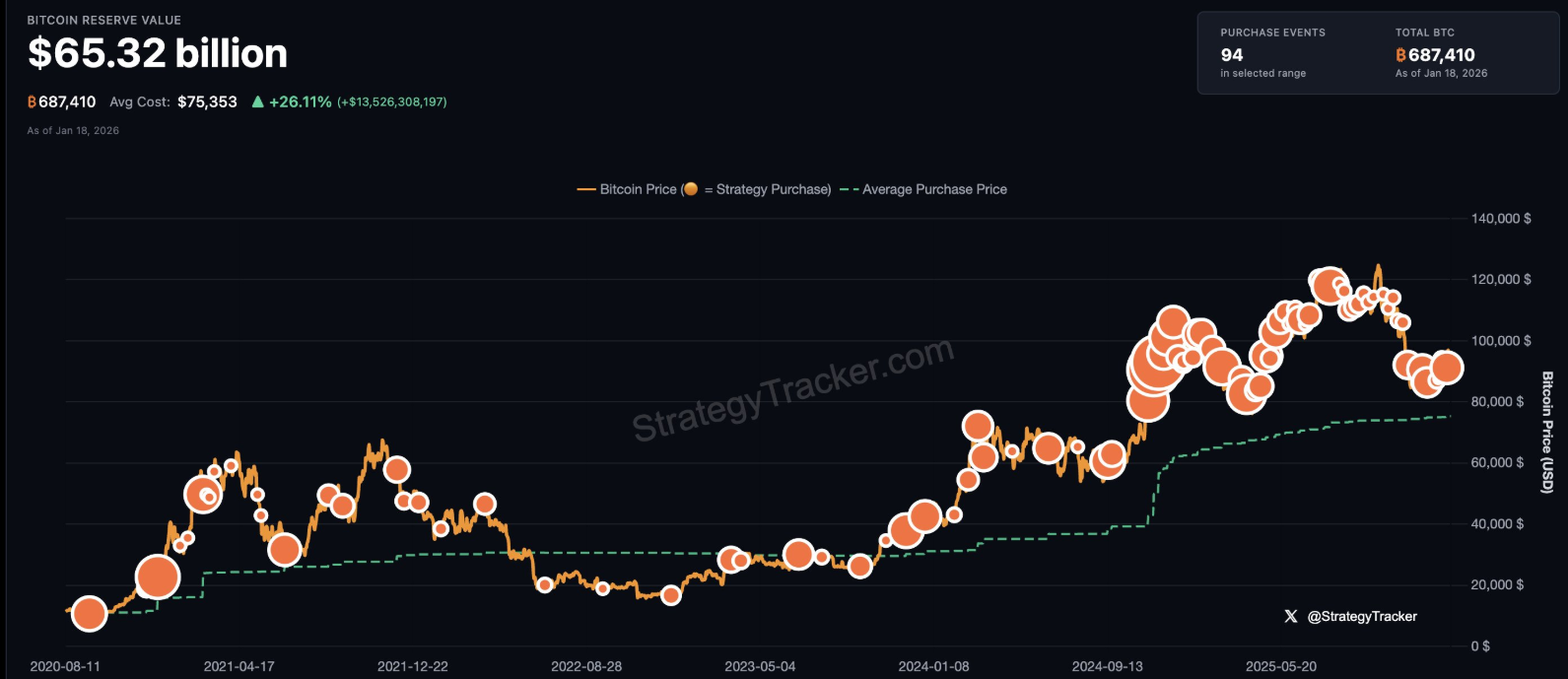

There seems to be no rest in the accumulation strategy of Strategy Inc. (formerly known as MicroStrategy). Just seven days after a massive $1.25 billion purchase, the Michael Saylor-led company has signalled its intention to launch a new market offensive.

The signal came directly from social media: a post by Saylor on the X platform, accompanied by the caption 'Bigger Orange', immediately shook the financial environment.

Market analysts agree: the expression is a clear reference to the intention to surpass the latest tranche of 13,627 Bitcoins acquired last week. If these intentions are confirmed, Strategy Inc. would be poised to cross the psychological and structural threshold of 700,000 Bitcoins held in treasury.

Chasing the myth of Satoshi Nakamoto

Reaching the 700,000 BTC mark would propel the company into an elite dimension in the global digital asset landscape. With such a reserve, Strategy Inc. would consolidate its supremacy as the world's largest corporate holder, positioning itself in a ranking dominated only by BlackRock's IBIT fund and the legendary 1.2 million BTC attributed to the network's creator, Satoshi Nakamoto.

However, this aggressive move comes at an extremely delicate time for the enterprise software company. Despite Saylor's long-term vision, the company's financial fundamentals are showing signs of strain that cannot be ignored by investors.

The collapse of the mNAV premium and the challenge of ETFs

Strategy Inc.'s business model, based on arbitrage to finance the purchase of Bitcoin, is facing its toughest test. Last year, the company's stock plummeted more than 50 per cent. Even more worrying is the compression of the market-to-net-asset-value (mNAV) premium, which has slipped to around 1.0x.

In the past, Strategy Inc. enjoyed a large premium over the value of Bitcoins held, allowing Saylor to raise cheap capital to purchase additional currency. Today, with the advent of the ETF Bitcoin spot, the market has changed: institutional investors can now gain direct exposure to Bitcoin without having to pay the premiums associated with Strategy Inc.'s shares or accept its operational complexity. This loss of leverage is forcing the company to resort to much more aggressive financing tactics.

Dilution and Skepticism on Wall Street

To sustain the pace of accumulation, the company has raised as much as $25 billion over the past year through the sale of common stock and the issuance of new types of preferred stock, including STRCs. This massive paper injection into the market has raised concerns among Wall Street analysts.

Recently, TD Cowen lowered the stock's target price from $500 to $440, while maintaining a 'Buy' rating. The main concern is the 'Bitcoin Yield' for the 2026 fiscal year, a proprietary metric that measures Bitcoin exposure per share. According to experts, the excessive equity issuance is diluting the return for shareholders, making each individual share less 'heavy' in terms of the underlying cryptocurrency.

A structural divide with traditional finance

Despite the scepticism, there is no shortage of supporters of the Saylor model. Some observers, such as analyst Makin, suggest that Strategy Inc. has built a 'structural moat' that traditional finance struggles to understand or replicate. According to this view, increasing regulatory pressure and market criticism would not be evidence of a failed model, but rather a reaction to its extreme effectiveness in revolutionising the concept of corporate treasury.

They have figured out how to accumulate Bitcoins on a large scale, package them into financial products, and offer exposure in ways that traditional banks simply cannot match, said affirmed Makin.

$MSTR has quietly built something banks weren't supposed to let happen.

- Shagun Makin (@shaguncrypto) January 18, 2026

They figured out how to accumulate Bitcoin at scale, package it into products and offer exposure in ways traditional banks simply can't match.

That's why the pushback feels inevitable.

Banks can't copy the... https://t.co/80ttWpEWwY

While the market awaits official confirmation of the next acquisition, one thing remains certain: Strategy Inc. has inextricably linked its destiny to the queen of cryptocurrencies, betting everything on a future in which the orange of Bitcoin will dominate global balance sheets.