Just twelve days before the end of his term, former New York City Mayor Eric Adams has unveiled his new cryptographic project: the NYC Token.

Presented during a grand event in Times Square on 12 January 2026, the token - launched on the Solana network - is being promoted as a tool to fund blockchain education and combat anti-Semitism.

However, the initial enthusiasm turned into a financial nightmare for many retail investors. Within about 30 minutes of its launch, the token's value plummeted by more than 81 per cent, wiping out about $500 million in paper value reached at its peak, when the market capitalisation was estimated at $540 to $600 million.

Annalysis On-Chain: Accusations of "Rug Pull"

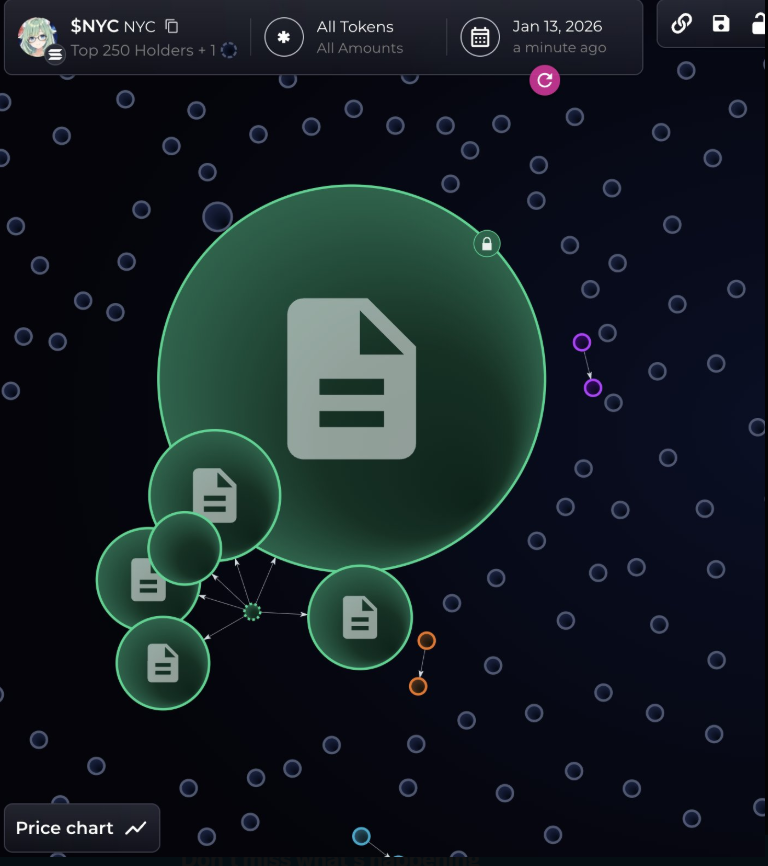

While the X account verified of Adams was promoting the launch, the platform later added a Community Note with a "rug pull" warning. On-chain investigators confirmed investors' fears. According to Bubblemaps' data, a wallet linked to the developer created a one-sided liquidity pool on Meteora, removing about $2.5 million in USDC just near the price spike.

Proud to launch @buynyctoken, a new token built to fight the rapid spread of anti-Semitism and anti-Americanism across this country and now in New York City.

- Eric Adams (@ericadamsfornyc) January 12, 2026

Now live at https://t.co/zowY9Ri3aK pic.twitter.com/qBMzV88Tmj

The same wallet later added back around $1.5 million after the price had already plummeted by more than 60 per cent. This manoeuvre left a gap of about $932,000 unaccounted for in this 'round trip'. Data from Solscan also show an extreme concentration of supply: the top five wallets hold about 92% of the tokens, while the top ten hold 98.73%, with a single wallet controlling 70% of the total.

The Impact on Small Savers

The losses for retail traders have been devastating. Transaction histories show emblematic cases: one wallet tracked by Solscan made five purchases totalling USDC 745,725, then resold it all for only USDC 272,177. The result? A net loss of about $473,548 in less than 20 minutes. The low removable liquidity and centralised structure made fair price discovery impossible, amplifying the slippage during exit attempts.

A Past Tied to Crypto and New Political Scenarios

The episode affects a public figure who built his political brand on blockchain technology. In 2022, Adams had converted his first salary as mayor into cryptocurrency, after promising in 2021 to receive his first three cheques in Bitcoin.

However, his political clout changed dramatically in 2025, after he lost the Democratic primary to Zohran Mamdani, leaving office at the end of the year. On the legal front, on 2 April 2025, a federal judge dismissed the bribery case against Adams with prejudice, following a motion to dismiss by the Department of Justice.

The Regulatory Vacuum and the Memecoin Market

The NYC launch comes amidst a difficult market environment. The overall memecoin market cap has fallen from the highs of 2025 (over $60 billion) to around $47.3 billion in early 2026. Despite the token boom on Solana, few achieve real stability.

From a regulatory perspective, an SEC statement on 27 February 2025 clarified that many memecoins are not considered securities transactions (securites) because they are purchased for entertainment or cultural purposes. This leaves investor protection in the hands of state authorities and anti-fraud laws. In New York, a bill aims to specifically criminalise 'rug pulls' based on the selling behaviour of developers.

While the US president manages his token (TRUMPOFFICIAL) with a planned and public removal of liquidity, Adams' method shocked the market with its destructive speed, further undermining confidence in cryptocurrencies as a positive force.