Decentralised Finance (DeFi) is transforming the landscape of traditional financial services, offering innovative blockchain-based solutions that promote new forms of investment. Among the various emerging projects in this area, one of the best known is Osmosis. This article will explore this project in detail, analysing its features, how it works and ultimately its impact on the future of DeFi.

What is Osmosis?

Osmosis is a decentralised automated market maker (AMM) protocol built on the Cosmos blockchain. In essence, it is a state-of-the-art decentralised exchange (DEX) platform that promises to redefine the way users interact with digital assets. In short, it is in many ways similar to other protocols such as, for instance, Uniswap for Ethereum. It is important to remember that Osmosis uses a consensus mechanism proof-of-stake and that its native crypto is called Osmo. But let's take a look at the specifics of this project.

Main Features of Omosis

Interoperability

One of the distinguishing features of Osmosis is its ability to operate on different blockchains thanks to Cosmos' Inter-Blockchain Communication (IBC) technology. This allows users to trade assets from different blockchains, expanding trading and investment opportunities. Interoperability allows greater flexibility and connectivity between different blockchain ecosystems, promoting a broader DeFi environment. Users can transfer assets between different blockchains without the need for centralised intermediaries, thus reducing transaction costs. As we mentioned, Osmosis is built on the Cosmo blockchain, which makes interoperability between blockchains its main feature, so much so that it allows heterogeneous blockchains to communicate via the aforementioned IBC protocol. Another problem that Cosmo's blockchain tries to solve is that of scalability; in fact, on this platform the fees are low and transactions are fast; in fact, this network can support thousands of transactions per second.

Customisable Liquidity Pools

Osmosis allows users to create and manage their own liquidity pools, offering a high degree of customisation. Users can set specific pool parameters such as transaction fees and asset proportions, making the platform highly flexible and suitable for different trading strategies. Customisable liquidity pools allow users to optimise their investment strategies by tailoring pools to their specific needs.

Decentralised Governance

Osmosis is managed by a community of OSMO token holders, who have the power to propose and vote on changes to the protocol. This decentralised governance approach ensures that the platform evolves in line with the interests of the community in question, promoting transparency and participation. Decentralised governance allows for a more democratic management of the platform, where each token holder has a say in decisions. This approach should theoretically reduce the risk of manipulation by centralised entities and consequently foster a more 'democratic' development of the protocol.

Incentives for Liquidity Providers

To incentivise participation, Osmosis offers rewards to liquidity providers in the form of OSMO tokens. This not only helps maintain high levels of liquidity on the platform, but also provides a way for participants to passively earn money on their assets. Incentives for liquidity providers are crucial to the success of a DEX, as they ensure that there is always enough liquidity to facilitate trading. Ample liquidity leads to greater stability of the platform and consequently more users interested in using it.

Before seeing how osmosis works, let's try to understand how a liquidity-pool

Liquidity pools are nothing more than liquidity pools made up of pairs of tokens that the platform tries to maintain in a ratio constructed in the following way: 50% of token A, 50% of token B. When the price of a token changes, the platform tries to keep this ratio constant. There are two categories of users on the platform:

Traders: those who swap (swap) token A for token B and pay trading commissions on this service;

Liquidity providers (LPs): those who deposit liquidity by adding funds to a pool, in short buying both token A and token B. These receive rewards on transactions.

When using a pool, we can always see how much is the dollar amount in that pool. However, one must keep in mind that being LP also means exposing oneself to possible losses, such as the impermanent loss. In a nutshell, the impermanent loss is the loss that occurs when the value of one of the tokens deposited in the pool changes from when it was deposited, leading to a potential loss compared to simplyholding (maintaining) the same cryptocurrencies. The loss does not occur until the user withdraws the funds deposited from it, which could in part be rebalanced by the fees generated by the pool, or by a return of the token to its initial price. If this occurs, the impermanet loss does not occur.

How does Osmosis work?

First you have to go to the website - Osmosis.zone from there you just connect your wallet with the platform. There are several digital wallets that allow us to operate with the osmo token. The wallets in question can also be used on smartphones. The most widely used wallet is certainly kepler, which can also be installed as a Chrome extension. The following screen will then open up:

As you can see from the image, we have various functionalities at our disposal. The most important ones are:

SWAP: which allows us to exchange tokens, such as ATOM for OSMO;

POOLS: where we can see the pools of liquidity on which we can deposit our funds;

ASSETS: where we can see all the assets we hold on the osmosis blockchain. Clicking deposit allows us to transfer liquidity, while clicking withdrawal allows us to withdraw funds. One of the interesting features is that this application, being part of the cosmos ecosystem, allows you to communicate with other blockchains without the need for a bridge.

