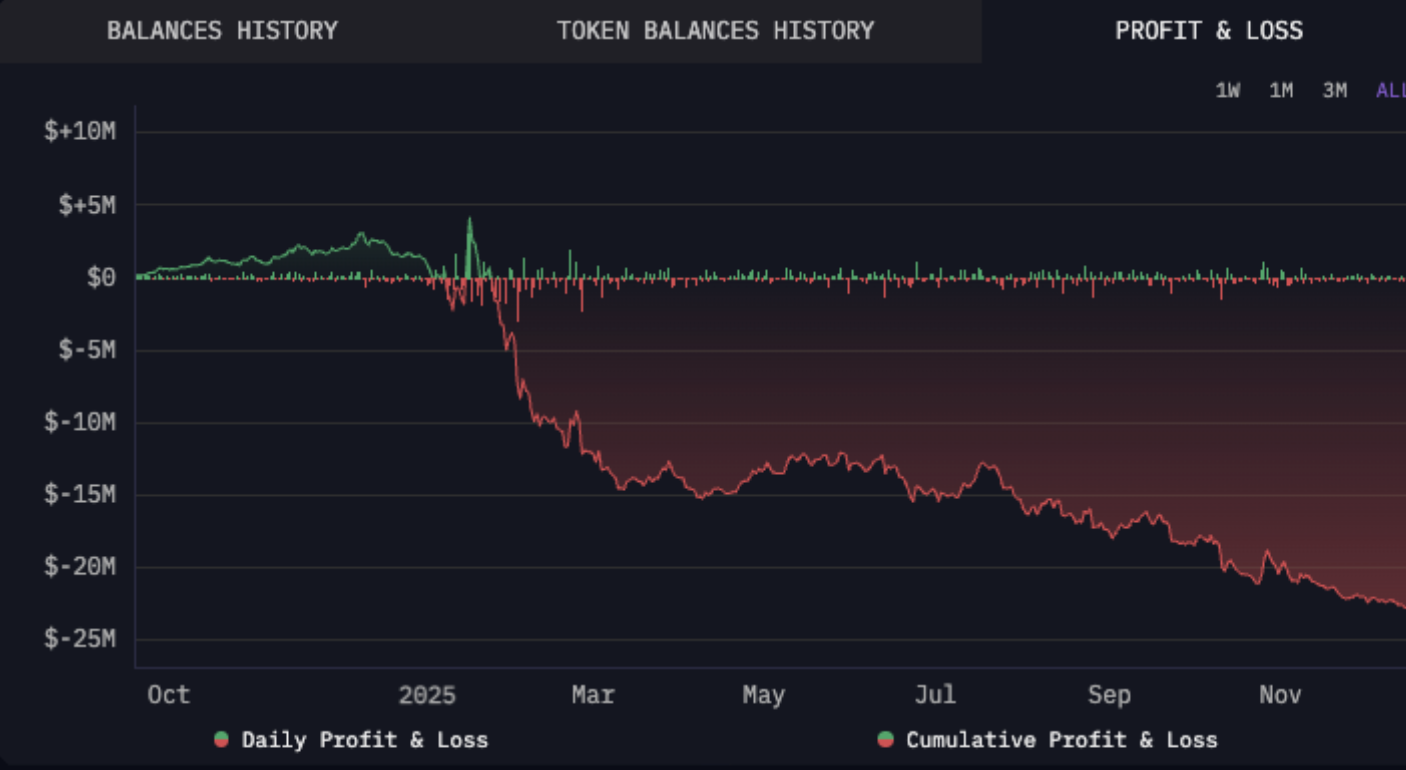

The cryptocurrency sector is used to volatility, but what happened on Base, Coinbase's blockchain, marks a new low. One high-profile investor, commonly referred to as a 'whale', suffered a devastating loss of $20.4 million after investing heavily in tokens linked to artificial intelligence agents.

What was supposed to be the investment of the future turned into an 88.77% drawdown, bringing the initial capital of $23 million down to just $2.58 million at the time of liquidation.

A portfolio up in smoke: the numbers behind the disaster

According to data provided by the on-chain analysis platform Lookonchain, the investor's strategy proved fatal due to the extreme concentration of risk. The hardest blow came from FAI, where a $9.87 million bet evaporated for 92.31%. It didn't fare any better with AIXBT, which posted a $7.81 million red (-83.74%).

The rest of the portfolio followed the same tragic fate:

- BOTTO: -936.000 dollars (-83.62%)

- POLY: -839,000 dollars (-98.63%)

- NFTXBT: the most drastic drop in percentage terms, at -99.13%

- MAICRO: -381.000 dollars (-89.55%)

Today, the investor's wallet looks like a deserted battlefield, containing some $3,584 in residual assets, mainly ETH and small amounts of smaller tokens.

This might be one of the worst investments ever.

— Lookonchain (@lookonchain) December 16, 2025

A whale/institution spent $23M buying AI agent tokens on #Base and sold everything today for only $2.58M, resulting in a $20.43M(−88.77%) loss.

Breakdown:$FAI: −$9.87M(−92.31%)$AIXBT: −$7.81M(−83.74%)$BOTTO:… pic.twitter.com/DbEqIyD6xT

The bursting of the AI Agent bubble

This event has reignited the debate on the sustainability of AI-related tokens. Although the idea of autonomous agents operating on blockchain is fascinating, the market reality in Q1 2025 showed a chronic lack of practical utility. Many of these projects have turned out to be empty boxes, fuelled solely by the media hype of late 2024.

With the start of 2025, the enthusiasm wore off, leading the sector to an overall 77% collapse. The poor liquidity of these tokens then accelerated the fall: when the big hands started to sell, there were not enough buyers to sustain prices, causing vertical slides.

A lesson in risk management

The case of the whale on Base is a warning to the entire ecosystem. The fatal mistake was not just betting on a speculative narrative, but allocating $23 million on six highly correlated assets.

In the absence of true diversification and an exit strategy, systemic risk overwhelmed the entire portfolio, proving that, in the crypto world, even the largest capital can be wiped out if not backed by prudence and sound fundamentals.