Cryptocurrency giant Binance now faces a growing legal battle with Nigeria. The Nigerian court has postponed a crucial hearing on tax evasion until 30 April.

The postponement gives the Federal Inland Revenue Service (FIRS) more time to respond to Binance's challenge to the way legal documents were served.

The FIRS alleges that Binance has done serious damage to Nigeria's economy. Binance's lawyer, Chukwuka Ikwuazom, challenged the email notification method as unacceptable. According to Binance, the company operates from the Cayman Islands and has no business in Nigeria. The lawyer stated that sending legal documents across Nigerian borders without judicial approval violates established procedures.

"On balance, the substituted notice order issued by the court on 11 February 2025 against Binance, which is registered and resident under the laws of the Cayman Islands, is improper and should be set aside," Ikwuazom stated.

The FIRS commenced legal action against Binance in February 2025. According to their claims, the unpaid fees for the years 2022 and 2023 would amount to about $2 billion. The agency is demanding USD 79.5 billion as compensation for the alleged economic damages. According to them, Binance's activities caused the devaluation of the naira and financial instability.

In spite of not having an official office in the country, according to FIRS Binance maintains a significant economic presence. From their point of view, Binance is liable to pay corporate income tax. In early 2024, Nigeria arrested two senior executives of Binance. Legal charges against Binance include tax evasion and money laundering.

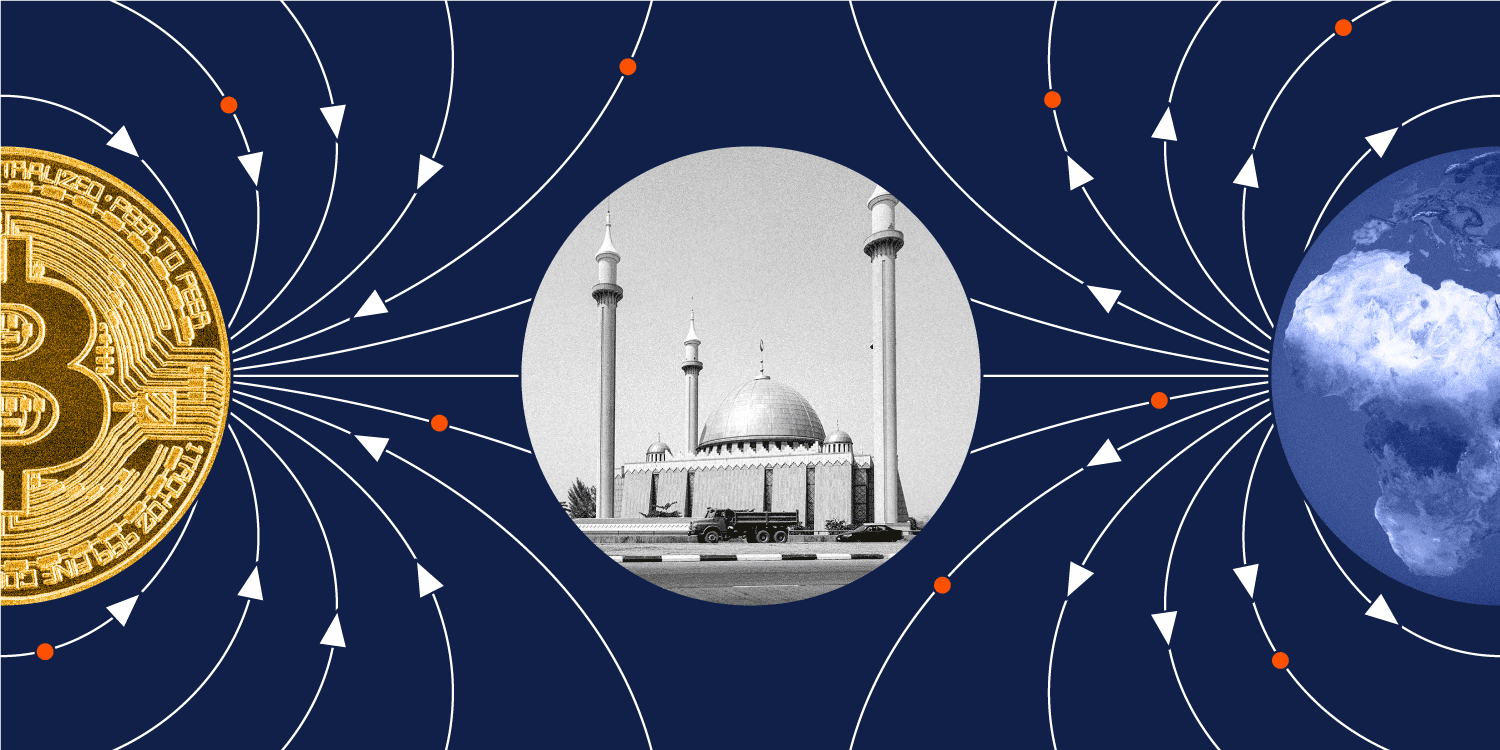

Binance stopped trading in Naira in March 2024 due to increased legal pressure. This decision was interpreted as a withdrawal from the Nigerian market. It all comes amid the government's crackdown on crypto exchange platforms, which are held responsible for the growing shortage of foreign currency.

About these events, Business Insider Africa said:

"From shutting down naira transactions to a shocking $81.5 billion lawsuit, the clash between Binance and Nigeria has been anything but ordinary. Arrested executives, allegations of bribery and alleged economic sabotage: this legal battle is redefining how the crypto sector functions in Africa's largest economy."

Growing economic instability is pushing more and more Nigerians towards the use of cryptocurrencies as a form of protective investment. According to Chainalysis, crypto trading volume in Nigeria reached about $59 billion in 2024.

The verdict of this legal dispute will have significant repercussions on the regulation of cryptocurrencies in Nigeria and could become a case study for other countries facing similar challenges with international exchanges.