The Russian cryptocurrency exchange Garantex, previously hit by Western sanctions and the seizure of its servers, is quietly getting its funds moving again.

According to a new investigation by blockchain analysis firm Global Ledger, Russian actors have managed to reconstruct a fully functioning on-chain payment architecture, despite law enforcement efforts to block the operation.

The forensic evidence gathered by Global Ledger confirms that Garantex has far from disappeared, having instead adapted to continue moving large sums of money, highlighting the evolution of tactics to circumvent international restrictions.

Garantex Returns: Millions on the Move

Global Ledger researchers have discovered new wallets linked to Garantex on Bitcoin and Ethereum. Collectively, these wallets contain over $34 million in cryptocurrency.

Of this sum, at least $25 million has already been disbursed to former users, confirming that the operation is up and running despite international pressure.

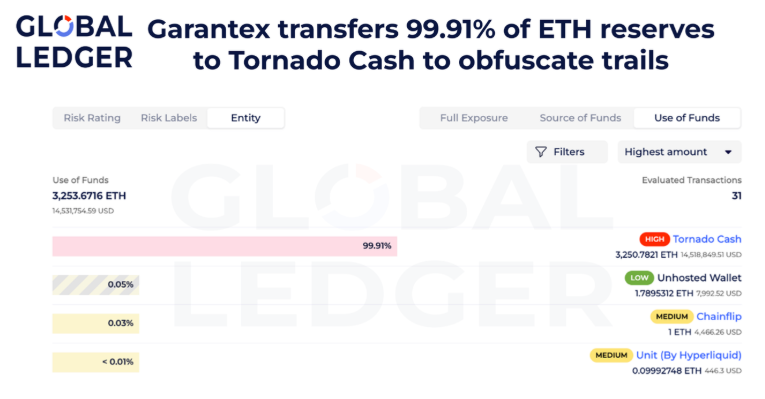

Global Ledger explained that Garantex uses a payment system specifically designed to hide the flow of money. The exchange moves its reserves to mixing services such as Tornado Cash, which mix the funds to obscure their origin.

Money is then routed through a series of cross-chain tools that facilitate the transfer of assets between different networks, including Ethereum, Optimism and Arbitrum. These transfers eventually flow into aggregation wallets, from which funds are distributed to individual payout wallets.

In spite of the activity, the survey also found that most of Ethereum's reserves remain intact: over 88% of the ETH linked to Garantex remains in reserve, suggesting that only the initial phase of payments has been initiated.

The Changing Russia: A7A5 and Trade Under Sanctions

The findings of the Global Ledger report are part of a broader transformation of the Russian financial system. In early 2022, the Russian Central Bank had proposed a blanket ban on cryptocurrencies, considered a threat to financial stability.

By 2024, the country has completely reversed its position, starting to use cryptocurrencies to support sanctioned trade.

To this end, President Vladimir Putin has personally backed a new payment network called A7. A7 launched a stablecoin pegged to the rouble, called A7A5, in early 2025.

This token is crucial for allowing money to flow in and out of the conventional financial system. According to Chainalysis, A7A5 has already supported over $87 billion in trading activity. Russian companies use A7A5 to convert roubles into USDT, allowing them to make cross-border payments even when banks refuse to process Russia-related transfers.

As Russia works to build a financial system independent of Western channels, Global Ledger's findings add a crucial layer, showing that Garantex has adapted its operations to reflect the latest state-backed structures.

The overall evidence shows how states are developing new cryptocurrency-based payment systems that not only circumvent specific sanctions, but also help erode traditional forms of external pressure.