A detailed analysis of six years' worth of data (2019-2024) reveals that five major large- and mid-cap cryptocurrencies often posted significant gains during the month of December.

However, their performance, often referred to as the 'Santa Rally' or 'Christmas Rally', is not a guaranteed annual phenomenon, but rather a concentrated success in specific years of strong market upside or recovery. The analysis focused on the USD returns of Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Litecoin (LTC) and Monero (XMR).

Bitcoin: Big Movements Arrive in Bullish Cycles

Bitcoin has shown that its December peaks are clearly linked to phases of strong momentum. Its strongest December was in 2020, up about 48% (from about $19,700 to $29,000). It replicated a solid performance in 2023, adding about 12% on the wave of optimism about the ETF.

In contrast, BTC closed negatively in the tense or end-of-cycle years, down 5% in 2019, 19% in 2021, 4% in 2022 and just over 3% in 2024. The model shows that the most significant moves occur after the holidays, with the post-Christmas week outperforming the previous week in both 2020 and 2023.

Bitcoin is on track for its biggest daily gain since May 2025, approaching $91,000, as liquidations of leveraged shorts increase. In the past 60 minutes alone, about $140 million of short positions have been liquidated compared to only about $3 million of long positions. The recent surges in the crypto world are TOTALLY mechanical, said stated Kobeissi Letter on X

Ethereum and BNB: High Beta in Positive Periods

Ethereum has followed a similar profile to Bitcoin, with prominent gains in 2020 (around 21%) and 2023 (around 11%), coinciding with improving macro sentiment. In bear or end-of-cycle phases, losses were more pronounced: -15% in 2019, -20% in 2021 and a decline of 8% in both 2022 and 2024. ETH tends to rise in December when risk appetite is high.

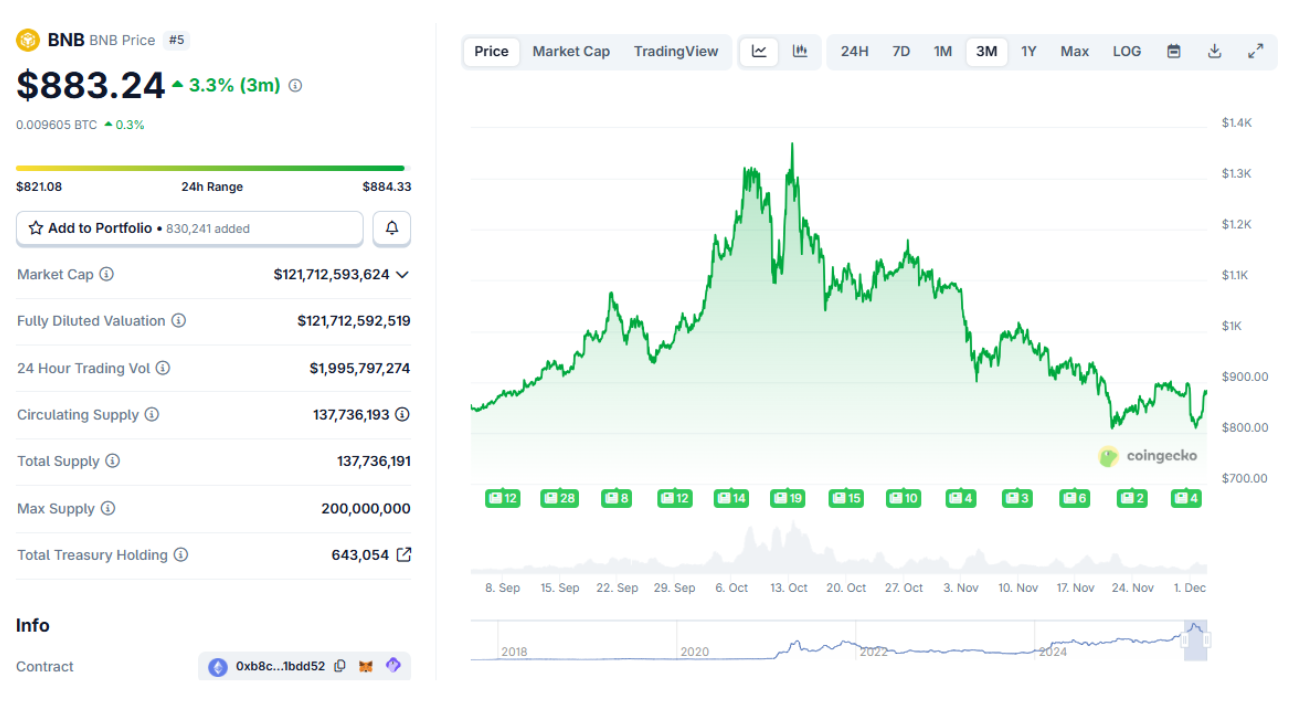

BBNB has shown some of the most dramatic rises, ranking as a high beta asset. It gained about 19% in 2020, but its biggest jump was in 2023, up 37% (from about $228 to $312).

A 'whale' transferred $120,000,000 into $ETH after 10 years of inactivity. He had bought them for only $12,400 and is now recording a return of 9,633 times. "Life-changing wealth with Ethereum," commented a user on X.

A whale transferred $120,000,000 in $ETH after 10 years of dormancy.

- Ted (@TedPillows) November 30, 2025

He bought them for just $12,400 and is now sitting on a 9,633x return.

Life-changing wealth with Ethereum. pic.twitter.com/sOaBGLgMyz

However, its losses have been deeper in times of stress, with declines of around 13% in 2019, 18% in 2021 and another 18% in 2022, often linked to FUD (Fear, Uncertainty, Doubt) on exchange-related issues.

Litecoin and Monero: Divergent Strategies

Litecoin behaved like a "leveraged" bet on the December mood, recording its strongest month in 2020 with a surge of about 42%. It struggled in subsequent years, losing almost 30% in 2021, but recorded modest gains in 2023 (5%) and 2024 (estimated 7%), still benefiting from risk-on phases.

Monero, by contrast, is characterised by a defensive, but often positive, pattern. It gained 15% in 2020 and a remarkable 9% in 2022, while many other currencies collapsed. With a further 10% gain in 2023, Monero avoided the extreme crash of December, positioning itself as one of the most resilient assets at year-end.

Conclusion: The Macroeconomy is the Decisive Factor

The data confirms that although historical December strength exists, it only manifests itself in bullish or recovering macroeconomic environments. December bear markets reward more defensive assets such as Monero. The message for traders is unequivocal: historical strength is no guarantee; it is each year's macroeconomic environment that decides whether Christmas will be 'green' for the portfolio.