In the pool section we have access to all the liquidity pools, which are multiple. There is the option of depositing funds via the Add liquidity button, and then it is possible to do a bonding, i.e. blocking our funds for a period of time that can be: one day, one week, fourteen days. Obviously, the APR-"Annual Percentage Rate"-changes depending on how long we decide to keep our funds locked in, the longer the time, the higher the percentage reward. It should be remembered that bonding operations (bonds and unbonds) are zero fee, i.e. free of charge. When, on the other hand, I decide to transfer for example a certain amount of ATOM to the platform, I have to pay a fee. In this case, first you have to choose the amount of tokens I want to transfer to the platform and then sign the transaction with your wallet. In this case, the service is not free, but I have three payment options: low, medium, high. Depending on the fee paid, the service will be slower or faster.

Liquidity Staking

As we know the proof-of-stake is one of the most widely used consensus mechanisms in modern cryptocurrencies. The proof-of-stake bases its security on distributed consensus and staking. With liquid staking we are delegating our funds to a validator node, in return we receive a kind of liquid derivative with a receipt that we can use on Defi protocols as we wish. For example, if we stake Ethereum- token ETH- on LIDO Finance, we get in return a stETH, the derivative token. It is, therefore, a different mechanism from staking calssic.

Superstaking

Another interesting option is the superfluid staking The superfluidstaking is a further evolution of the proof-of-staking that allows users to earn rewards from both providing liquidity and staking their assets, thereby optimising returns without having to choose between the two activities. Furthermore, this system also serves to increase the security of the Osmosis platform.

How Superfluid Staking Works

- Supplying Liquidity:

- Users deposit token pairs into a liquidity pool on Osmosis. In return, they receive LP tokens (Liquidity Provider tokens) representing their share in the pool.

- Staking of LP tokens:

- Instead of simply holding LP tokens, users can staking these tokens on Osmosis. This process is called superfluid staking.

- Stacked LP tokens generate staking rewards, similar to those that would be achieved by directly staking the original tokens.

Tokenomics OSMO

As we have seen, the token of Osmosis governance is Osmo. This token allows the stakers to keep the protocol secure and is used for:

- Governance: i.e. to vote on updates to the protocol;

- Setting the base rate for the swap: i.e. deciding the price of the fees to be paid to have this service;

- Getting rewards from the liquidity pools you invest in: by participating in a liquidity pool you receive the rewards in osmo.

