While the privacy coin sector is experiencing a new wave of optimism, led by assets such as Monero (XMR) and Zcash (ZEC), Dash (DASH) finds itself navigating rough waters.

Although the prevailing narrative is positive, several technical indicators suggest that the third largest privacy-oriented cryptocurrency by market capitalisation is facing significant structural risks.

The revival of “old” DASH: distribution phase underway?

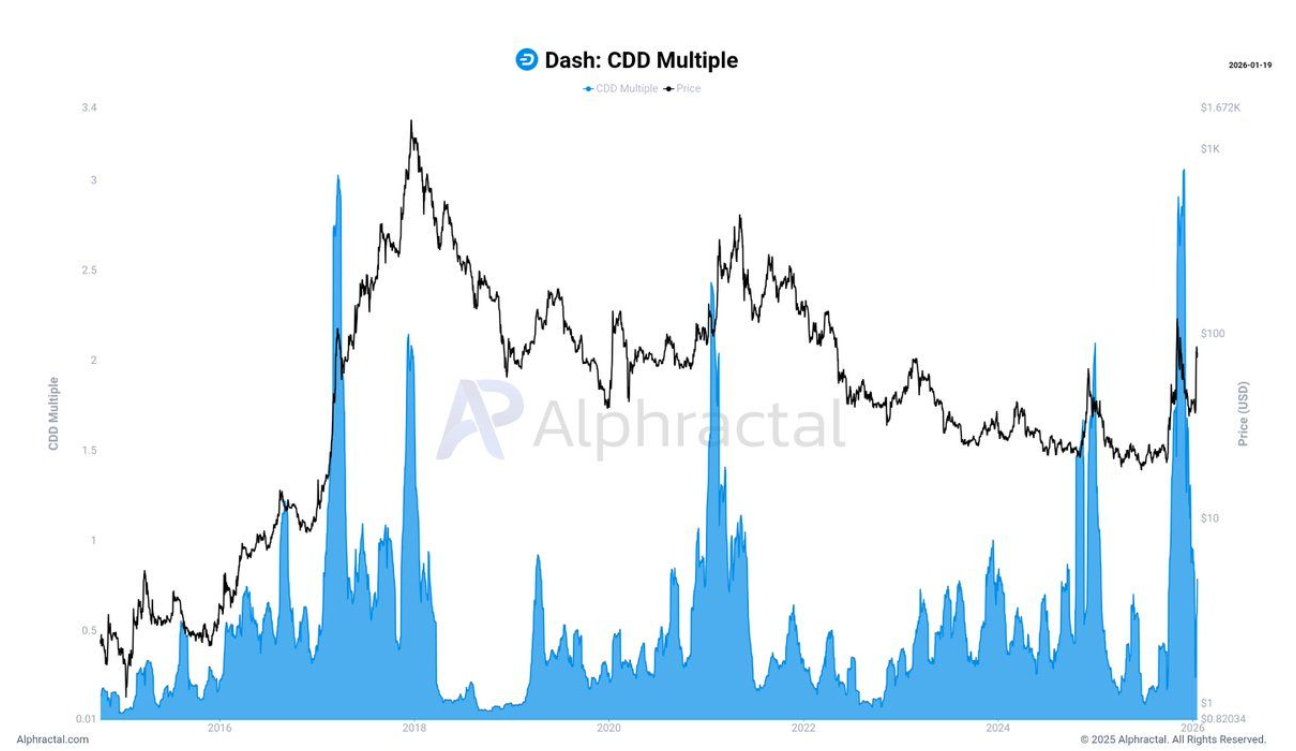

The first warning sign comes from the behaviour of long-term holders. In November 2025, there was an abnormal wave of reactivation of Dash coins that had been dormant for years.

Historically, the movement of old stocks is a distribution signal: early-stage investors start liquidating their positions near market peaks.

The Coin Days Destroyed (CDD) metric, which measures the volume of coins moved multiplied by the time of inactivity, showed worrying peaks. Although reactivation activity seems to be declining by the day, analysts warn that distribution phases can last for months.

This allows 'big money' to quietly exit, but creates a constant bearish pressure that could choke the price in the medium term.

