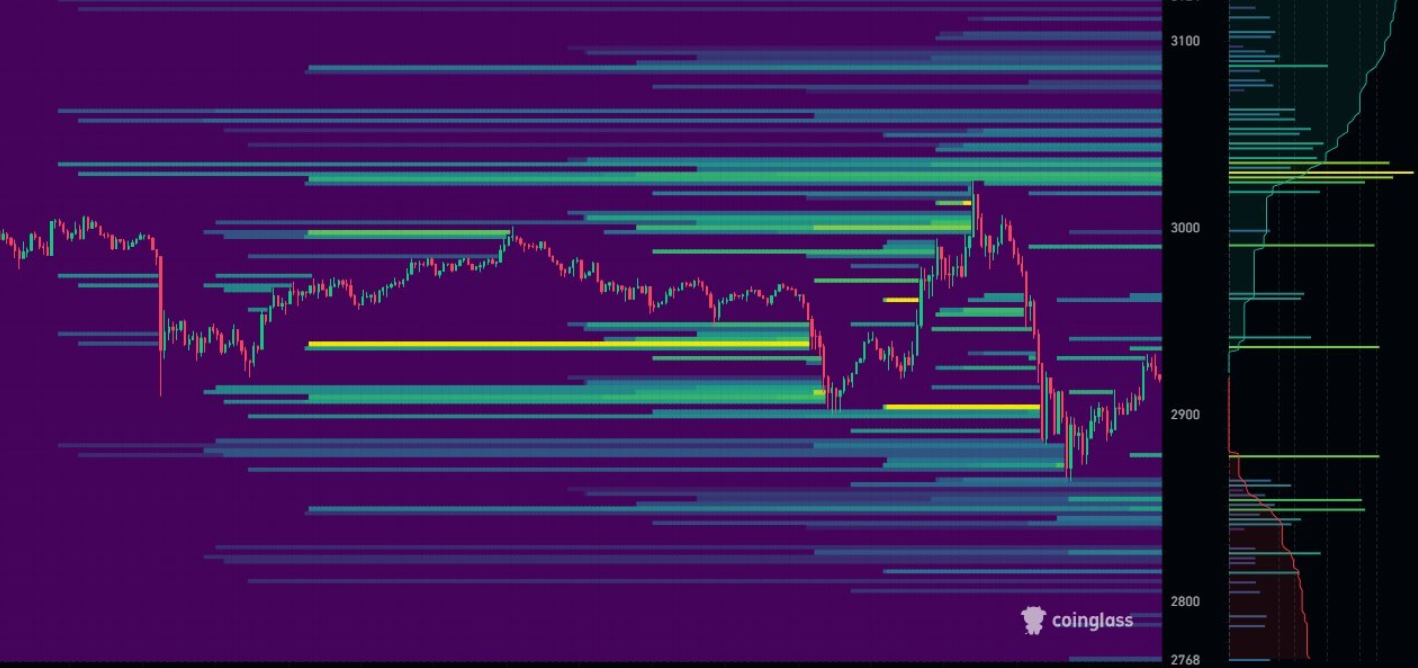

Where risks are concentrated: liquidation maps

The CoinGlass data show that there are significant leverage clusters between $2,800 and $2,600, with a further concentration near $2,400. Although the threshold of this wallet ($2,268) is lower, a drop across the $2,400 zone could trigger a chain reaction that would suck even this mammoth position.

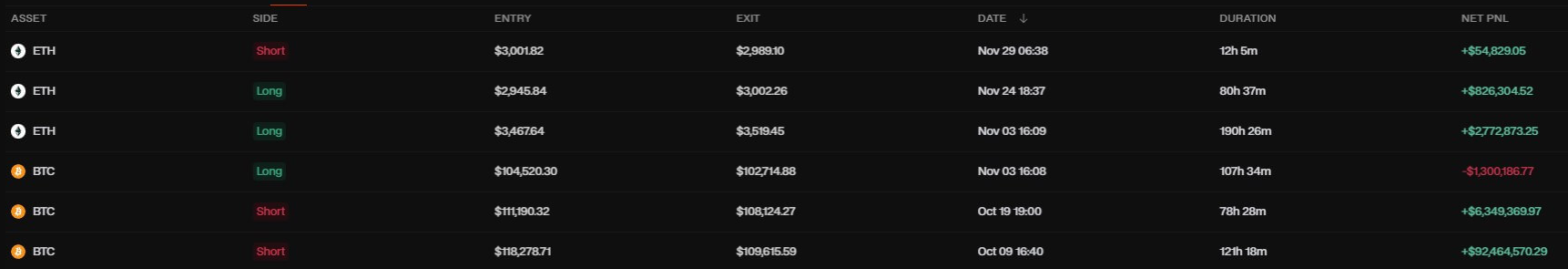

Conclusion: a bet against the time

The wallet owner is no novice: as of October, he had generated over $101.6 million in profit by riding the trends of Bitcoin and Ethereum. However, this current position is burdened by a negative carry (funding) and a duration that is eroding the account's equity. The future of this half-billion investment now depends entirely on Ethereum's ability to reverse course before volatility forces the system to intervene.