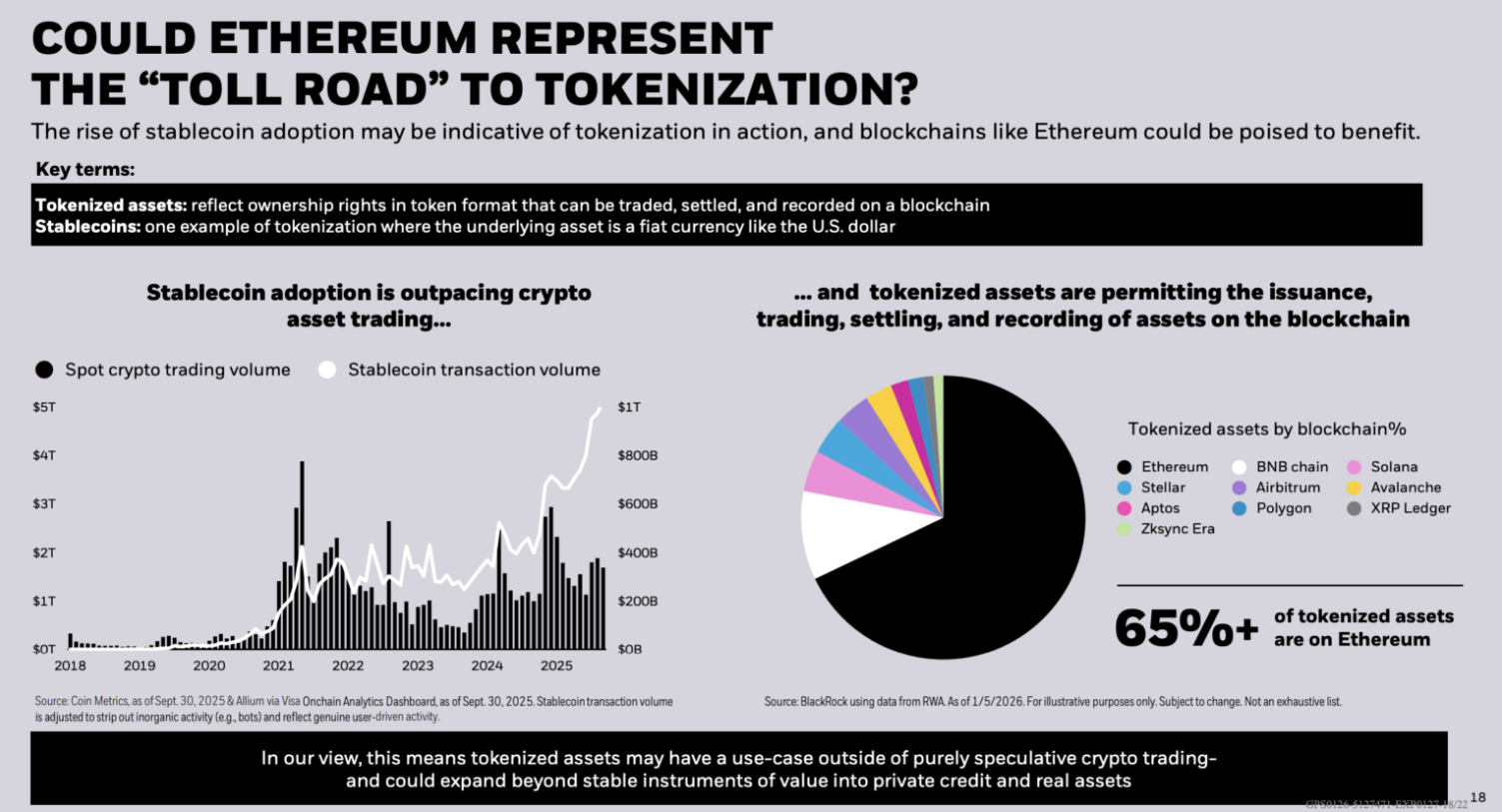

BlackRock's "Thematic Outlook 2026" has cast Ethereum at the centre of the tokenization revolution, raising a fundamental question for investors: can the network really act as a 'toll road' for global finance?

According to the asset management giant, over 65% of tokenized assets currently reside on Ethereum, positioning the network not just as a speculative asset, but as the primary infrastructure for the settlement of real capital.

Ethereum's dominance and the drift of market-shares

Despite the 65% figure cited by BlackRock in early January, the market is constantly evolving. An analysis at the end of January shows that this figure is a 'moving target'. According to data from RWA.xyz, as of 22 January, Ethereum's market share for Real-World Assets (RWA) stood at 59.84 per cent, with a total value of around $12.8 billion. Other surveys indicate a total value (excluding stablecoins) of $13.43 billion.

This slight downturn suggests that while Ethereum retains leadership, the expansion of issuance on other blockchains and different reporting timelines are creating share 'drift'. For ETH holders, the challenge is no longer just whether institutions will tokenize their assets, but whether such activity will generate fees directly on Ethereum's base layer.

The role of rollups and the complexity of commissions

The "toll road" model is complicated by the emergence of Layer 2 (L2). Data from L2BEAT show that huge pools of value are already secured by the major rollups: Arbitrum One leads with $17.52 billion, followed by Base ($12.94 billion) and OP Mainnet ($2.33 billion).

Although this architecture preserves Ethereum's role as a settlement layer, it shifts the payment of daily fees away from the mainnet. If execution shifts to rollups or other Layer 1s, the value captured directly from ETH could be diluted, turning the network into an underlying security guarantor rather than a direct commission collection centre.

Filtering the "noise": Organic volumes against bot activity

A crucial point in BlackRock's report concerns the quality of metrics. Citing the Visa Onchain Analytics dashboard, the need to "clean up" transaction volumes from inorganic activity, such as that generated by bots, is emphasised.

Visa has shown that stablecoin volume over the past 30 days plummets dramatically from $3.9 trillion to just $817.5 billion if artificial noise is removed. For investors, this means that the true profitability of the 'toll road' will depend on organic and irreplaceable settlement demand, not simple nominal transaction counts.

The Future of Tokenisation: Cash and Multi-chain Strategies

The potential for growth remains immense. A report by Citi estimates that stablecoin issuance could reach between $1.9 and $4 trillion by 2030. With a circulation velocity assumption of 50x, this would translate into between $100 and $200 trillion in transactional activity.

In this scenario, BlackRock's strategy with the BUIDL fund - available on seven different blockchains thanks to Wormhole's interoperability - demonstrates that institutions prefer to reduce the risk of concentration. Even if Ethereum remains the leader in credibility and value, the future seems to be pointing towards a multi-chain distribution, where the specific utility of each network matters as much as the security of the underlying layer.

A single registry or a fragmented ecosystem?

While the possibility of a 'single common ledger' was discussed during the Davos forum, driven by the visions of leaders such as Larry Fink, the 2026 World Economic Forum (WEF) documents remain more cautious. Tokenisation offers undeniable benefits in terms of fractioning and speed, but the battle for infrastructure dominance has only just begun. For Ethereum, remaining neutral and decentralised will be critical as it becomes increasingly tied to regulated issuers and institutional venues.