In a surprising and aggressive move, Grayscale has decided to suspend sponsor fees and reduce staking costs on its Grayscale Solana Trust (GSOL).

This measure is designed as a powerful incentive to attract new institutional capital flows, with the stated goal of making Solana attractive to institutions, just as Bitcoin and Ethereum were in their early stages of adoption.

The suspension of fees on the Solana Trust will last for three months or until the Trust reaches $1 billion in assets, whichever comes first.

100% Staking, 0% Commissions¹ with Grayscale Solana Trust ETF (ticker: $GSOL), said the official statement.

100% Staking, 0% Fee¹ with Grayscale Solana Trust ETF (ticker: $GSOL)

- Grayscale (@Grayscale) November 5, 2025

- 0% Fee¹ With Waiver

- 7.23% Staking Rewards Rate² powered by @galaxyhq @CoinbaseInsto @Figment_io

- 95% $SOL Staking Rewards³

Gain exposure to one of the world's biggest crypto ecosystems from the... pic.twitter.com/5l61xvpjyC

This decision is part of a broader strategy by Grayscale to adapt to the changing behaviour of institutional investors in the digital asset market.

While products on Bitcoin and Ethereum have seen outflows of nearly $800 million in recent weeks due to the rebalancing of large funds' portfolios, Solana has quietly recorded consecutive days of inflows. This suggests that institutional investors are beginning to explore alternative blockchain networks.

A Product Focused on the Investor

By removing fees and enhancing staking rewards, Grayscale aims to accelerate this nascent momentum around Solana. The Solana Trust now stacks 100 per cent of its holdings of SOL, generating an annual return of 7.23 per cent and returning 95 per cent of staking rewards directly to investors.

For now, GSOL stands out as one of the most cost-effective and investor-oriented products in the digital asset landscape.

Solana's attractiveness continues to grow due to its speed, low transaction costs and increasingly active ecosystem of decentralised applications, evolving from a niche blockchain to a key dynamic player in DeFi and NFT.

Grayscale has just suspended sponsor fees for $GSOL, with the aim of increasing investor participation and growing AUM (Assets Under Management) faster, as kyledoops on X stated.

Grayscale just paused sponsor fees for $GSOL - aiming to boost investor participation and grow AUM faster.

- Kyledoops (@kyledoops) November 5, 2025

The fee waiver runs for 3 months or until AUM hits $1B.

Quick look:

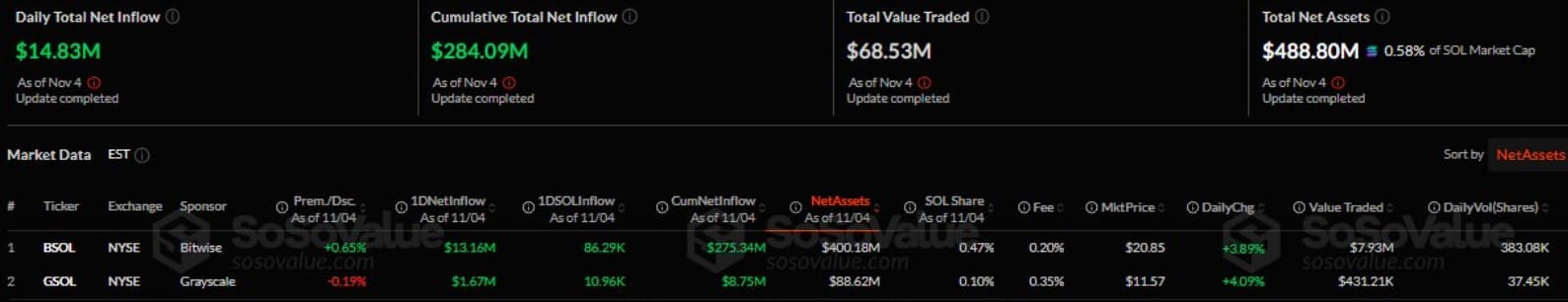

- Net assets: $88.6M (as of Nov 4)

- Market share: 0.10% of SOL

- Staking: 100% SOL staked, earning... pic.twitter.com/fFjVeq4YDv

Recent technical upgrades and improved network reliability have also restored confidence, after previous outages raised questions about its scalability.

Grayscale's initiative is clearly intended to capitalise on this momentum by offering a regulated and accessible investment vehicle that allows traditional investors to participate in Solana's growth without directly managing crypto assets.

Success is not guaranteed, as institutional investors continue to prioritise liquidity, regulatory clarity and long-term stability, areas where Solana is still maturing compared to Bitcoin and Ethereum. However, the Trust's new structure could set a benchmark for how digital asset managers compete for institutional capital in the next phase of the market.

If inflows accelerate, this could mark a pivotal moment, establishing Solana as the third pillar of institutional exposure to cryptocurrencies, after Bitcoin and Ethereum.

The message from Grayscale is unequivocal: it is not simply backing Solana; it is betting it all, a confident bet that could redefine the next chapter of institutional investment in cryptocurrencies.