The official Trump meme coin (TRUMP), based on Solana, is back in the spotlight, soaring more than 42% in the last week alone.

Although it had faced significant volatility, losing more than 70 per cent of its value since its launch earlier this year, and hitting all-time lows following the crypto's 'Black Friday', recent macroeconomic changes triggered a rally that not only recouped losses, but pushed the price up.

On Wednesday, TRUMP touched $8.6, marking a near six-week high. At press time, the coin was trading at $8.2, up 5.28 per cent in the past 24 hours. On-chain data and broader developments suggest that the bullish momentum could persist next month, based on four key factors.

Signals of accumulation and growing demand

The data from Nansen show a steady accumulation of TRUMP tokens by large holders over the past 30 days. At the same time, balances on centralised exchanges fell by 1.4 per cent.

This pattern indicates strong holder confidence and less intention to sell, suggesting investors see current conditions as an accumulation phase.

In support of this, Lookonchain reported that new wallets are also buying TRUMP tokens betting on further price increases. Nevertheless, concentration remains high, with the top 10 holders owning about 92.5 per cent of the supply, a whale-like level of control that can trigger sharp price swings.

Some have created new wallets to buy $TRUMP spot on #Solana and at the same time went long on $TRUMP on #Hyperliquid - already boasting over $1.5 million in profit, he declared the company.

Has $TRUMP started moving? 👀

- Lookonchain (@lookonchain) October 30, 2025

Someone created new wallets to buy $$TRUMP spots on #Solana while also going long on $TRUMP on #Hyperliquid - already sitting on over $1.5M in profit!

- On Solana, he spent 5,346 $SOL($1.07M) to buy 165,401 $TRUMP ($1.4M) at $6.45, with $335K in... pic.twitter.com/RLXEs1g0Mt

Trading Activity and Institutional Perspectives

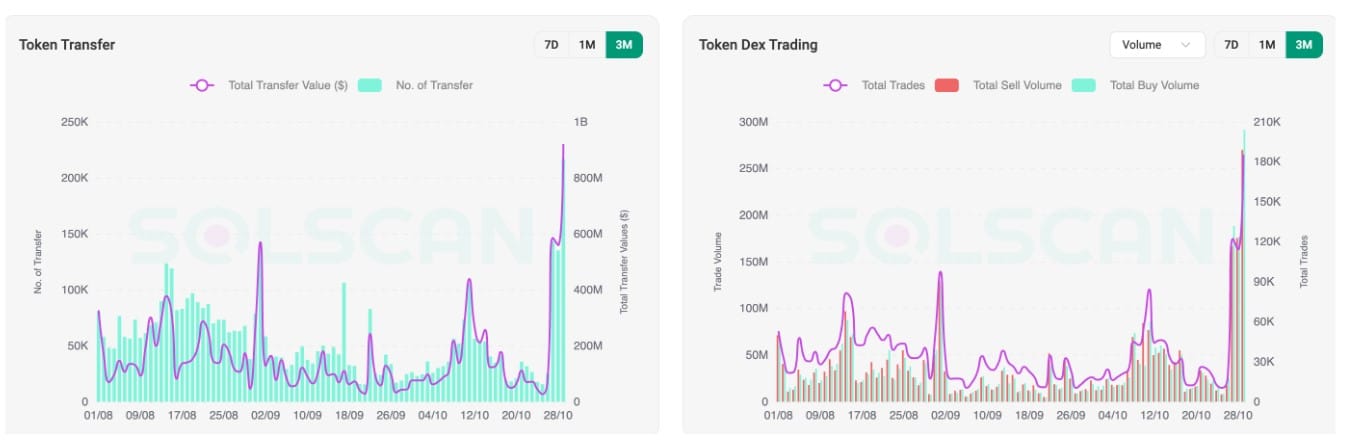

Trading activity has grown, with transfer and trading volumes on DEX (decentralised exchanges) reaching their highest levels in three months, according to data from Solscan.

In particular, buying volume remained predominantly higher than selling volume, signalling an increase in demand and market participation.

An additional impetus comes from growing institutional interest. In August, Canary Capital filed an S-1 registration statement with the SEC to launch the Canary Trump Coin ETF.

Although formal approval is still pending, the listing of the ETF on the DTCC platform in early October conferred legitimacy, boosting market confidence.

This move could encourage holders to maintain or expand their positions in anticipation of regulatory advances, especially at a time when the SEC is showing a more pro-crypto stance.

Technical Reversal Signal

From a technical perspective, market analysts note that the meme coin recently broke through a falling wedge pattern (descending wedge).

This formation is classically bullish and suggests a potential trend reversal and the beginning of a momentum upward.

$TRUMP: The breakout of the descending wedge is confirmed," Faibik said on X.

The combination of accumulation by the 'whales', the ETF's potential, and the bullish technical formation place the token TRUMP in a favourable position for a remarkable November.

The sustainability of the rally will, however, depend on the general economic climate, regulatory decisions and overall market sentiment.