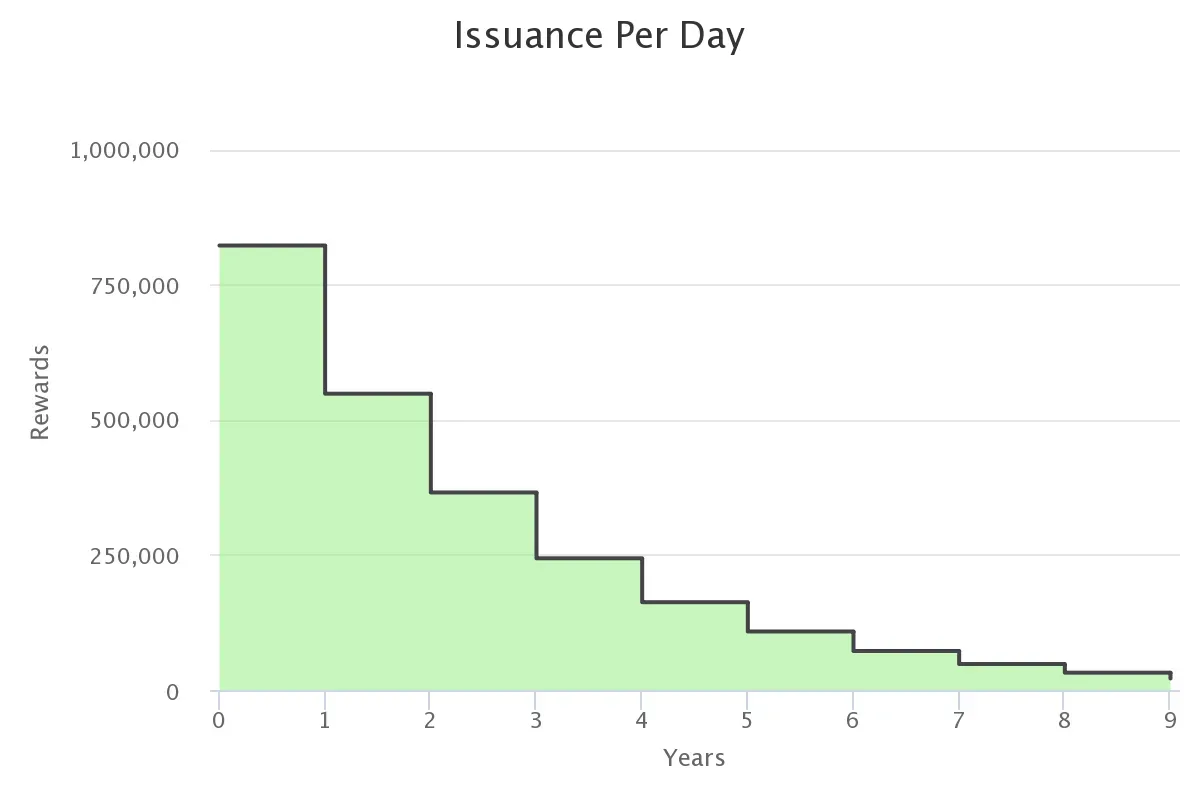

Osmo's tokenomics is supported by an inflationary issuance model. The total supply is around 1 billion and is reduced each year according to a fixed emission pattern, as shown in the following chart:

The programme works as follows: in the first year, a total of 300 million tokens will be released. After 365 days, this will be reduced by ⅓, and then there will be a total of 200 million tokens released in the second year. In the third year, a total of 133 million tokens will be released. And so on. This process will allow OSMO to reach a maximum supply of 1 billion.

Token location:

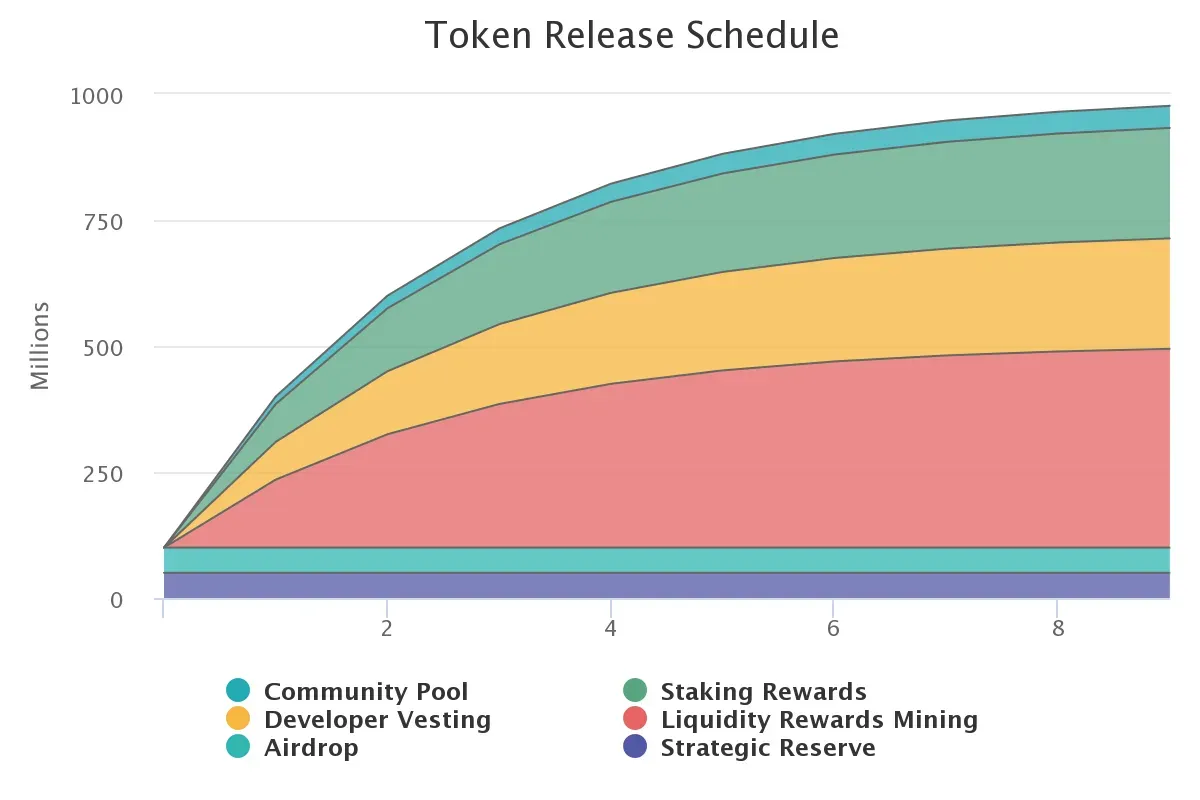

The allocation of OSMO tokens is divided into several main categories:

