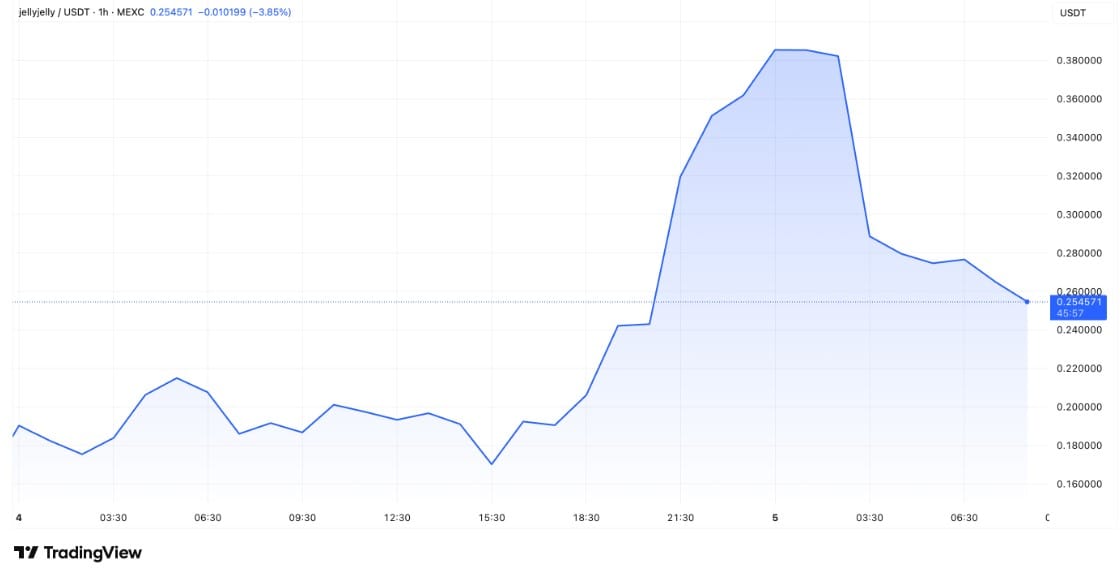

While the cryptocurrency market faces a sharp downturn, with major assets steadily declining, Jelly-My-Jelly (JELLYJELLY), a Solana-based meme coin, defied the general trend, reaching a new all-time high (ATH).

The market suffered a sharp drop on 4 November. Bitcoin (BTC) briefly fell below $100,000, while Ethereum (ETH) slipped as low as $3,000, a low not seen since July. Despite this turmoil, JELLYJELLY emerged as a counter-trend stock, reaching an all-time high of $0.5 on 4 November. With this increase, its market capitalisation also jumped to $500 million.

JELLYJELLY Another Case Of Coordinated Trading

The record-breaking run, however, has raised suspicions from blockchain analytics platform Bubblemaps, which has expressed concerns about possible coordinated trading and potential market manipulation.

The meme coin underwent a modest correction after ATH. At the time of writing, JELLYJELLY is trading at $0.25, but is still up 31.7 per cent in the past 24 hours.

Its market value has also adjusted to around $250 million. Trading activity has remained strong, with data from CoinGecko showing a 96% increase in daily trading volume to $462 million.

Bubblemaps noted that seven wallets with no previous activity have withdrawn 20% of JELLYJELLY's supply from centralised exchanges Gate.io and Bitget over the past four days.

Shortly after these CEX withdrawals, JELLYJELLY jumped +600%... after falling 80% from previous highs, has declared Bubblemaps.

3/ Shortly after these CEX withdrawals, JELLYJELLY jumped +600% to a new ATH of $400M mcap - after dropping 80% from previous highs

- Bubblemaps (@bubblemaps) November 4, 2025

Follow those whales here:https://t.co/uLVBH85k50 pic.twitter.com/s09xnZ3jHq

This suggests possible market manipulation, as the coordinated withdrawal of a significant portion of the token's supply likely restricted liquidity on exchanges, facilitating artificial price increases.

Also, this is not the first time JELLYJELLY has been at the centre of coordinated activity. In March 2025, the token was central to an incident on the decentralised exchange HyperLiquid, where a whale (large holder) manipulated the price, causing a short squeeze that threatened losses of up to $230 million in HyperLiquid's vault HLP. The incident led HyperLiquid to delist JELLYJELLY and increase security measures.