A political before technological signal

In the cryptocurrency scene, the launch of a new stablecoin is rarely just technical news. However, when a major issuer decides to introduce a fully regulated version in the United States, the significance goes far beyond the mere debut of a new product.

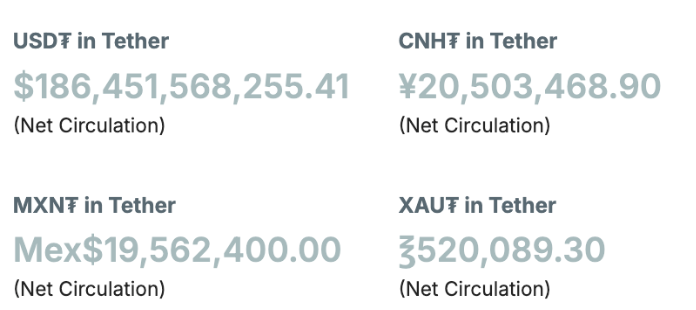

In recent years, Washington has increasingly watched the expansion of stablecoins, now considered a critical infrastructure for digital markets. Cross-border payments, trading, decentralised finance: everything revolves around these instruments that promise stability in a notoriously volatile world.

The plan for a US-compliant stablecoin comes at a delicate time, marked by political pressure, debates over monetary sovereignty, and attempts to bring the heart of digital finance back within the US regulatory perimeter.

Why a regulated stablecoin changes the picture

From grey zone to full compliance

For years, much of stablecoin has operated in an intermediate zone: legitimate, but often issued outside the United States and with varying levels of transparency. The introduction of a stablecoin directly subject to US supervision marks a paradigm shift. It is not just about complying with the rules, but rethinking the relationship between stablecoin and the traditional financial system.

The main objectives of this type of project include:

- ensuring verified and fully segregated reserves;

- offering a product compatible with banks and institutions;

- reducing the risk of sudden regulatory intervention.

This approach aims to transform stablecoin from a 'crypto-native' instrument into an integrated component of the US financial infrastructure.

A message to the regulators and the market

Launching a regulated stablecoin in the US also sends a political message: the blockchain technology should not be fought, but channelled into controllable structures. In a context where digital dollars and instant payments are being discussed, regulated private stablecoins could become an experimental laboratory for the future of currency.

The CEO's voice: "Stablecoins are now infrastructures, no longer experiments"

According to the CEO of the company behind the launch, the launch of the new stablecoin represents a turning point for the entire industry.

"Stablecoins are no longer a fringe phenomenon," he said in a recent presentation. "Today they are critical infrastructure for digital markets. Bringing them inside a regulated framework means making them safer, more reliable and more useful for the real economy."

Tether Announces the Launch of USA₮, the Federally Regulated, Dollar-Backed Stablecoin, Made in America 🇺🇲🚀

- Tether (@tether) January 27, 2026

Read more: https://t.co/rIMQTQ7ipX

The risks not to be underestimated

Although the outlook appears positive overall, the project has a number of criticalities that cannot be ignored. Entering a fully regulated perimeter inevitably entails higher costs, more complex procedures and a reduction of the operational flexibility that has characterised many initiatives in the crypto world so far. This could affect the competitiveness of the product, especially in a market already populated by established and widely used stablecoins.

The question of user acceptance also remains open. A significant part of the crypto community might look with suspicion on tightly controlled tools, fearing a loss of autonomy and privacy. At the same time, it is not yet clear how supervisory authorities will react in the event of market turbulence or liquidity crises, a test case that could prove decisive for the credibility of the project.

A scenario looking beyond the crypto world

The deeper meaning of this initiative may only emerge in the medium term. A regulated stablecoin is not simply a tool to facilitate trading on exchanges, but could be a key building block in the evolution of payment systems of the future. If properly integrated, it could find application in instant interbank settlements, retail payments and experimental projects related to digital identity and smart contracts public.

In this sense, the project should be interpreted not as an isolated product, but as part of a broader transformation of the financial infrastructure. If successful, it could pave the way for a new generation of private digital currencies, fully integrated into Western circuits and able to dialogue directly with banks, institutions and businesses.

Potential impacts on market and competition

A new hierarchy between stablecoins

The arrival of a stablecoin fully compliant with US rules could change the existing balance. In a market dominated by a few big names, the difference will not only be technological, but legal and institutional.

Many operators may prefer an instrument that offers:

- greater legal protection;

- easier access to the banking system;

- lower risk of regulatory blockages.

This could trigger a gradual migration of capital towards products perceived as more 'safe' from a regulatory perspective.

Between control and innovation a new phase for stablecoins

The launch of a regulated stablecoin in the US marks the industry's entry into a more mature phase. The era of improvisation gives way to progressive institutionalisation, in which the emphasis shifts from revolutionary rhetoric to the patient construction of reliable infrastructure.