Silent shutdown for a platform born in the heart of the on-chain ecosystem

Parsec, a real-time analytics platform focused on DeFi and NFT, has announced the closure of its operations, citing difficult market conditions and increasing volatility as the driving factors. The decision comes at a time when the entire crypto sector is going through a period of adjustment, with a general reduction in volumes and risk appetite.

The news highlights how not only projects related to trading or speculation, but also support and analysis infrastructures, are directly affected by market cycles.

A project designed for the most active on-chain traders

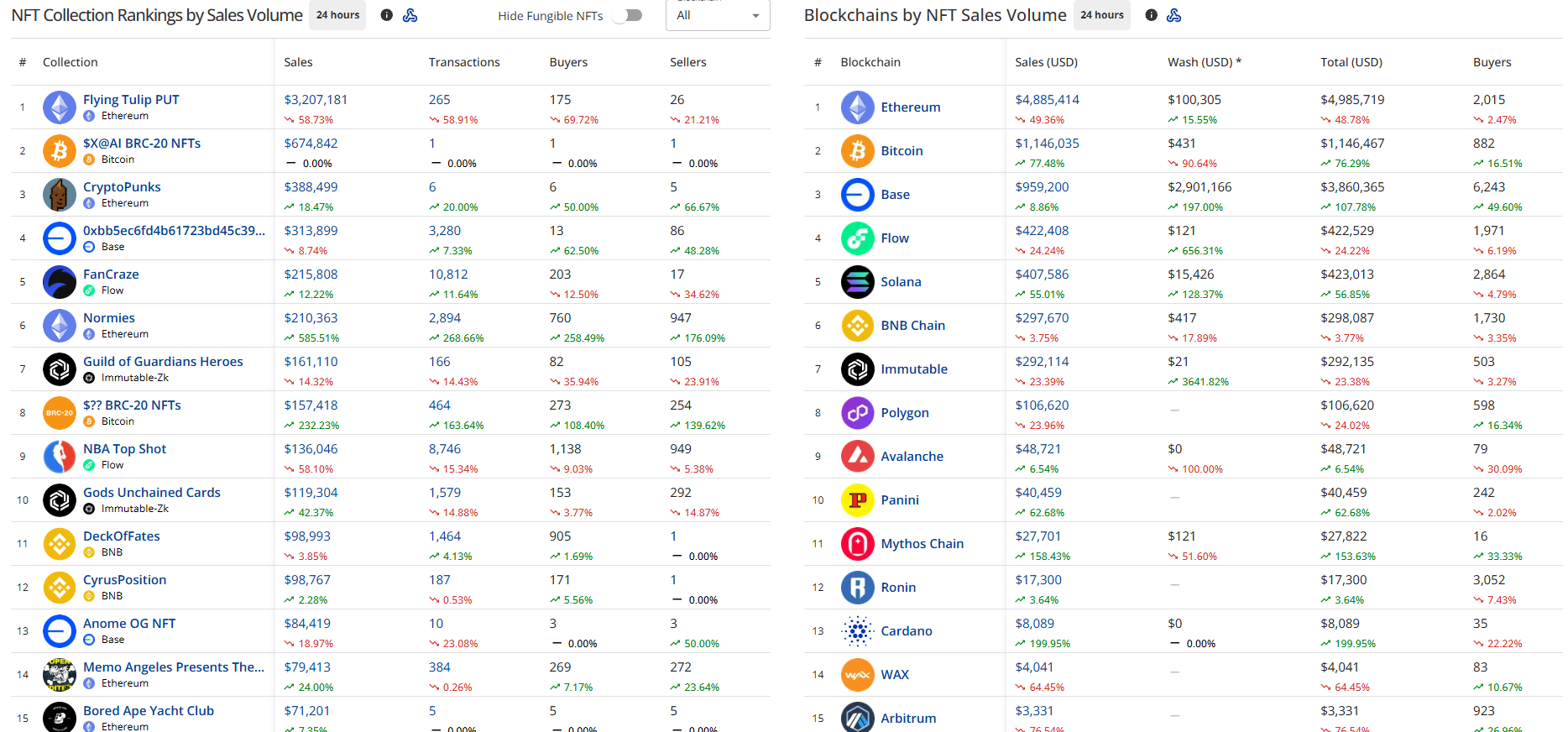

Parsec had positioned itself as an advanced tool to monitor real-time activity on blockchain, wallet movements, liquidity pools and NFT markets. The goal was to offer traders and analysts an immediate view of the dynamics on-chain, reducing the information lag typical of many traditional platforms. In an ecosystem where speed is often a competitive advantage, tools like Parsec have been a benchmark for sophisticated operators and professional users.

The announcement came directly from the company's official channels. In a message posted on X, Parsec confirmed the closure of operations, while CEO Will Sheehan acknowledged that the strategic choices did not follow the evolution of the market.

This process, however painful, contributes to a natural selection that over time strengthens the ecosystem. "Parsec is shutting down, the market has taken a different direction from ours, and we've been on the wrong trajectory too many times," said the CEO.

Volatility as a structural factor

According to the findings, the combination of unstable markets, reduced on-chain activity, and difficulty in sustaining a scalable business model has made it increasingly complex to keep the platform operational. Volatility has not only affected asset prices, but also the economic sustainability of services that depend on high volumes and active users.

This scenario highlights an often underestimated reality: in bear markets, infrastructure suffers as much, if not more, than the most visible projects.

The sustainability node for analytics platforms

On-chain analytics platforms operate in a delicate balance. They have to bear high technology costs, ensure continuous updates and, at the same time, compete in a market where many basic tools are free or open-source.

In times of market contraction, monetising becomes more difficult. Users reduce their subscriptions, traders' budgets shrink and the focus shifts from experimentation to capital preservation.

What's left after closing

For users and developers, Parsec's experience represents much more than just a platform exiting. The project has helped spread an increasingly sophisticated approach to blockchain data analysis, pushing the market towards tools that offer real-time insights, contextual readings of on-chain flows and greater analytical depth.

The demand for advanced tools does not disappear with the closure of a single entity, but rather tends to redistribute. Users migrate towards more robust solutions, integrated into larger ecosystems or supported by business models better adapted to market cycles. At the same time, many of the ideas and functionalities introduced by Parsec continue to influence the development of new products. In the medium term, on-chain analysis is set to evolve further, probably through hybrid models that combine open-source components with premium services, increased automation and integration with risk management tools.

In context, the most likely directions include:

- more integrated analytics platforms with wallets, DEX and DeFi protocols;

- greater focus on the economic sustainability of services;

- flexible access models between free and advanced subscriptions;

- tools geared not only to traders, but also to institutions and developers;

- a growing use of on-chain analytics for compliance, auditing and risk management.

Between market cycles and sector maturation

The end of Parsec is part of a transition phase for the crypto world: less euphoria, more focus on fundamentals. In this context, the survival of projects will increasingly depend on their ability to build real and resilient value, regardless of short-term fluctuations. More than an isolated failure, the platform's closure appears as a reminder: in digital markets, innovation must be accompanied by sustainability. Only then can it weather the inevitable storms of volatility.