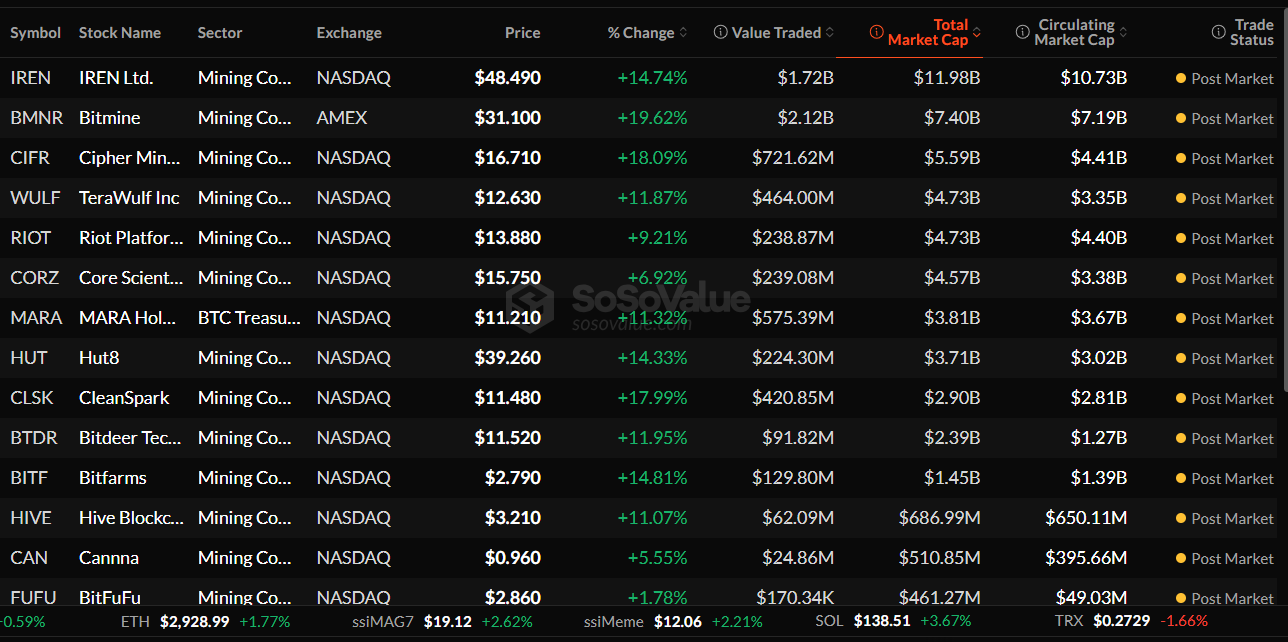

The cryptocurrency mining sector was swept by a wave of optimism, recording a generalised rally with a sector gain of 13.84% (data SoSoValue). Shares in BitMine jumped nearly 20 per cent, while Cipher Mining rose more than 18 per cent.

This significant increase follows Amazon's announcement of an investment of up to $50 billion earmarked for artificial intelligence infrastructure for US government agencies. The plan calls for the addition of 1.3 gigawatts of capacity in various data centres, with construction scheduled for 2026.

Miner Energy Infrastructure Becomes Strategic

Amazon's move and the urgent need for AI computing capacity have highlighted a paradigm shift. Faced with declining profitability after Bitcoin's April 2024 halving, miners are looking for new sources of revenue. Their grid-integrated, high-capacity plants are now seen as strategic partners by tech giants facing energy shortages.

IREN, formerly Iris Energy, is a prime example of this transformation, having signed a $9.7bn deal with Microsoft for a data centre, providing early access to GPUs Nvidia.

Since then, IREN stock has risen 580% this year. Other miners have also performed exceptionally well: Riot Platforms has gained 100 per cent, TeraWulf 160 per cent and Cipher Mining 360 per cent.

The combined energy capacity of 14 gigawatts held by US miners has become crucial for technology companies seeking rapid expansion.

The Surge in AI Infrastructure Investment

Amazon's expansion does not stop there: the company also announced a $15 billion investment in Northern Indiana for new data centre campuses, with a capacity of 2.4 gigawatts.

Globally, big tech companies are accelerating investments, with Amazon, Microsoft, Google, Oracle and Meta possibly spending $400 billion this year on AI and data centres.

To finance this growth, companies are resorting to debt. Meta launched its largest-ever bond issue, totalling $30bn, while Amazon issued a $15bn US bond, its first in three years, which attracted demand of $80bn.

The merger of cryptocurrency mining infrastructure and AI computing demand marks a strategic shift for both sectors, enabling the tech giants to expand rapidly.