The recent financial movements of SpaceX have reignited a heated debate within the cryptocurrency markets.

Speculation on Twitter (X Hour) quickly turned into concrete fears, suggesting that Elon Musk's aerospace giant is preparing to sell off its digital reserves. However, a closer analysis of the on-chain data paints a much more nuanced picture: there is, at the moment, no confirmed evidence of a mass liquidation.

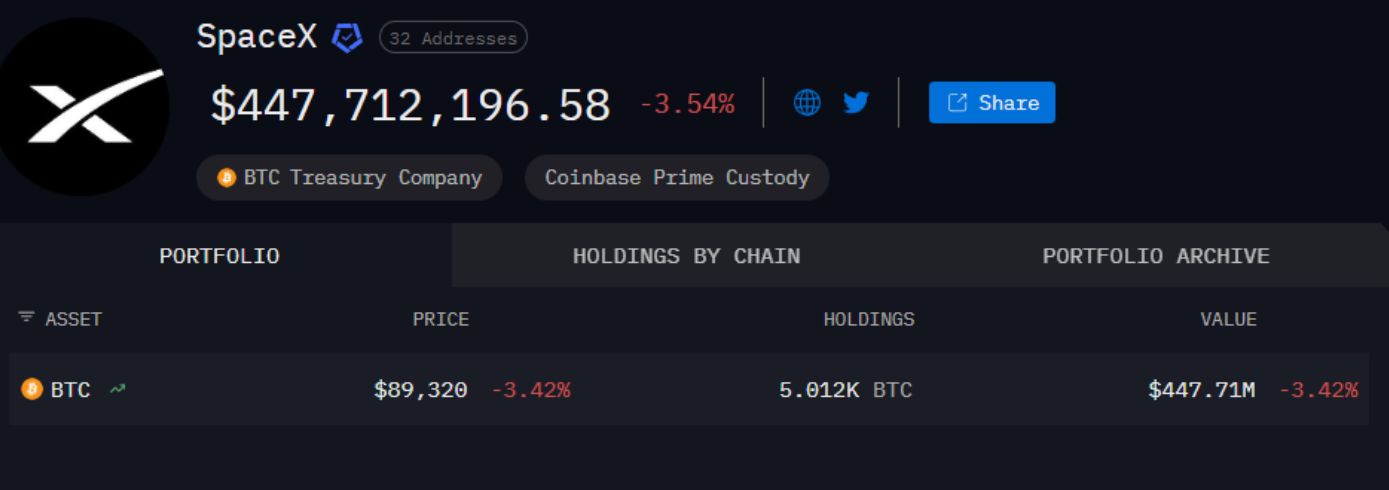

The Arkham Data and Transferred Volumes

According to data provided by the Arkham analytics platform, SpaceX has moved approximately 2,246 BTC over the past 12 hours and the previous week. These transfers include two massive outflows totalling over $200 million, alongside several smaller incoming transactions from Coinbase Prime.

SpaceX is about to SELL all of its Bitcoins. They've moved it all to an exchange, a move you only make when you're selling, said said Jacob on X

SpaceX is about to SELL all their Bitcoin. They've moved it all to an exchange, a move done only when selling. pic.twitter.com/uQ8AAsNCWe

- Jacob King (@JacobKinge) December 5, 2025

Despite the viral outcry that claimed the company had transferred 'all' of its holdings, the reality is quite different. SpaceX still holds over 5,012 BTC, worth an estimated $448 million. This means that less than half of the tracked Bitcoins owned by the company have actually been moved.

The Reaction of "Crypto Twitter" and the Reality of Wallets

The crypto community on social media has been quick to interpret these outflows as a sign of an impending sale. Many posts have argued that the movement of funds from treasury wallets to new addresses is typical behaviour that precedes corporate liquidations.

However, there is one key technical detail that weakens this theory: the target wallets are not labelled as exchanges. No direct connection to Binance, Coinbase or OTC (Over-The-Counter) settlement desks has been confirmed. The absence of a transfer to sales platforms greatly weakens the hypothesis of a planned 'dump' in the market.

Neutral explanations and macroeconomic context

There are much more neutral and technical explanations for these movements. SpaceX could simply be rotating the wallets for security reasons, consolidating the funds or changing the custody structure.

It is common practice for corporate treasuries to rebalance or upgrade storage systems without necessarily selling assets. Paradoxically, this move could also be interpreted as bullish: if funds were directed to multi-signature vaults for long-term storage, they would not exert any immediate selling pressure.

Currently, the price of Bitcoin has fallen back below 90.000, but analysts attribute this drop mainly to outflows from US ETFs and macroeconomic fears related to the Bank of Japan raising interest rates, rather than Musk's actions.

For now, SpaceX's activity is certainly noteworthy, but not conclusive. Until the target wallets are linked to a known exchange or a clear distribution pattern appears, the claim that the company is selling its Bitcoins remains unproven. At this time, speculative noise seems to outweigh the reality of the data.