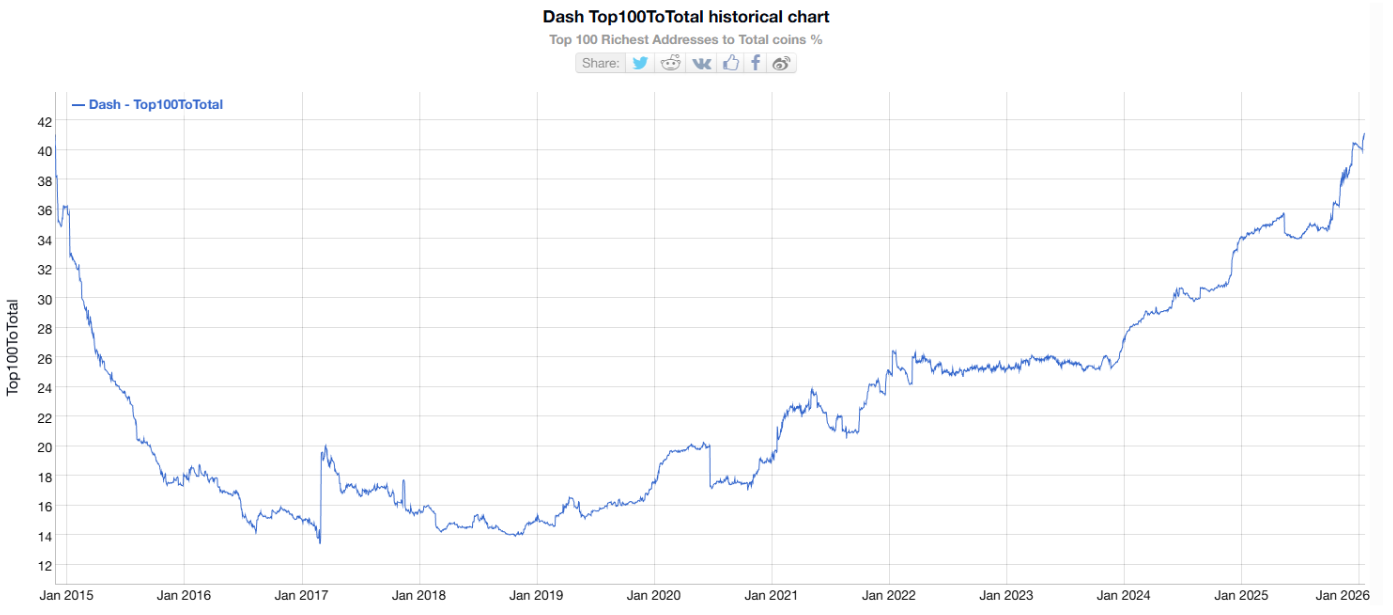

Whale concentration: at a decade high

Another crucial risk is related to the distribution of wealth within the network. Currently, the top 100 richest portfolios control over 41% of the total DASH offering. This is the highest level of concentration recorded in the last decade.

For comparison, in December 2017, when Dash reached its all-time high, this share was only 15.5%. While concentration can offer stability if large investors remain confident, it also exposes the market to systemic risks.

A coordinated sell-off - or even a sudden disinvestment by a few individual whales - could overwhelm the order books, triggering cascading sales that are difficult for retail traders to contain.

Open interest at historic highs and risks of liquidation

The third, and perhaps most immediate, risk concerns the derivatives market. Although Dash is trading at around $150 - half its November highs - the Open Interest (OI) has exploded above $180 million. This is double the figure recorded two months ago and represents the highest value ever touched in Dash's history.

Such a high OI indicates unprecedented leverage exposure. In contexts of high volatility, such a concentration of open positions creates fertile ground for mass liquidations.

These events can generate a 'domino effect' that quickly spills over into the spot market, causing vertical price collapses within minutes.

In addition, recent analysis shows that capital flows are shifting towards smaller-capitalisation privacy coins, suggesting that investor expectations for 'large-cap' assets such as Dash are diminishing. With competition advancing and on-chain signals turning red, DASH holders would do well to monitor these indicators very closely in the coming weeks.