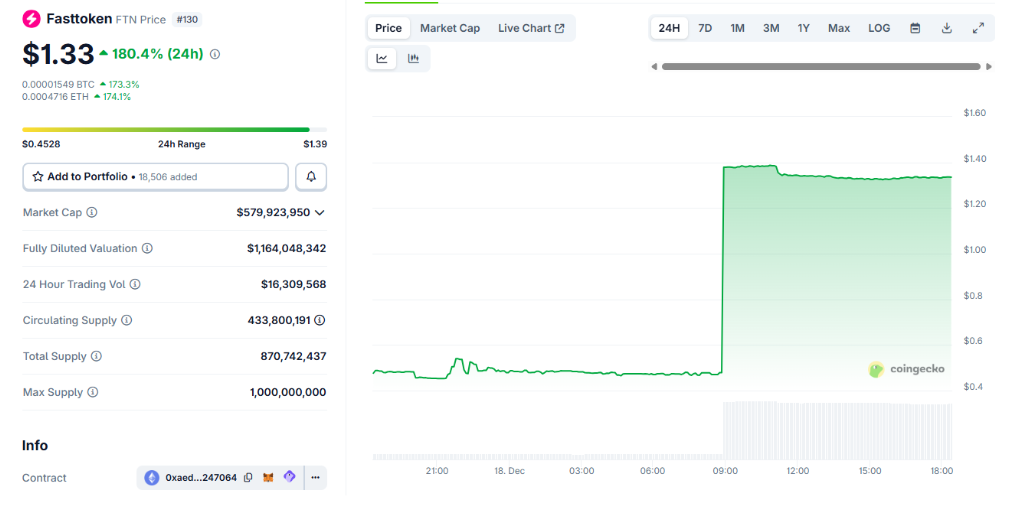

In a day characterised by persistent weakness in the altcoin sector, Fasttoken (FTN) emerged as the star performer on 18 December. The token native to the Fastex ecosystem experienced a meteoric rally, jumping from around $0.37 to over $1.30 in less than 24 hours, marking growth close to 200%.

What is Fasttoken (FTN)?

Developed by SoftConstruct, FTN is the token utility that powers the Fastex ecosystem and the Bahamut blockchain, an EVM-compatible Layer-1 network. Bahamut is distinguished by its Proof-of-Stake and Activity (PoSA) consensus model, which rewards validators not only for staking, but also for the activity generated by smart contracts. FTN is used for network fees, staking, payments via Fastex Pay and within Web3 applications related to gaming and NFT.

A volatile 2025

The current rebound comes after an extremely complex year. At the beginning of 2025, FTN traded above $2.00, only to suffer a drastic sell-off that lasted for months. Among the main causes of the collapse, which led to the token losing over 90% of its value and hitting lows between $0.25 and $0.37, were:

- Massive token unlocks that increased the circulating supply.

- A risk-averse sentiment that hit altcoins hard.

- The inclusion of FTN in the 'Special Treatment' (ST) category by the MEXC exchange for risk monitoring.

Fasttoken $FTN has risen 216% in the past 24 hours, said reported Web3 AjaX on X.

Fasttoken $FTN is up 216% in the last 24 Hours 😲

- Web3 AjaX 🦅🔥 (@Web3AjaX) December 18, 2025

For those unaware

-> $FTN is the native crypto of Bahamut, a public EVM-compatible L1 Blockchain

-> The project is developed by SoftConstruct and is part of the Fastex Ecosystem

-> This token painted an upward only chart from... pic.twitter.com/g1QsH0FP0f

The reasons for the rally

In the absence of official announcements or last-minute partnerships, analysts attribute the surge to technical and psychological factors. Extreme oversold conditions made the price attractive to speculators looking for a technical rebound.

Fears of an imminent delisting by MEXC faded in mid-December, bringing relief among traders. Low liquidity on many exchanges has also acted as a multiplier: in such thin markets, even moderate buying volumes can trigger disproportionate price movements.

Outlook and caution

Despite the enthusiasm, caution remains in order. Fasttoken's official X account has been inactive since late September, and the project still faces future token unlocks that could generate new sales pressure. The sustainability of this recovery will depend on the actual adoption of the Bahamut infrastructure and Fastex's ability to maintain operational momentum over the long term.