BS Bank, Southeast Asia's largest bank, has partnered with Franklin Templeton and Ripple to launch trading and lending products backed by tokenized money funds (MMFs) and Ripple's RLUSD stablecoin.

The collaboration was announced on Thursday by Ripple, at a time when its stablecoin reached a record market capitalisation in September, increasingly drawing investors' attention to RLUSD-based financial products.

The year 2025 has seen a number of absolute firsts for the industry, with traditional financial institutions moving onchain - and the collaboration between Ripple, DBS and Franklin Templeton to enable repo transactions on a tokenized money fund with a regulated, stable and liquid mode of exchange like RLUSD is truly revolutionary," he stated Nigel Khakoo, VP and Global Head of Trading and Markets at Ripple.

Thanks to this agreement, institutional investors will be able to purchase sgBENJI tokens-representing a Franklin Templeton-backed money market fund-on the DBS Digital Exchange platform using RLUSD. In addition, the money fund will also be tokenized on the XRP Ledger, Ripple's public, enterprise-grade blockchain.

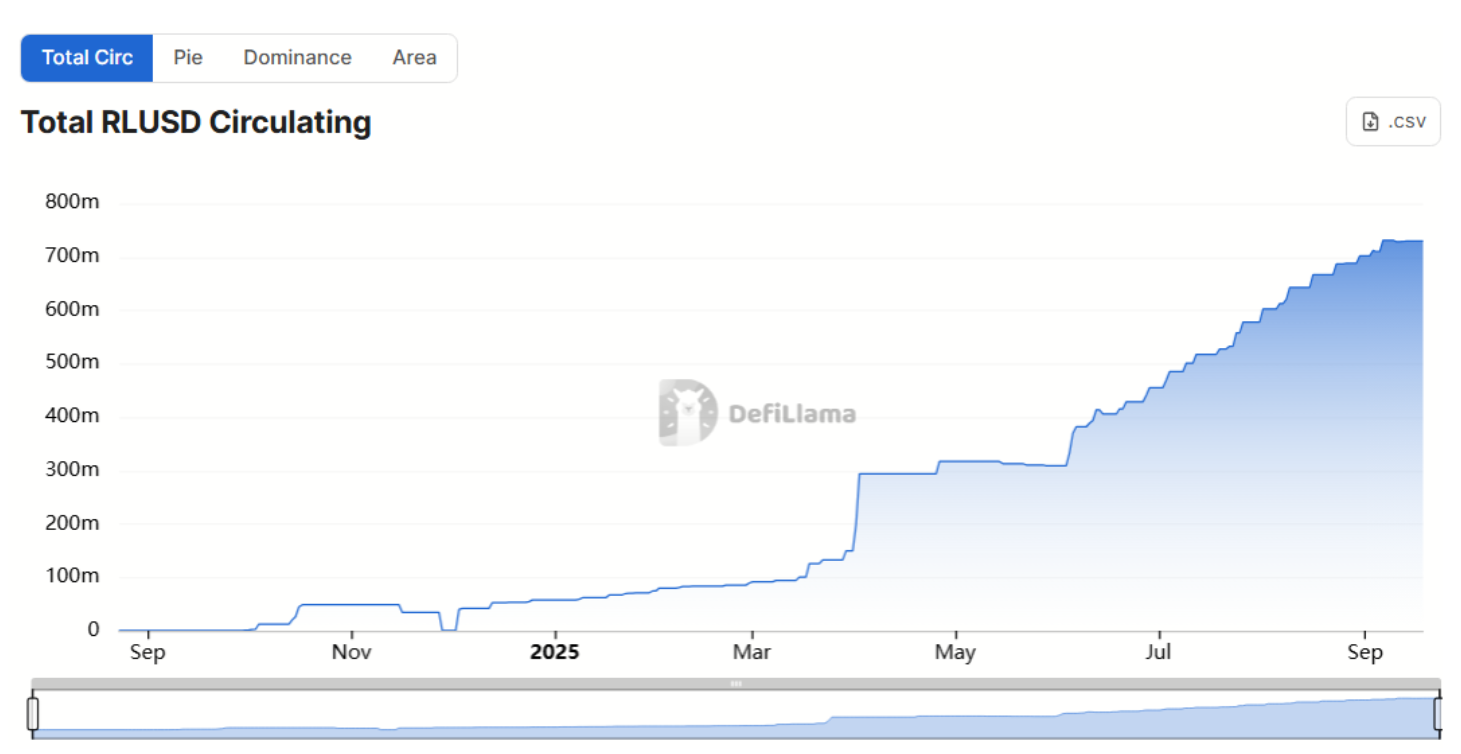

RLUSD's capitalization in strong growth

According to DeFiLlama's data, RLUSD's market capitalization reached $729 million at the end of September, more than ten times higher than in January 2025. This result confirms significant growth during the year. Analysts estimate that capitalisation may soon cross the $1 billion mark, driven by Ripple's global partnerships in Africa and Asia.

In spite of this, market share remains small compared to the industry leaders. Tether (USDT) dominates with $170 billion, while Circle's USDC stands at $73 billion. With 36,245 holders, RLUSD holds only 0.26% of the market, compared to Tether's 78%.

Expansion into Africa and Asia

In September 2025, Ripple expanded RLUSD's availability in sub-Saharan Africa, announcing partnerships with local fintechs such as Chipper Cash, VALR and Yellow Card. According to Chainalysis, Sub-Saharan Africa is now one of the fastest growing regions in the crypto sector, with a 345% increase in the first half of the year alone, driven largely by retail trading.

At the same time, Ripple is also looking to Asia. Last month, the company signed a memorandum of understanding with SBI Holdings to distribute RLUSD in Japan via the SBI VC Trade platform.

With a growing network of partnerships and ongoing fund tokenization, Ripple aims to further increase RLUSD adoption and consolidate its position among the leading global stablecoins.