- Liquidity Providers: A significant portion of the tokens issued is allocated to liquidity providers, who receive rewards for their contribution to liquidity pools.

- Staking: OSMO holders can staking their tokens to earn rewards and participate in the governance of the platform.

- Development Funds: A portion of the tokens is reserved for funding future development of the platform, including technical improvements and marketing initiatives.

- Community Pool: A portion of the tokens is earmarked for a community pool, which can be used for community-led initiatives.

The funds have been distributed as follows:

- Liquidity providers: 45%

- Staking rewards: 25%

- Development funds: 25%

- Community pool: 5%

Updates

The V25 update was recently approved by Osmosis governance, introducing several new features and improvements. One of the most interesting new features was the implementation of a token burning mechanism, which resulted in the destruction of 1.3 million OSMO tokens immediately after the update.

The update also aims to improve consensus by reducing the time needed to add a block, which now takes 2.5 seconds, compared to 3 seconds previously. This change is expected to increase the efficiency and speed of transactions on the platform.

Let's see specifically how governance works

Governance and Voting

OsMO token holders can participate in the platform's governance process by proposing changes or voting on existing proposals. This decentralised governance system ensures that the community has an active role in determining the future of the protocol. Participation in governance is incentivised, with token holders able to earn rewards for their active involvement. This should foster a more engaged and knowledgeable community that can contribute to the sustainable development of the platform.

Asset Exchange

As previously mentioned Osmosis uses an automated market-making (AMM) algorithm to facilitate the exchange of assets within liquidity pools. Users can exchange assets in real time, with transactions being settled on the blockchain in a secure and transparent manner. Osmosis' AMM algorithm is designed to ensure that exchanges take place as efficiently as possible.

Security

Being built on the Cosmos blockchain, Osmosis benefits from the security and reliability of the Cosmos network. Security would seem to be a major concern for any DeFi platform, and Osmosis addresses this challenge with a robust and reliable infrastructure. Users can trust that their assets are safe and that transactions take place transparently.

Accessibility

Osmosis is designed to be user-friendly, with an intuitive interface that makes it easy for users to navigate and use the platform. The ability to exchange assets between different blockchains significantly increases the accessibility for users of different blockchain ecosystems.Accessibility is key to the mass adoption of DeFi solutions, and Osmosis is a good product in this respect as it is not complex to use and therefore usable by a diverse audience, not just experts.

Cost-Efficiency

Thanks to the use of IBC technology and Cosmos' advanced features, Osmosis offers fast and low-cost transactions. This makes the platform competitive with traditional centralised exchanges and other DeFi solutions. Cost efficiency is critical for users seeking to maximise their earnings, and Osmosis offers a cost-effective solution that reduces transaction expenses.

Challenges and Opportunities

As with any emerging project, Osmosis faces several challenges, including the need to increase liquidity in pools and expand its user base. In addition, the increasing competition in the DeFi industry requires constant improvement and innovation to stay relevant. Technical challenges, such as scalability and security, are ever-present and require constant attention to ensure that the platform remains reliable and secure for users.

With the growing adoption of DeFi, Osmosis has the opportunity to become a leading platform for exchanging assets between different chains. Continued expansion of functionality and integration with new blockchains could further expand its ecosystem and attract more users and liquidity providers. The opportunities for growth could be manifold, with the possibility of expanding service offerings and entering new markets. Osmosis is well positioned to capitalise on these opportunities and consolidate its position as a leader in the DeFi industry. Osmosis represents an innovative solution in the decentralised finance landscape, offering an interoperable and flexible DEX that allows users to exchange assets across different blockchains. Osmosis has the potential to revolutionise the way we interact with digital financial services. Despite the challenges, the platform stands out as one of the most promising answers to the needs of modern DeFi. We, at Spaziocrypto, will try to follow its evolution.