While political and economic instability grips Iran in an unprecedented grip, the Bitcoin (BTC) has ceased to be a mere speculative asset and has turned into a true 'resilient element'. According to the latest report by Chainalysis, the cryptocurrency ecosystem in the country has seen a meteoric rise, surpassing a total value of $7.78 billion by 2025.

In an environment marked by a national currency pulverised by inflation and mass protests that show no signs of abating, Iranian citizens have identified digital currencies as the only viable alternative for financial survival and personal autonomy.

The flight from the Rial: The numbers of mass adoption

Since the end of December 2025, Iran has been through a wave of demonstrations triggered by the carvita and the extreme devaluation of the Rial against the dollar. The response of the authorities has been harsh: the HRANA agency estimates more than 2,500 casualties and the government has repeatedly resorted to total blocking of Internet access to stifle dissent.

However, precisely in this climate of uncertainty, on-chain activity has surged. Chainalysis noted a significant increase in the average daily volume of transactions and, above all, a massive shift towards personal wallets. The data show growth across all withdrawal ranges:

- Large withdrawals (under $10,000): Growth of 236% in dollar value and 262% in number of transfers.

- Average withdrawals (under $1,000): 228% increase in value and 123% in transactions.

- Institutional withdrawals (under $100,000): Up 32% in volume and 55% in number of transactions.

- Small withdrawals (under $100,000): Up 111% in value and 78% in the number of transfers.

Bitcoin as a tool of freedom and mobility

Why Bitcoin? Unlike traditional assets, which are often illiquid or easily seized by the state, Bitcoin's decentralised nature offers an inherent resistance to censorship. The ability to manage one's funds through self-custody provides individuals with critical financial mobility, critical for those who fear asset seizure or consider leaving the country.

Chainalysis emphasises that, in this crisis, Bitcoin not only serves to protect purchasing power, but also acts as a shield against government surveillance. The marked movement of capital from local exchanges to unattributable private wallets highlights the desire of citizens to escape the monitoring of the state apparatus.

The "double nature" of Iran's crypto market

The report however highlights a complex and contradictory reality. While for citizens, Bitcoin is a weapon of defence, for the regime it represents a means of circumventing international sanctions.

The Islamic Revolution Guards Corps (IRGC) has become a dominant force in the industry. In the fourth quarter of 2025, IRGC-related on-chain assets accounted for about half of the total value received in Iran. It is estimated that wallets attributable to this group received over $3 billion in 2025, a sharp increase from $2 billion the previous year.

This 'dual nature' sees state actors on the one hand using the crypto to support regional financial networks and bypass economic blockades, and on the other hand the civilian population using them to protect themselves from the economic mismanagement of those same actors.

An ecosystem fueled by crises

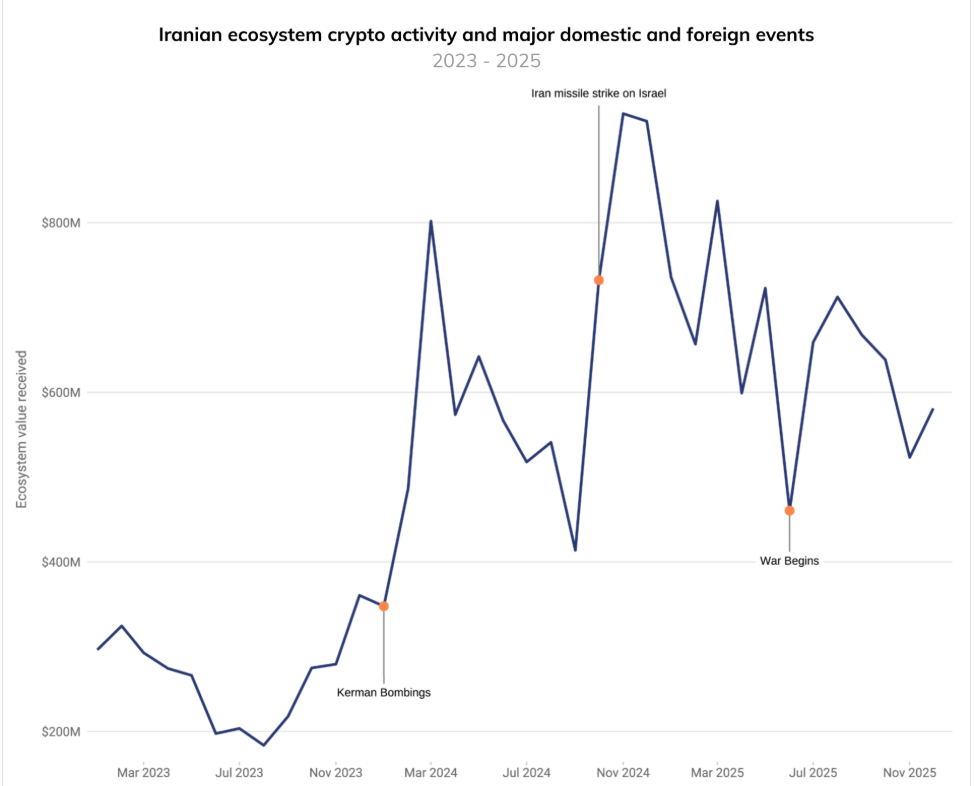

Historical analysis by Chainalysis confirms that crypto activity in Iran is not constant, but explodes at geopolitical shocks. Significant peaks were recorded during the Kerman bombings in January 2024, the missile attacks against Israel in October of the same year, and most recently during the '12-day war' in June 2025. The latter conflict has seen targeted cyber attacks against the country's main national bank and Nobitex, the country's largest cryptocurrency exchange.

Despite technological threats and government blockades, the trajectory seems to be set: as long as the traditional financial system remains vulnerable and under the control of a repressive authority, cryptocurrencies will remain the mainstay of financial autonomy for millions of Iranians.